The Case for Covenants (Last of a Series)

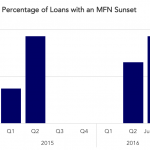

“When things are good, people don’t pay attention to covenants, but when things go sour, covenants are their only line of protection.” So said one head of credit research of a large asset manager in a recent Bloomberg article. He was referring to bond covenants, but the lesson applies equally to loans. And things have…