Leveraged Loan Insight & Analysis – 8/3/2015

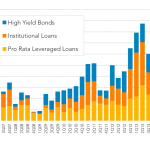

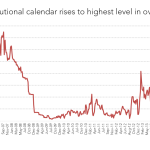

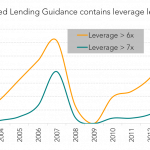

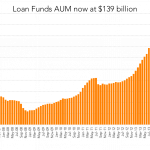

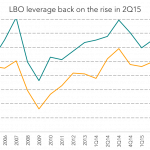

After a temperate first half, buyout deals to hit market in 3Q15 are pushing the boundaries with regards to leverage levels. Although deal flow remains light, large corporate LBO leverage levels have risen to 6.3 times so far in 3Q15, up from 6.01 and 5.99 times respectively in 2Q15 and 1Q15. The upward trend is driven by…