PDI Picks – 4/14/2025

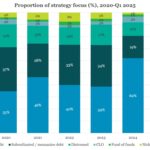

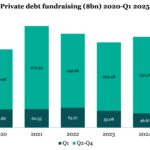

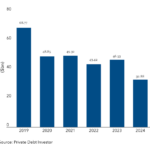

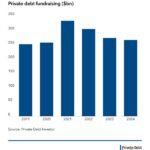

Distress takes the fundraising limelight Q1 2025 saw a reversal in fortunes, with direct lending making a slow start to the year. In recent years it’s almost felt as if direct lending has been the only game in town. Whenever Private Debt Investor collects global fundraising data, we always break it down by target strategy….