Leveraged Loan Insight & Analysis – 2/25/2019

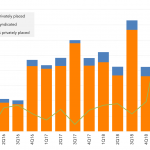

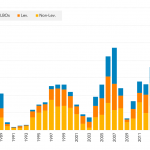

Privately placed second-lien issuance picks up this quarter So far this quarter there is US5.2bn in completed and pipeline second-lien issuance, well below the US$8bn level it has reached the previous nine quarters. In addition, a greater share of second-lien issuance is getting privately placed…. Login to Read More...