Featuring Charts

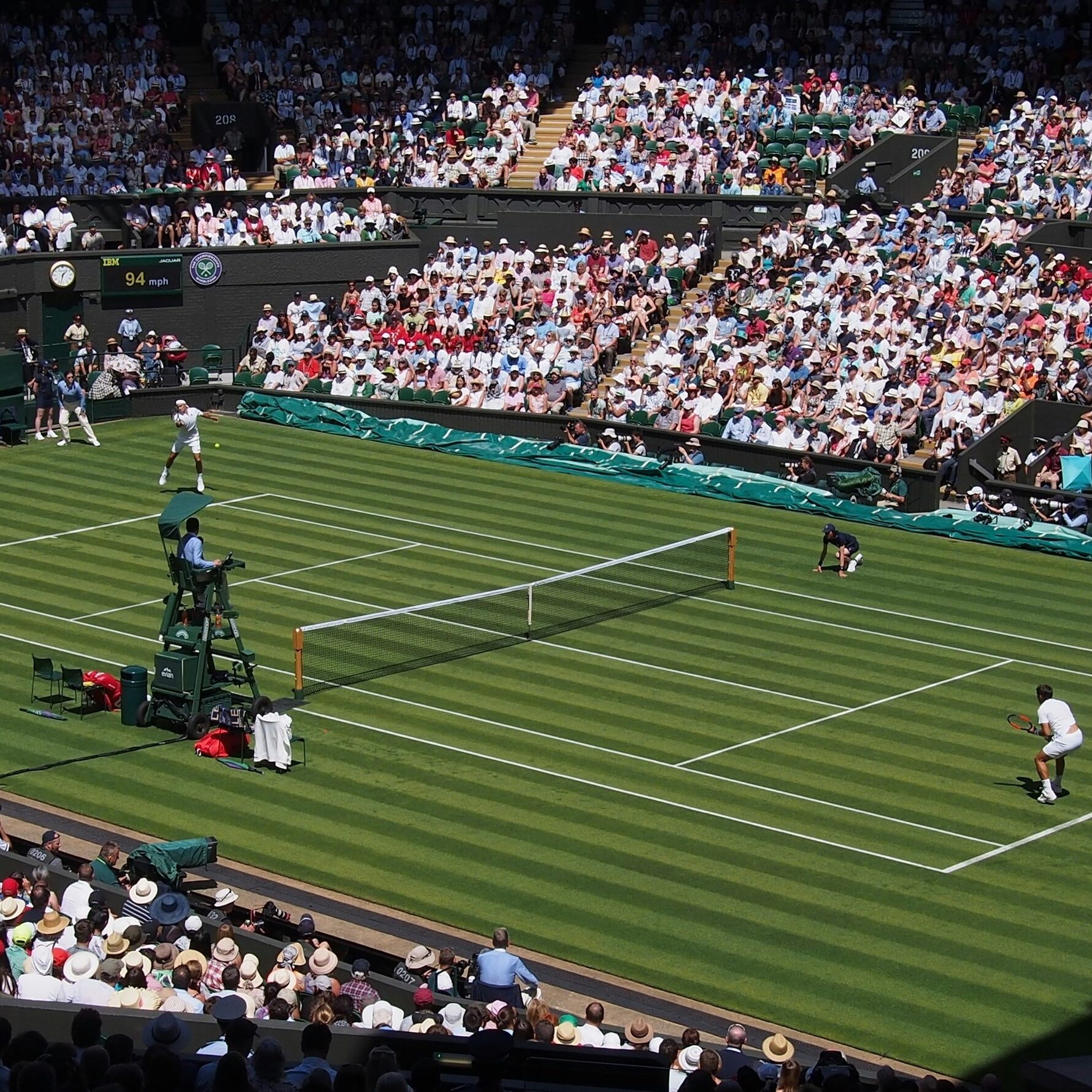

Chart of the Week: Wealth Effects

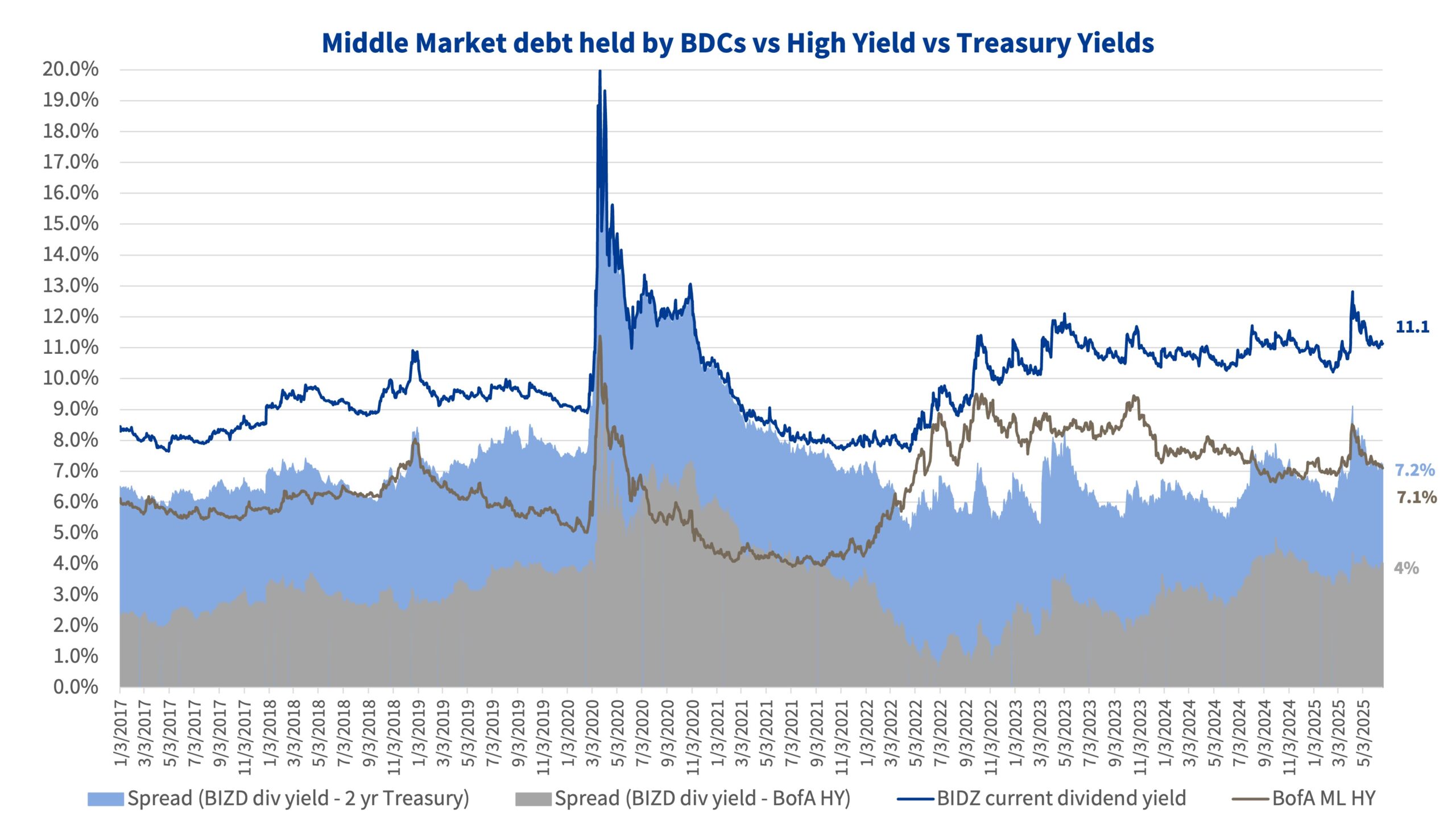

The share of wealth assets dedicated to private credit is on the rise. Source: FT, Oliver Wyman

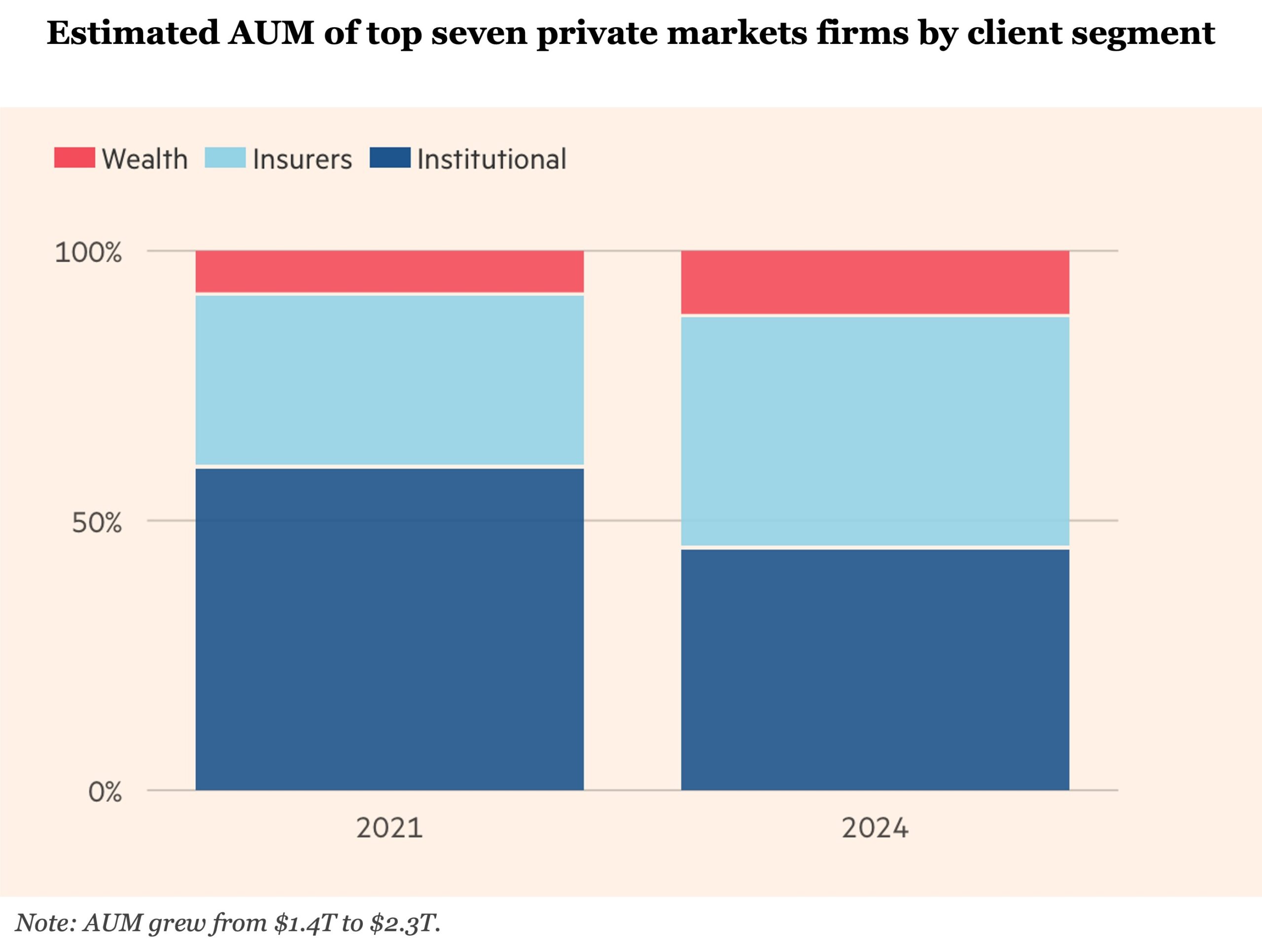

Read MoreChart of the Week: Secondary Effects

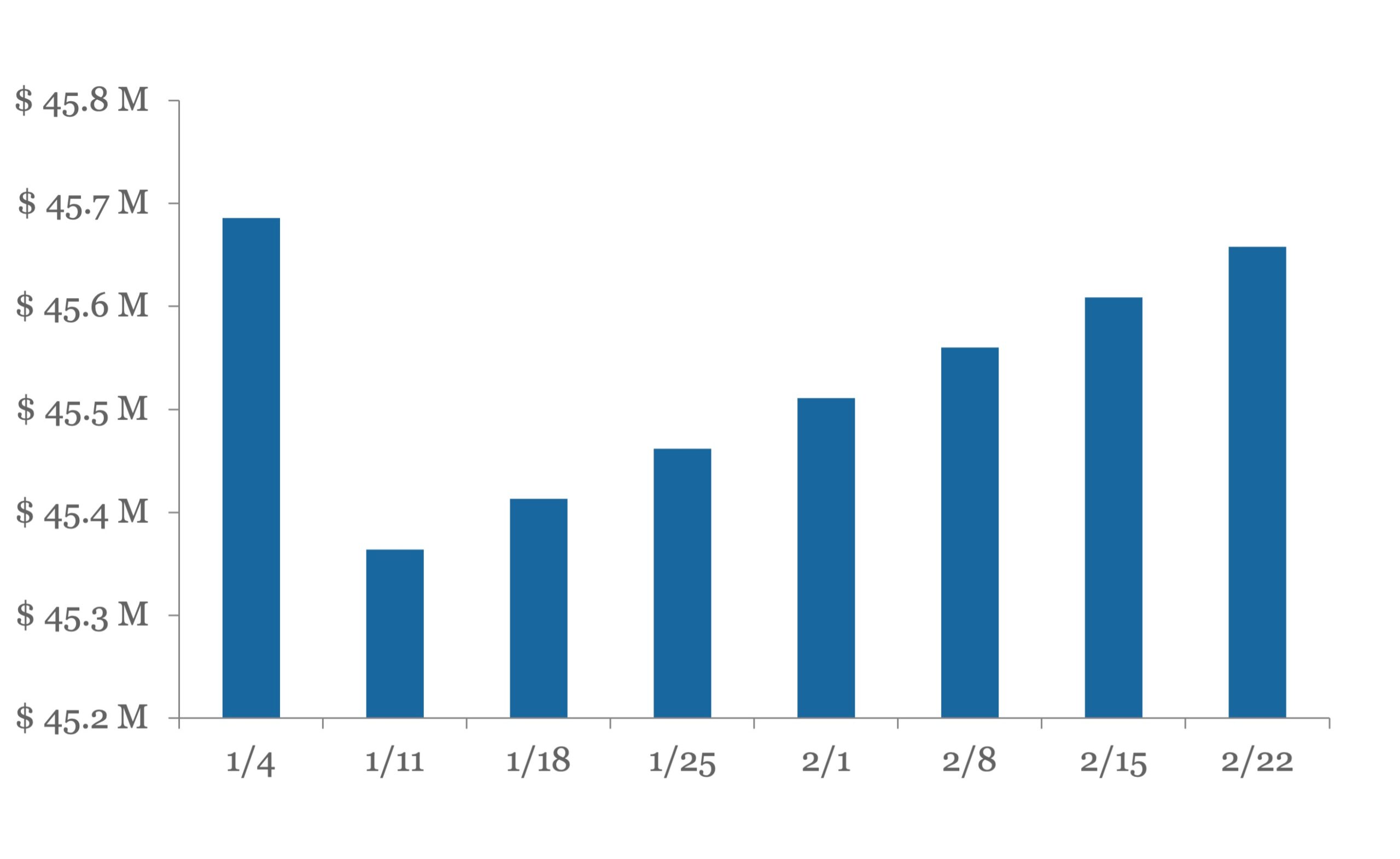

Since Liberation Day, leveraged loan trading prices have slowly moved higher. Source: Bloomberg US Leveraged Loan Index

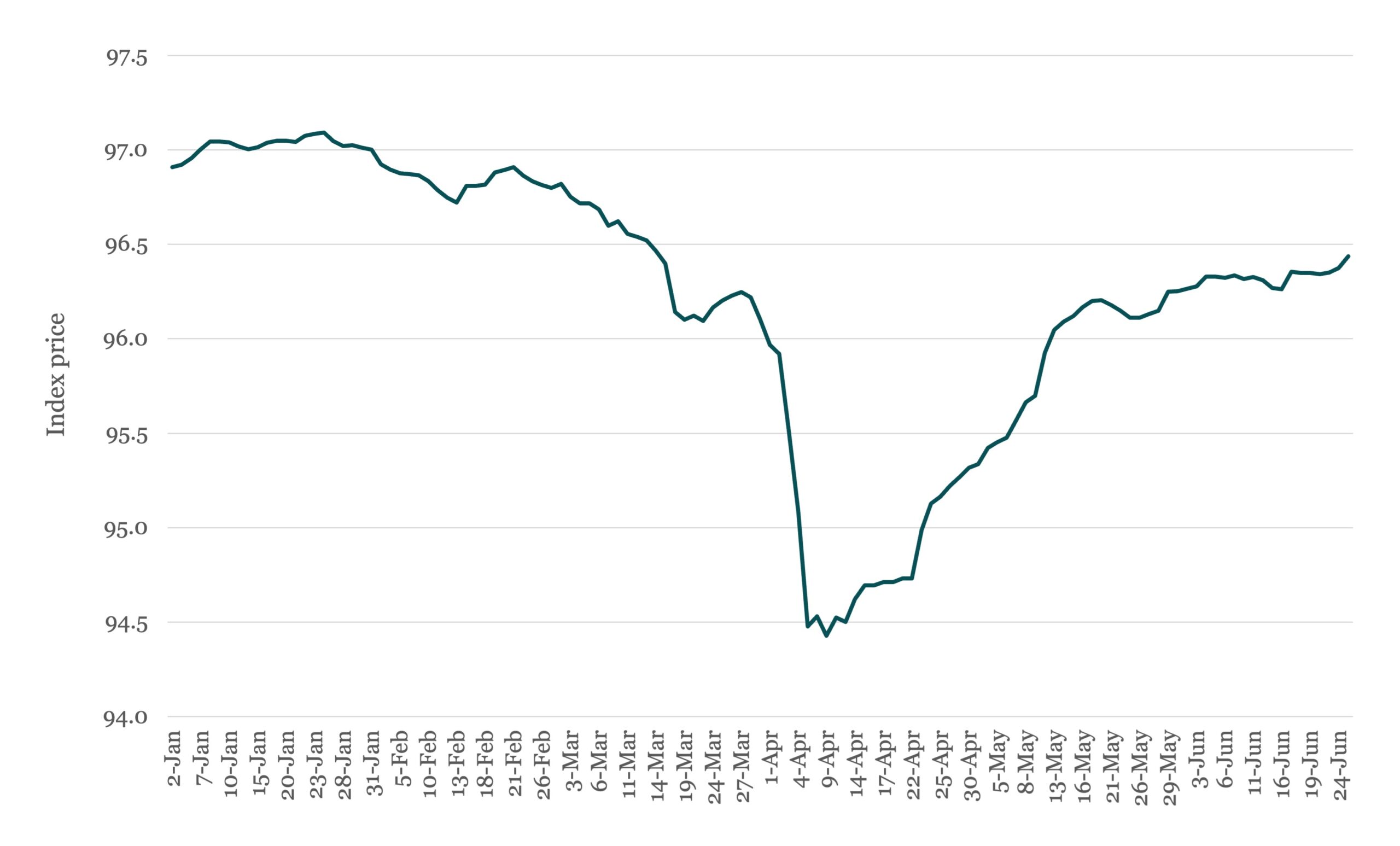

Read MoreChart of the Week: The Comeback Kid

Since the 2021 peak, global M&A activity has been on the rebound. Source: LSEG

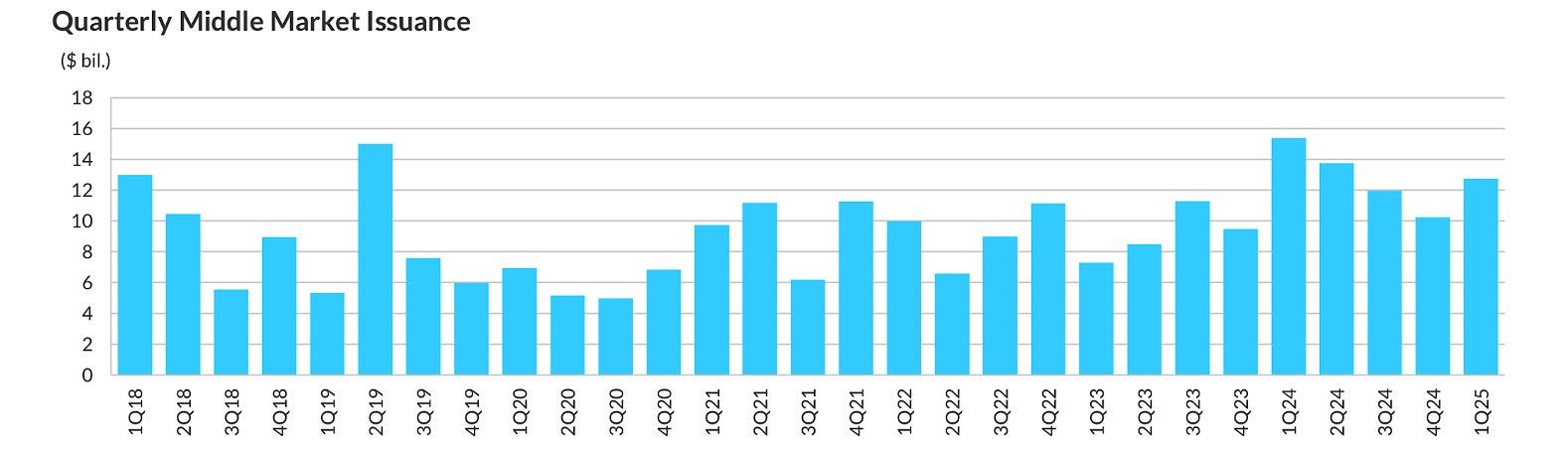

Read MoreChart of the Week: Midcaps Motor On

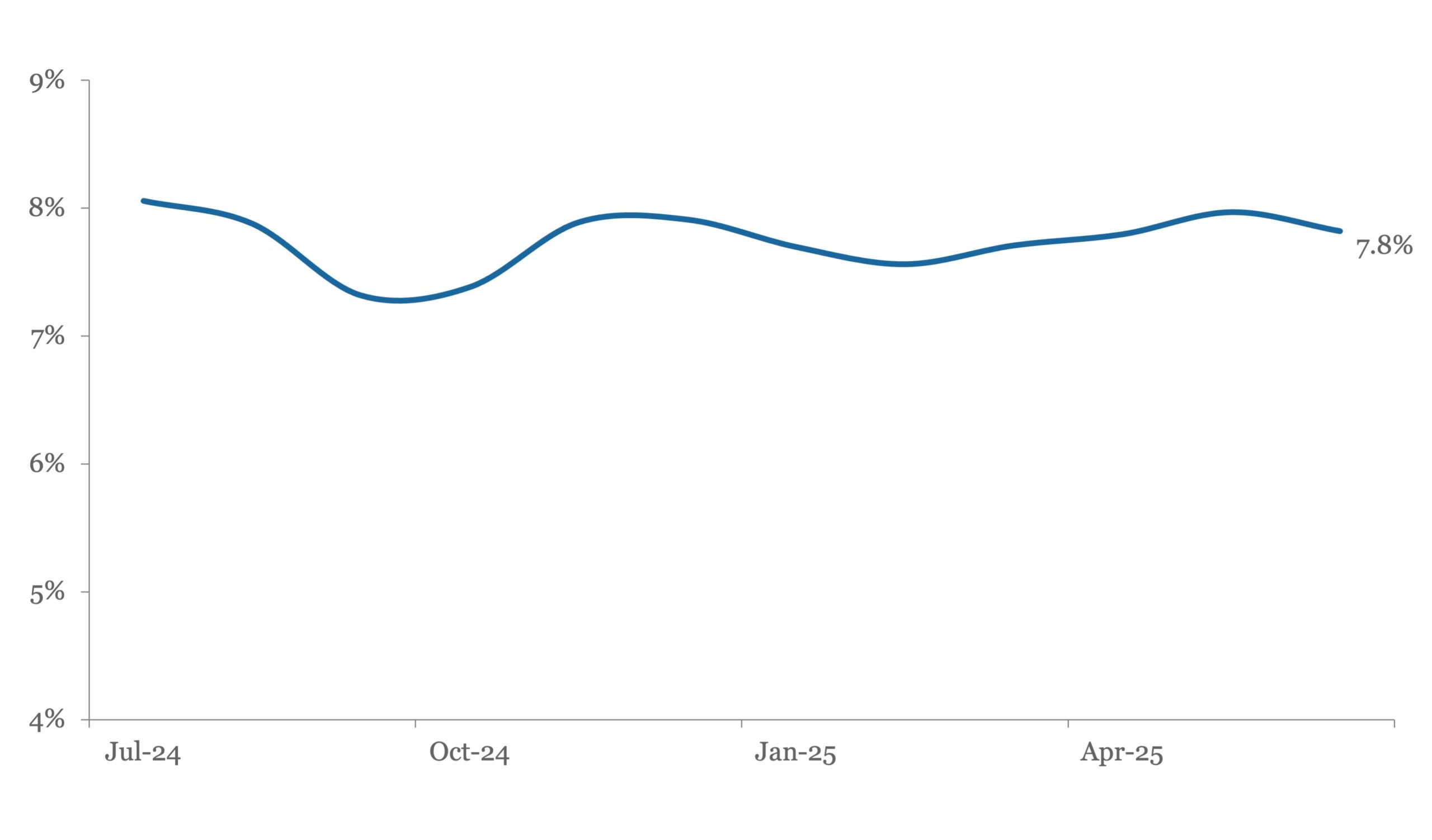

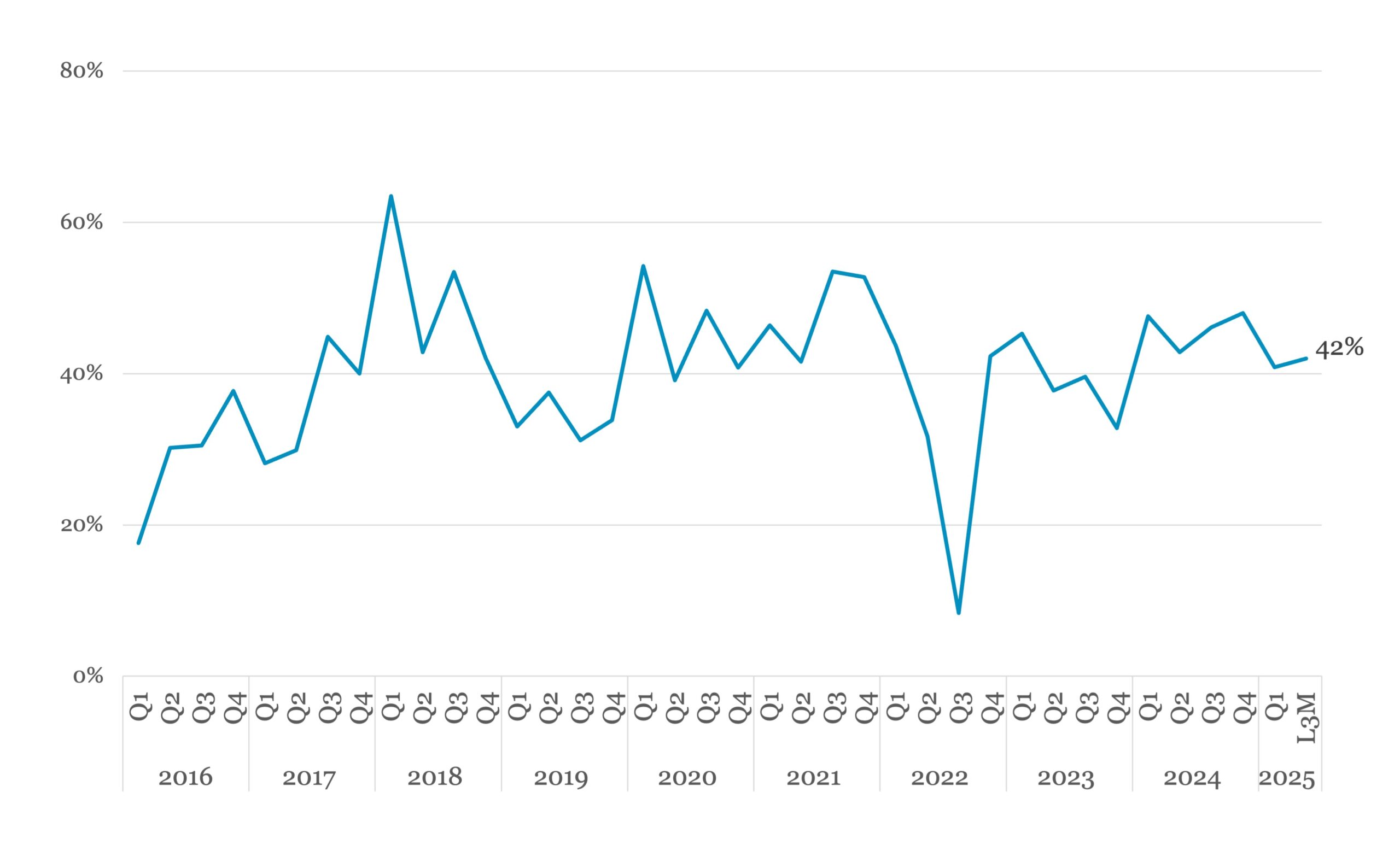

Through Covid and rate hikes, middle market loan issuance has tracked up. Source: LevFin Insights, a Fitch Solutions company

Read MoreChart of the Week: Mission Unstoppable

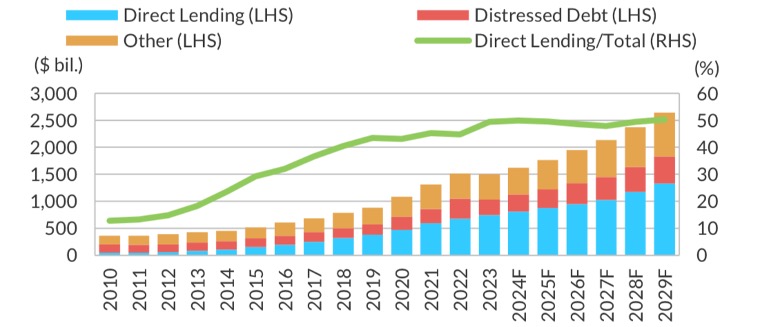

Private credit AUM expected to continue steady growth, driven by direct lending. Source: Fitch Ratings, Preqin

Read MoreChart of the Week: Rising Sun

Japan’s long-dated bond yields have moved up sharply so far in 2025. Source: The Daily Shot

Read MoreSubscribe Now!

Join the leading voice of the middle market. Try us free for 30 days.

Click here to view the Newsletter sample.

What is the Lead Left?

- One-stop source for deals and data

- Market trend commentary and analysis

- Exclusive interviews with thought leaders

View Article By

Features

Bloomberg: Leveraged Lending Insights – 7/7/2025

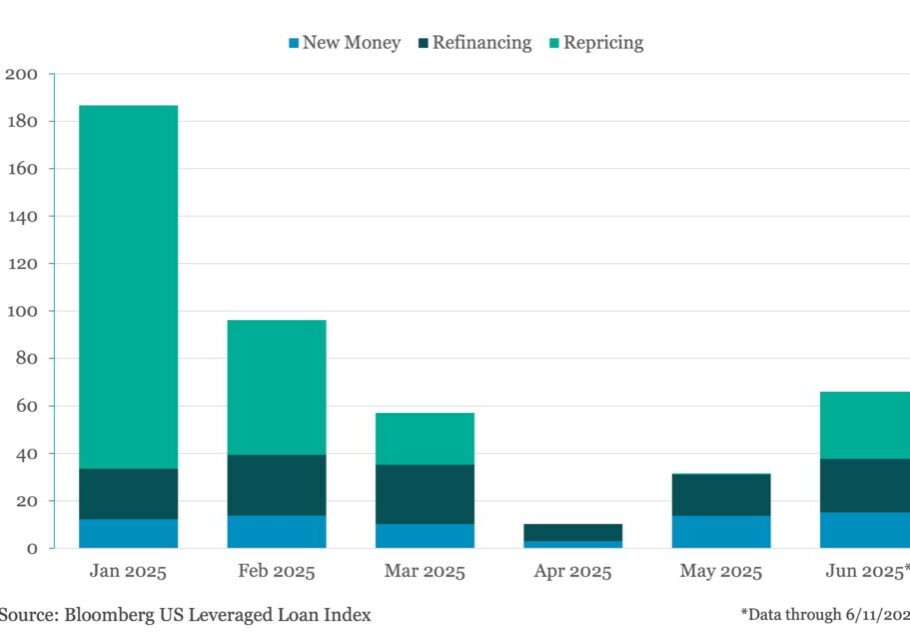

US Leveraged Loan Issuance Tops $65bn in June June’s 75 deals for $66b was up $34.4b, or 109%, from the previous month’s $31.6b, but was down $83.6b or 56% from the same month a year ago. It brought the Q2 total to $107.4b across 128 deals for a 68% decline from the first quarter total…

The Pulse of Private Equity – 7/7/2025

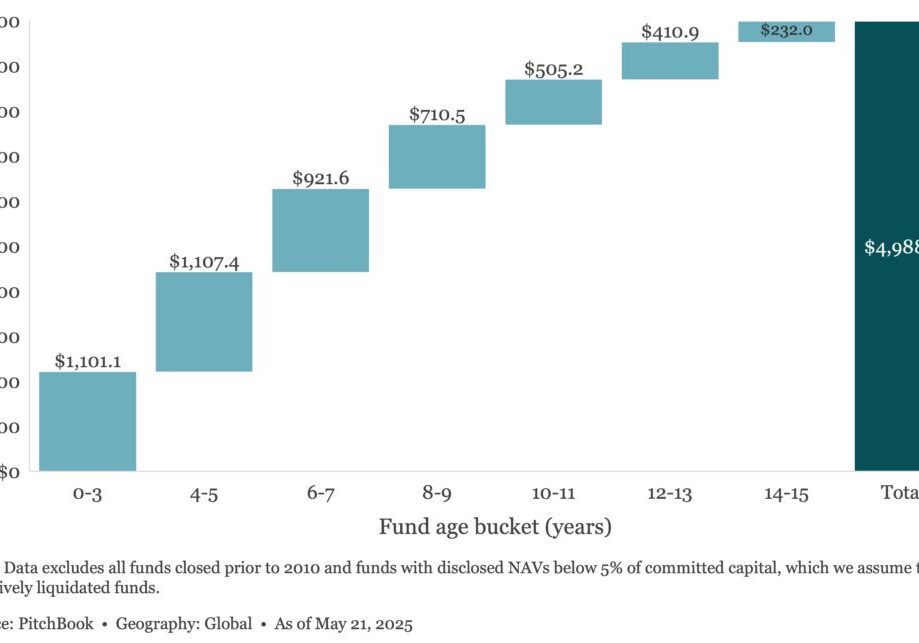

PE capital raised ($B) by age bucket (2010-2025) Download PitchBook’s Report here. Looking at the funds that face the most imminent fund terms, 11.8% of active funds are 10 to 11 years old, and 13.7% of active funds are 8 to 9 years old…. Subscribe to Read MoreAlready a member? Log in here...

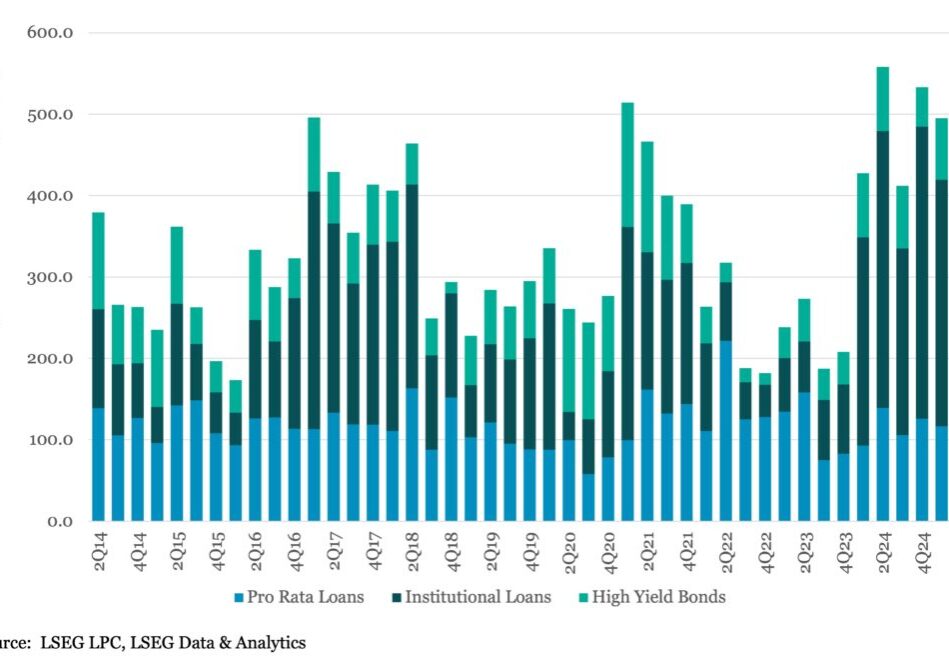

Leveraged Loan Insight & Analysis – 7/7/2025

As overall issuance slips in 2Q25, strategic M&A remains a bright spot for LevFin market Leveraged finance issuance topped US$343bn in 2Q25, down approximately 30% from 1Q25 and off nearly 40% versus 2Q24…. Subscribe to Read MoreAlready a member? Log in here...

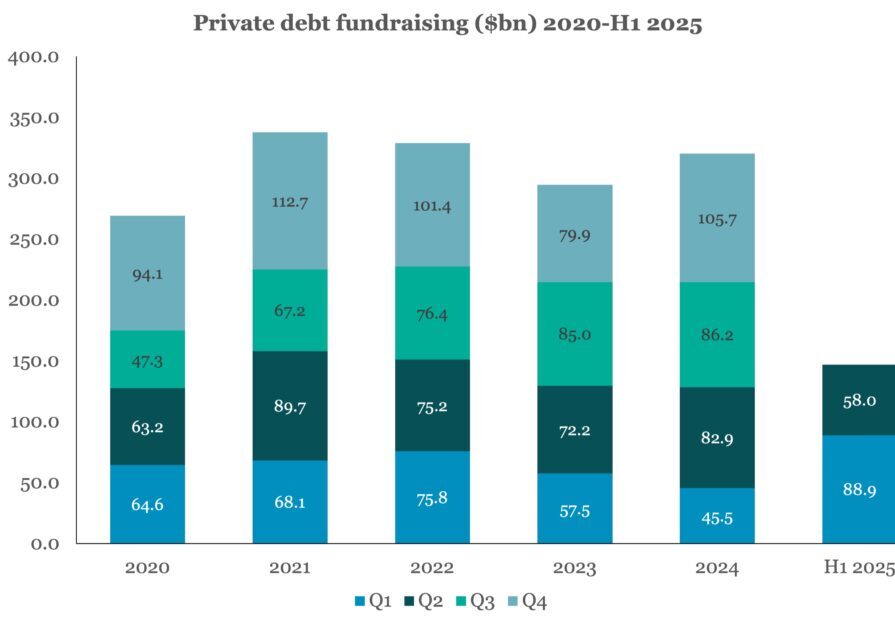

PDI Picks – 7/7/2025

2025 sees fundraising extremes Our data shows the brakes have been slammed by investors after a fast start to the year for those raising fresh capital. ‘Volatile’ is the word frequently being used to describe the economic and political backdrop to investing today. For private debt managers, that same volatility is being seen on the…

Middle Market & Private Credit – 7/7/2025

Smaller, Non-Systemic U.S. Banks Most Concentrated to Non-Bank Lending Click here to download report. Executive Summary: Evolving regulation has shone the spotlight on liability-driven investment strategies, driven by the optimization of technical provisions…. Subscribe to Read MoreAlready a member? Log in here...

Beginning in July 2022 The Lead Left published a series of articles on credit market. This report consolidates those articles.

Cov-lite trends Inflation & rising interest rates – LIBOR to SOFR transition Mega-tranche uni trend ESG takes center stage Login to view interactive report and download PDF version. … Subscribe to Read MoreAlready a member? Log in here Related posts: 2H 2021 Midyear Outlook Report State of the Capital Markets – Fourth Quarter 2016 Review and

Beginning in September 2021 The Lead Left published a series of articles on supply chain. This report consolidates those articles.