Leveraged Loan Insight & Analysis – 1/25/2016

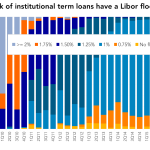

Libor floors, used to guarantee a minimum spread to investors in a low rate environment are now a major theme in the market given rising interest rates. In 2015, 98% of institutional term loans were issued with a Libor floor, the bulk of which were done… Login to Read More...