Leveraged Loan Insight & Analysis – 4/17/2017

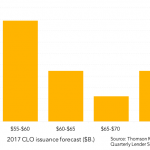

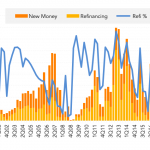

CLO issuance is on track to meet or exceed market forecast in 2017 One third of loan arrangers, CLO arrangers and managers surveyed by Thomson Reuters LPC expect CLO issuance could reach or exceed $70bn this year. But challenges remain including a lack of new issue supply and complying with risk retention. Amidst the ongoing…