Leveraged Loan Insight & Analysis – 7/9/2018

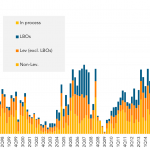

Middle market sponsored syndicated volume reached US$20.9B in 2Q18 Middle market sponsored syndicated loan activity was pretty solid in 2Q18 reaching US$20.9bn, similar to 1Q18 issuance of $21.7bn. However, refinancings and repricings drove close to 40% of activity in 1Q18 and 2Q18 which is much higher than the mid 20% area in 2017. Furthermore, compared…