PDI Picks – 7/7/2025

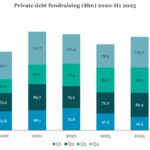

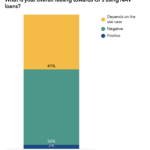

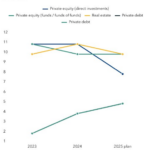

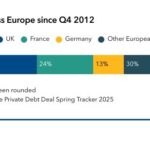

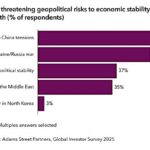

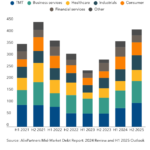

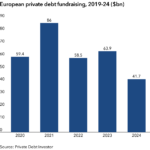

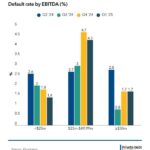

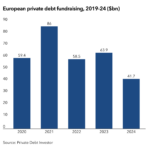

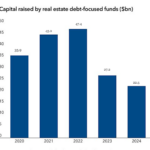

2025 sees fundraising extremes Our data shows the brakes have been slammed by investors after a fast start to the year for those raising fresh capital. ‘Volatile’ is the word frequently being used to describe the economic and political backdrop to investing today. For private debt managers, that same volatility is being seen on the…