The Pulse of Private Equity – 7/7/2025

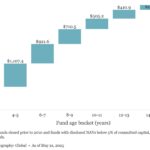

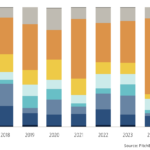

PE capital raised ($B) by age bucket (2010-2025) Download PitchBook’s Report here. Looking at the funds that face the most imminent fund terms, 11.8% of active funds are 10 to 11 years old, and 13.7% of active funds are 8 to 9 years old…. Subscribe to Read MoreAlready a member? Log in here...