Leveraged Loan Insight & Analysis – 2/6/2017

Overall LBO leverage on the rise in 1Q17

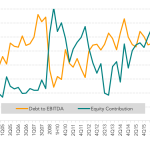

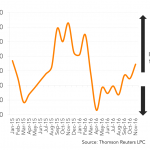

Average leverage levels on both large corporate and institutional middle market LBO deals have shown a meaningful jump in 1Q17. With refinancings and repricings dominating the leveraged loan market, investors seem more willing to stretch on new money LBO deals. The average leverage level so far in 1Q17 is at 5.0 times first lien and 6.50 times total debt to EBITDA, up from 4.6 times senior by 6.1 times total last quarter...