Featuring Charts

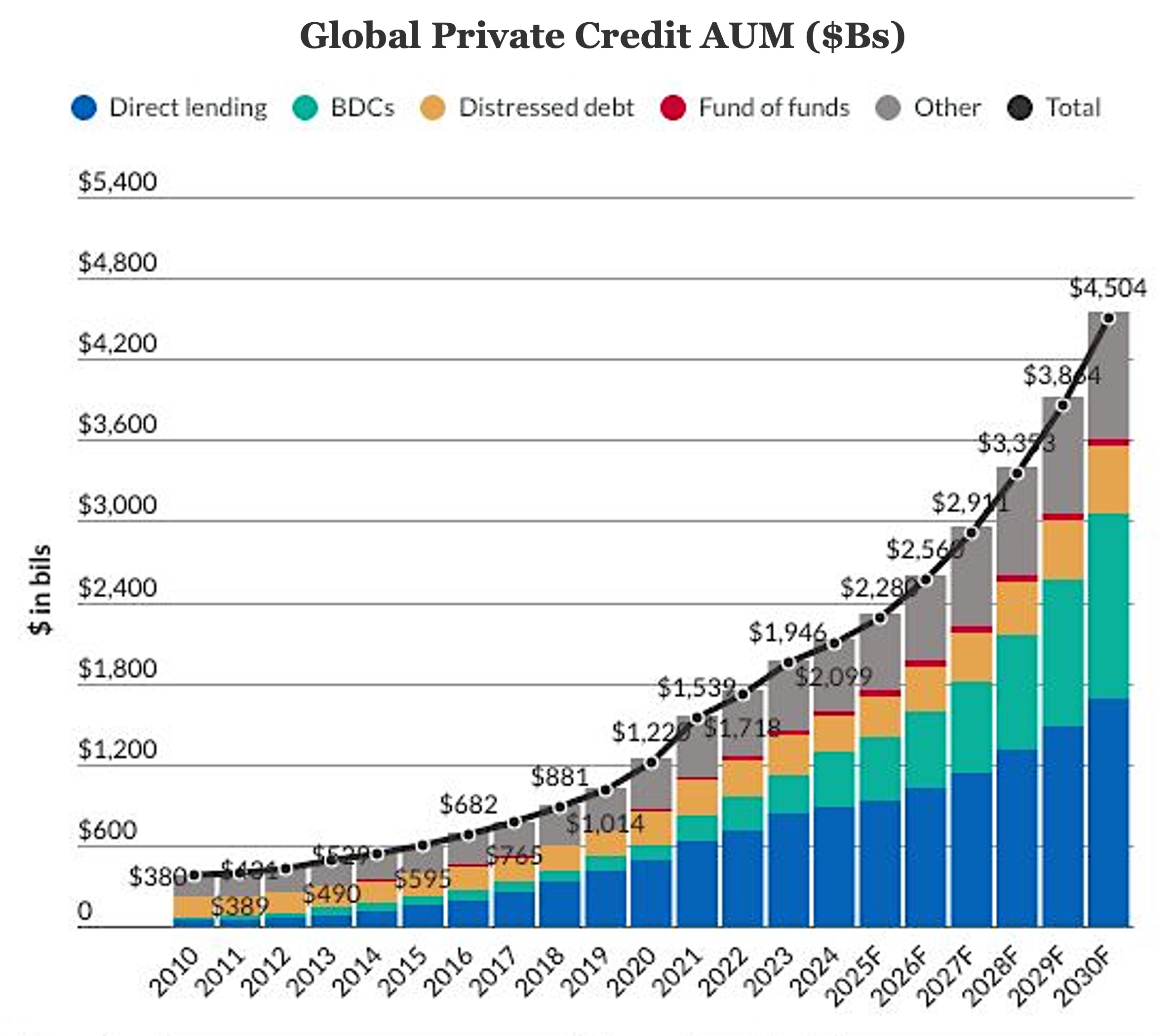

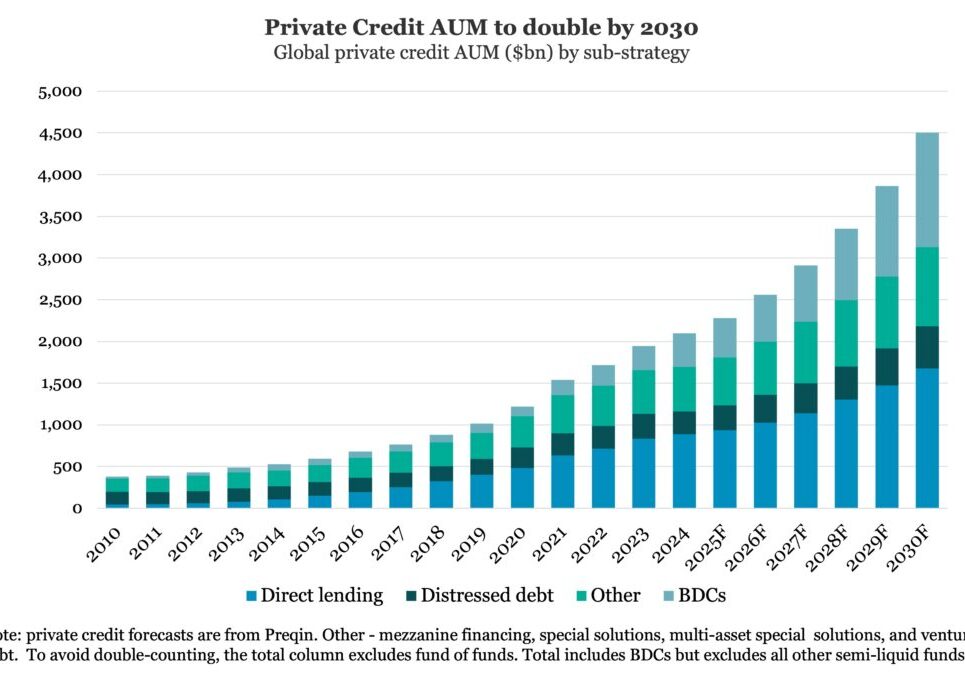

Chart of the Week: Private Credit Doubles

Direct lending and BDCs expected to lead the growth of private credit. Source: Fitch Ratings

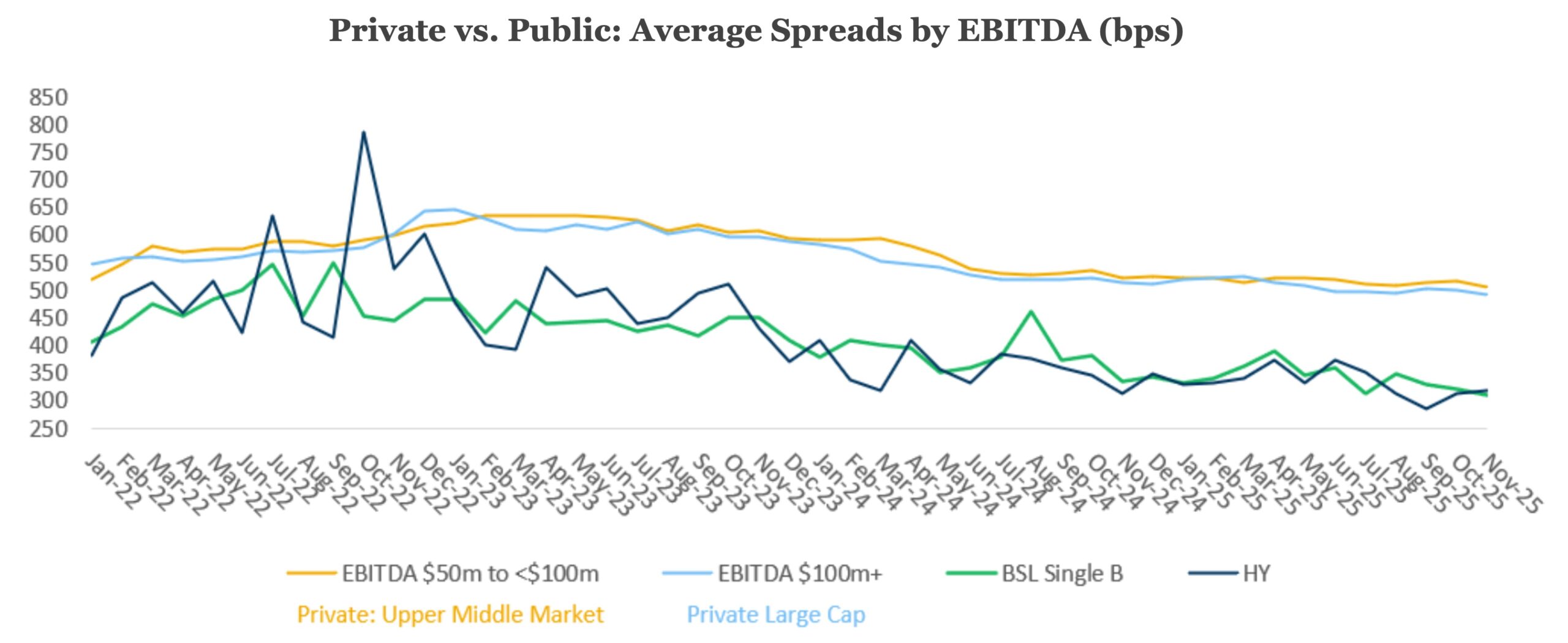

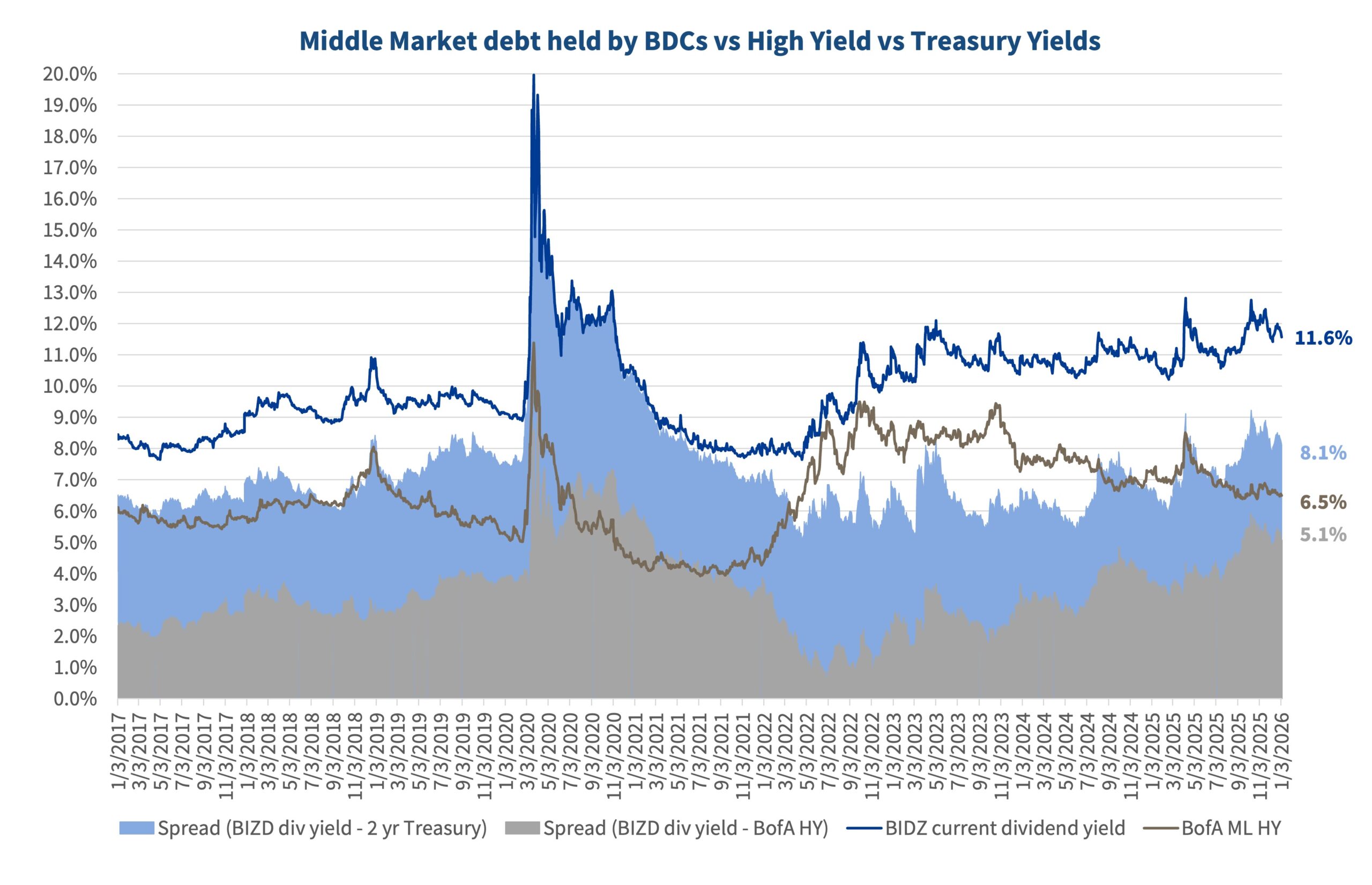

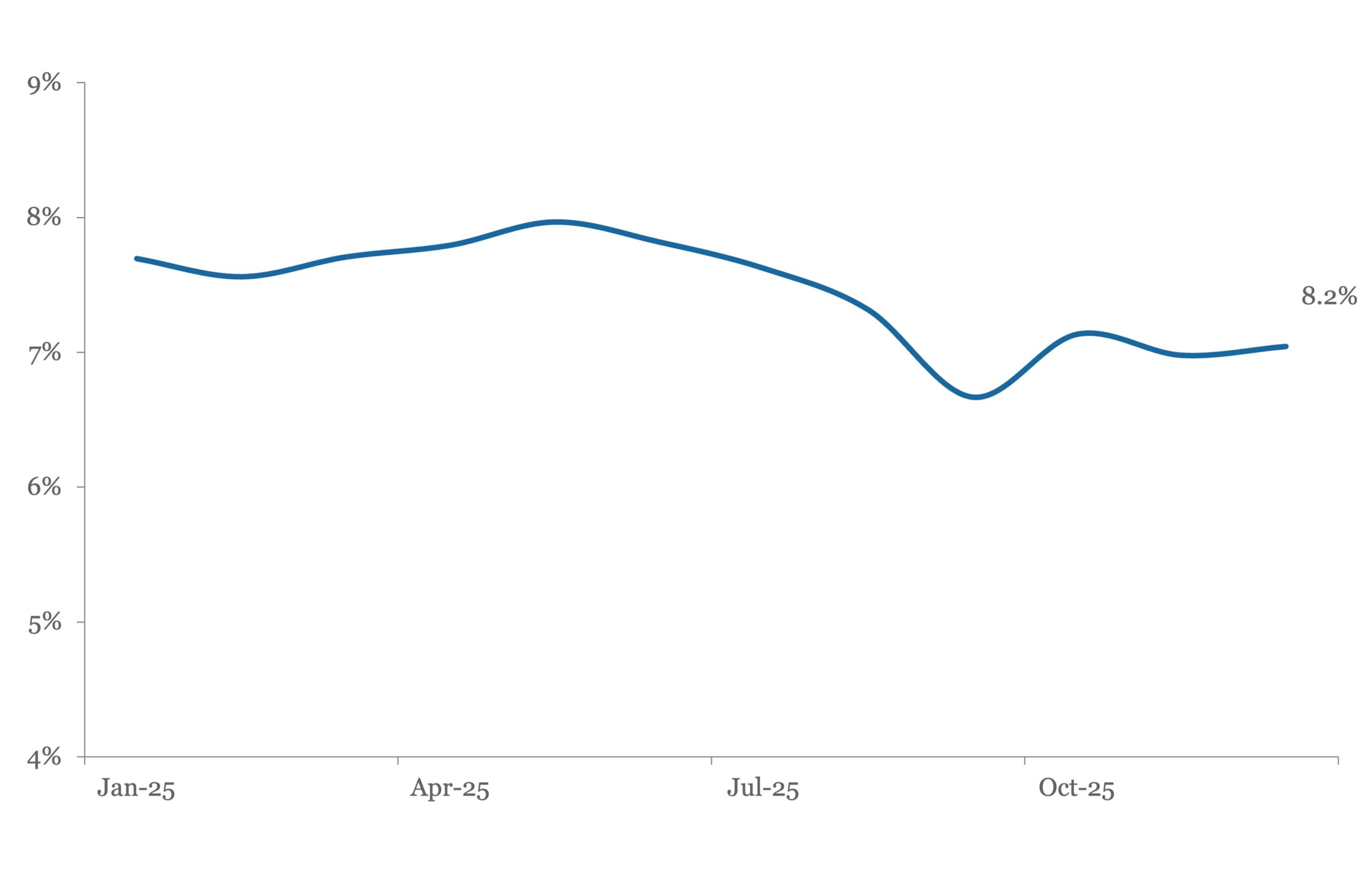

Read MoreChart of the Week: Premium Outlet

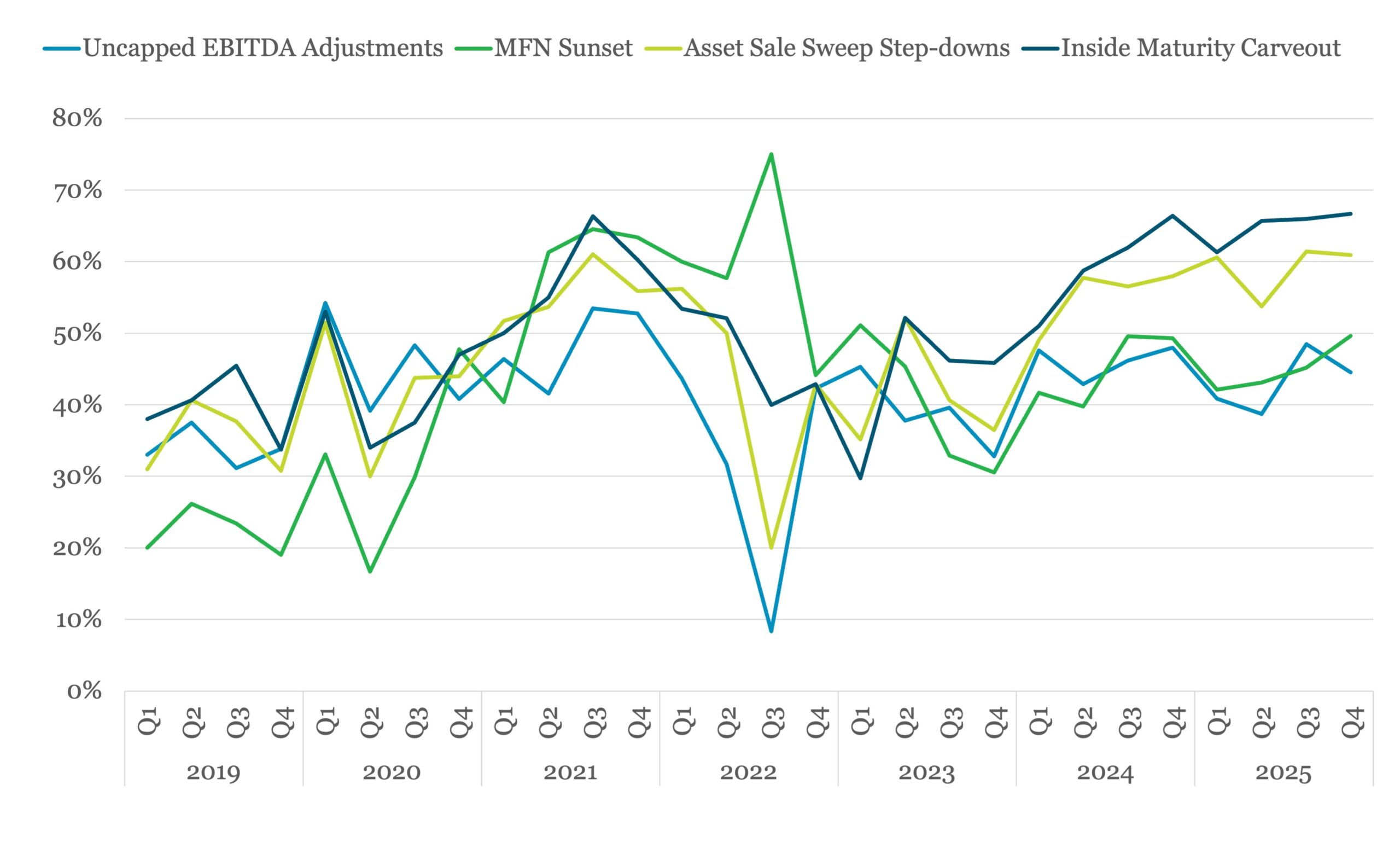

The private credit yield advantage over BSL widens as single-B spreads shrink. Source: KBRA DLD Research, PitchBook LCD

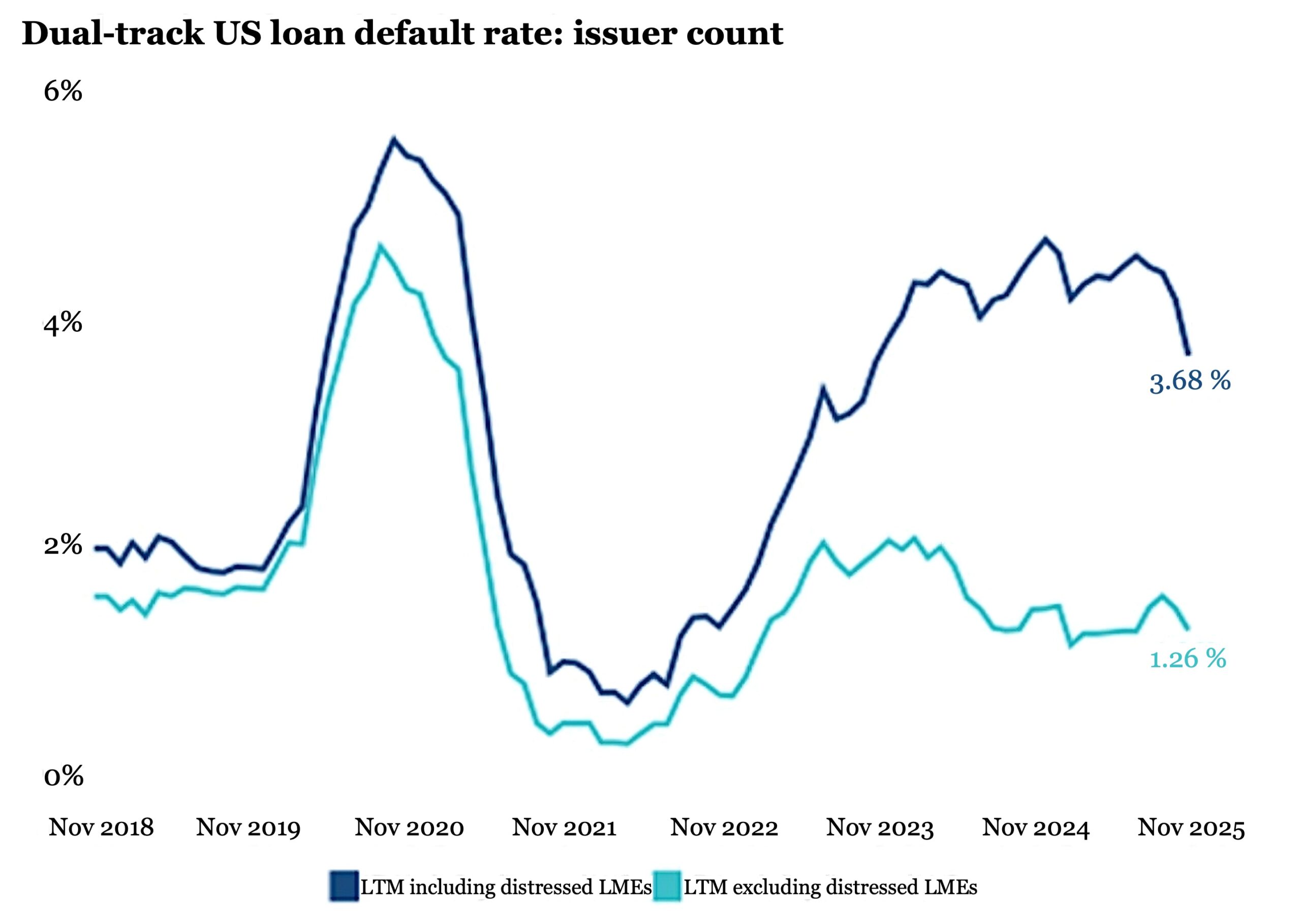

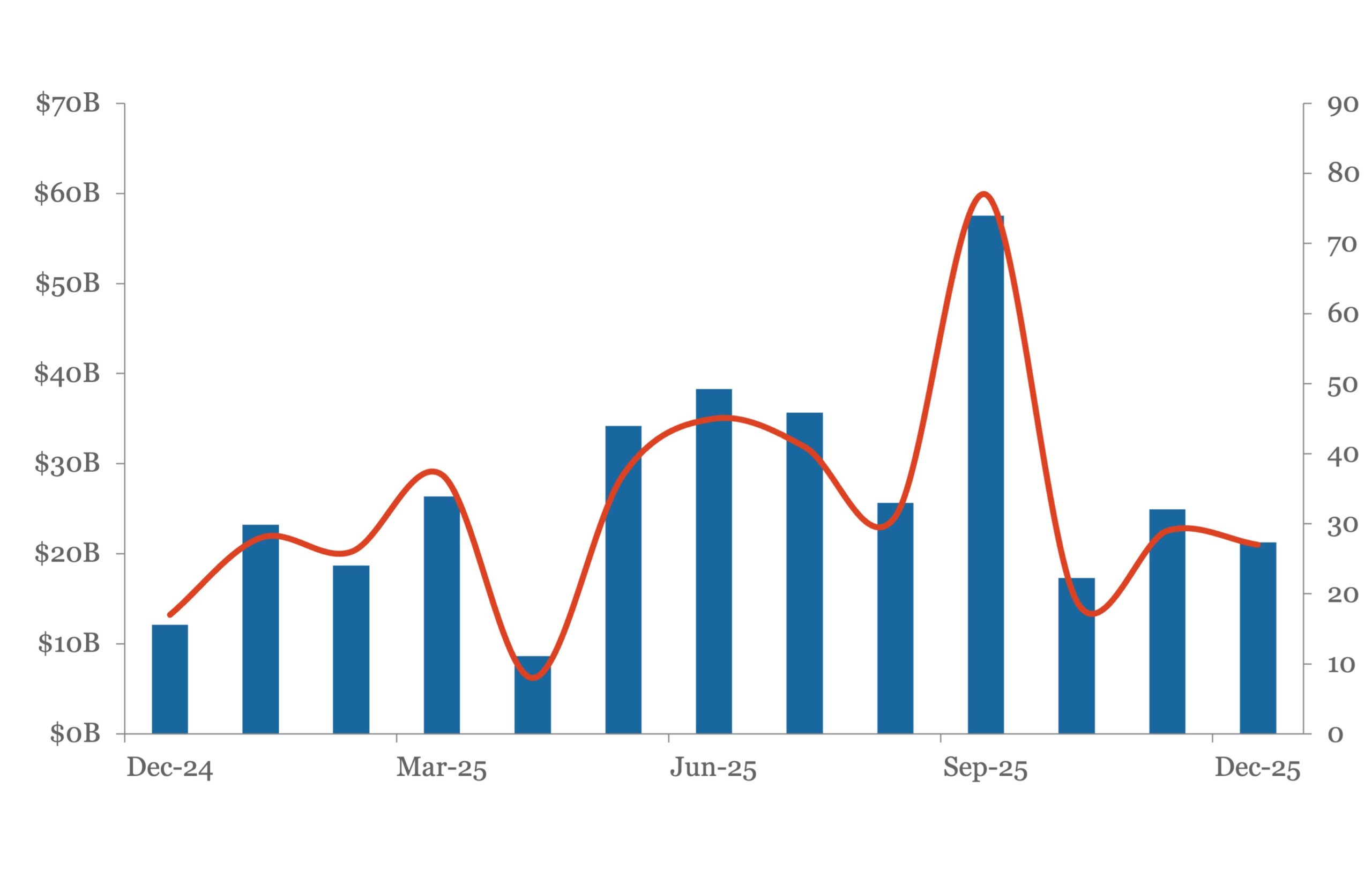

Read MoreChart of the Week: Easing Down

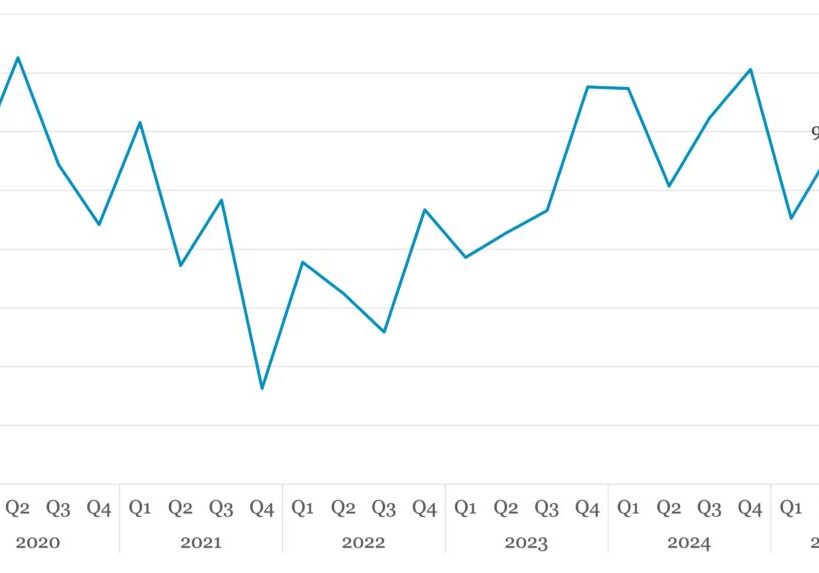

Defaults for the overall leveraged loan market are at lowest point since 2023. Source: The Daily Shot, PitchBook/LCD, Morningstar LSTA US Leveraged Loan Index

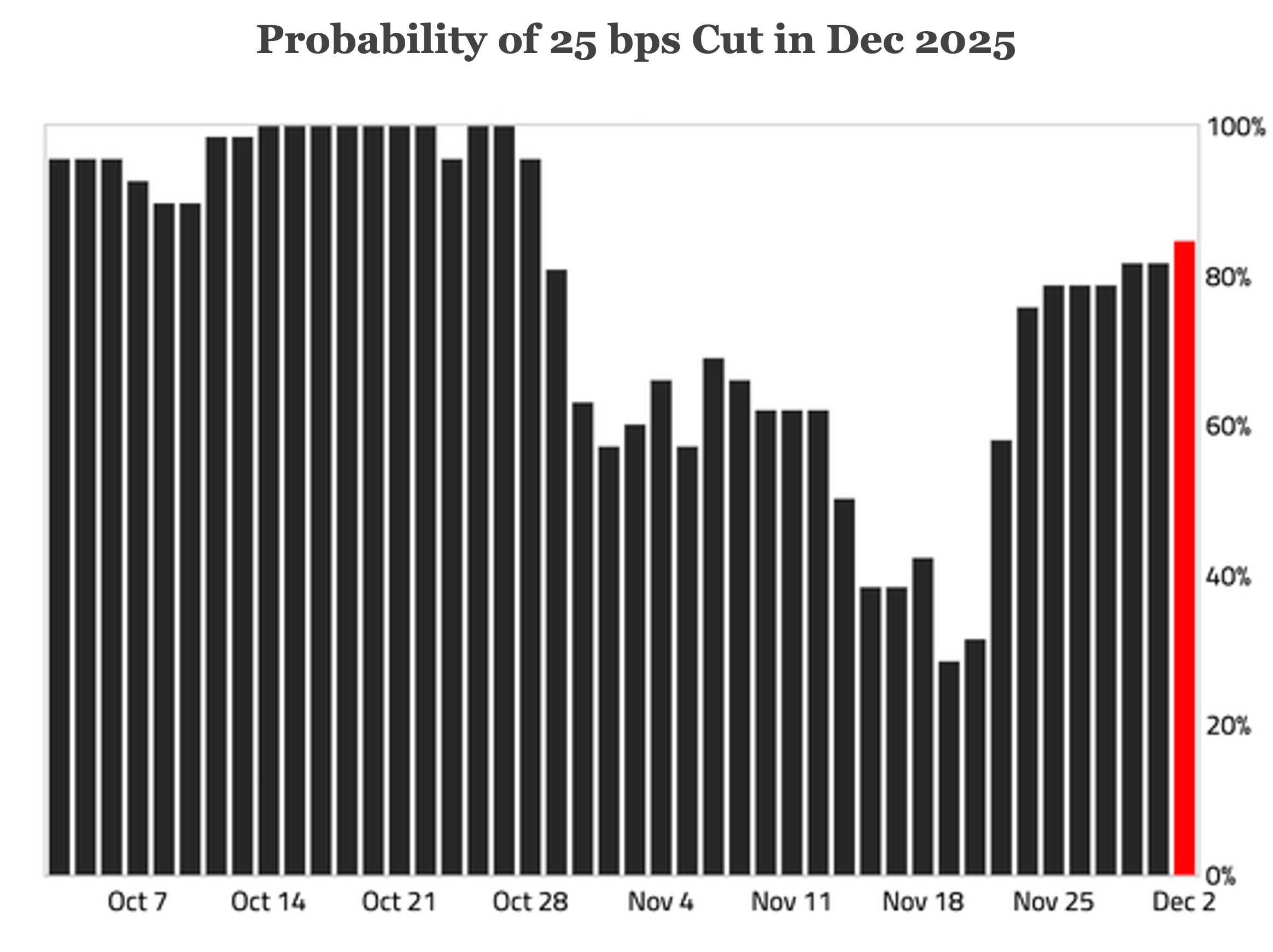

Read MoreChart of the Week: Prime Cut

A low probability just weeks ago, chances for a 25 bp cut now seem likely. Source: The Daily Shot

Read MoreChart of the Week: Lower for Longer

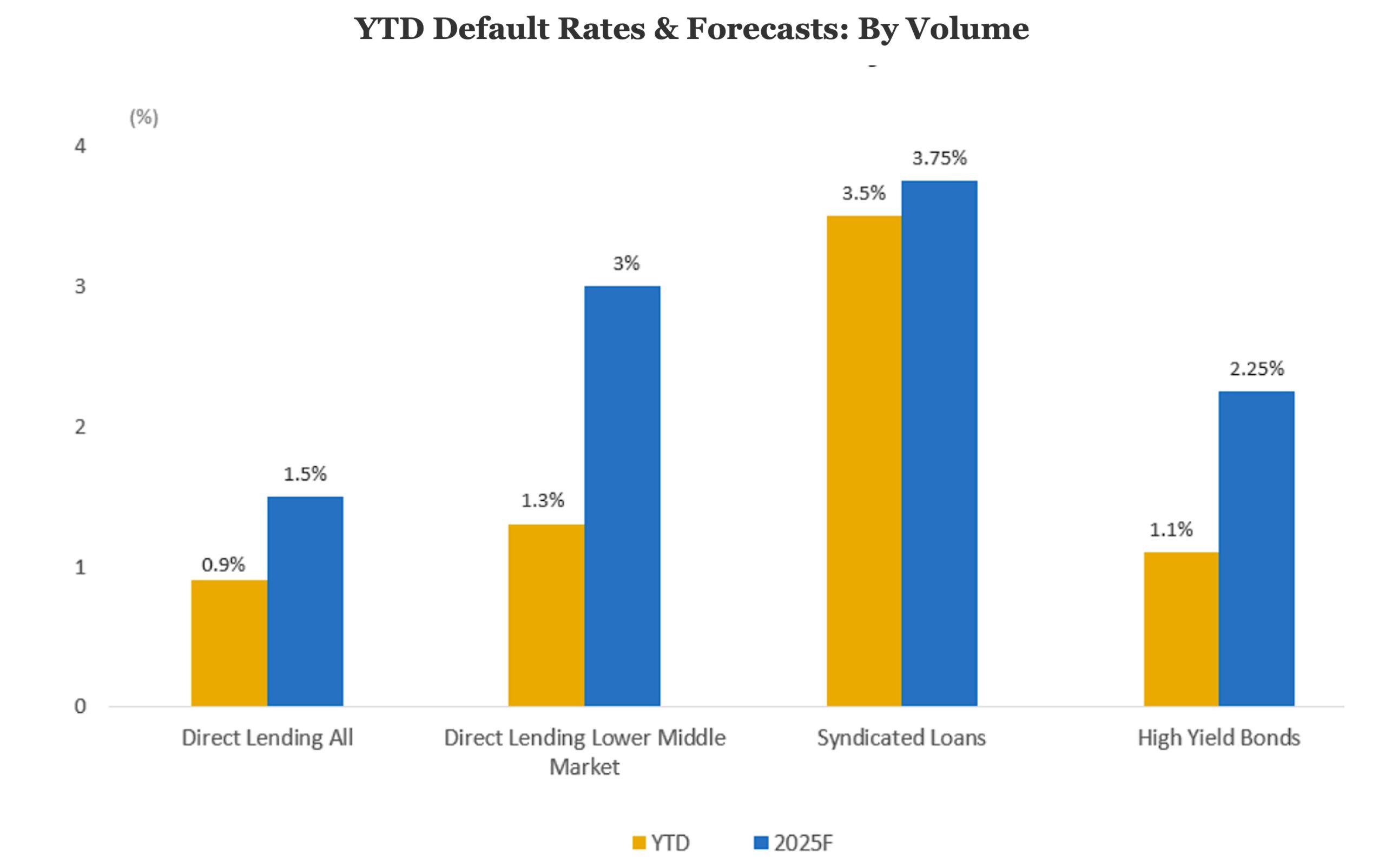

Direct lending defaults lead credit categories in low defaults, though headed higher. Source: KBRA DLD Default Research

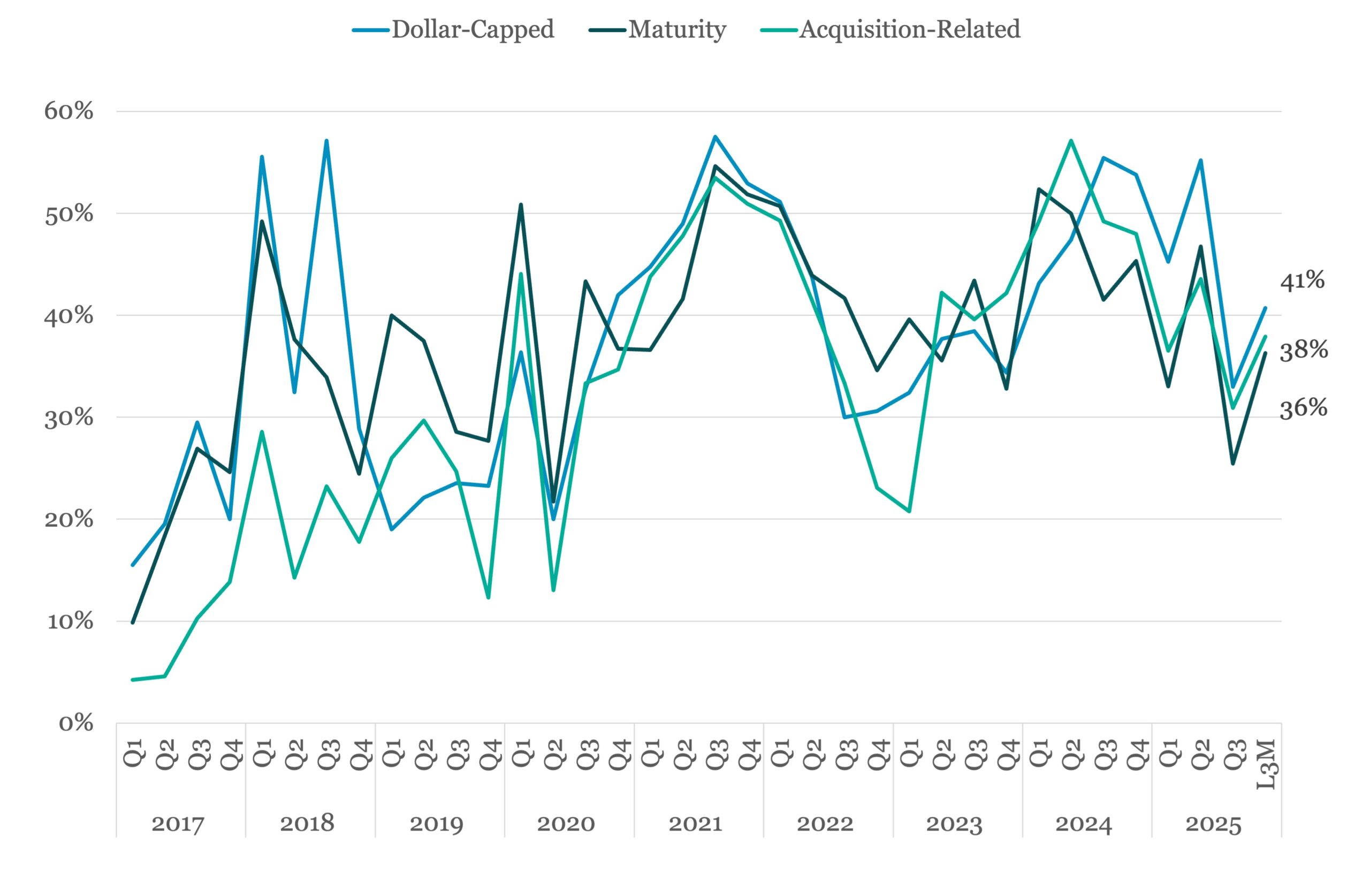

Read MoreChart of the Week: Higher for Longer

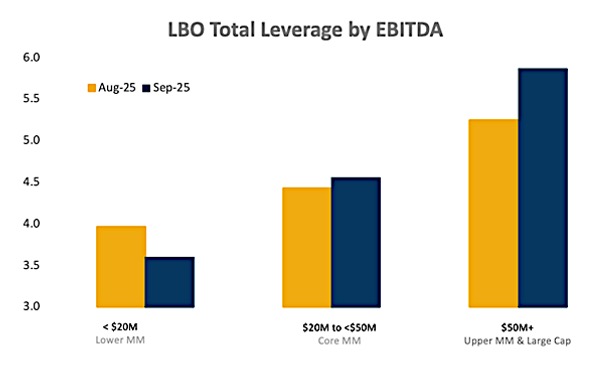

Larger LBO financings in direct lending are sporting increasingly higher leverage. Source: KBRA DLD Research, 3-month rolling averages

Read MoreSubscribe Now!

Join the leading voice of the middle market. Try us free for 30 days.

Click here to view the Newsletter sample.

What is the Lead Left?

- One-stop source for deals and data

- Market trend commentary and analysis

- Exclusive interviews with thought leaders

View Article By

Features

The Pulse of Private Equity – 1/5/2026

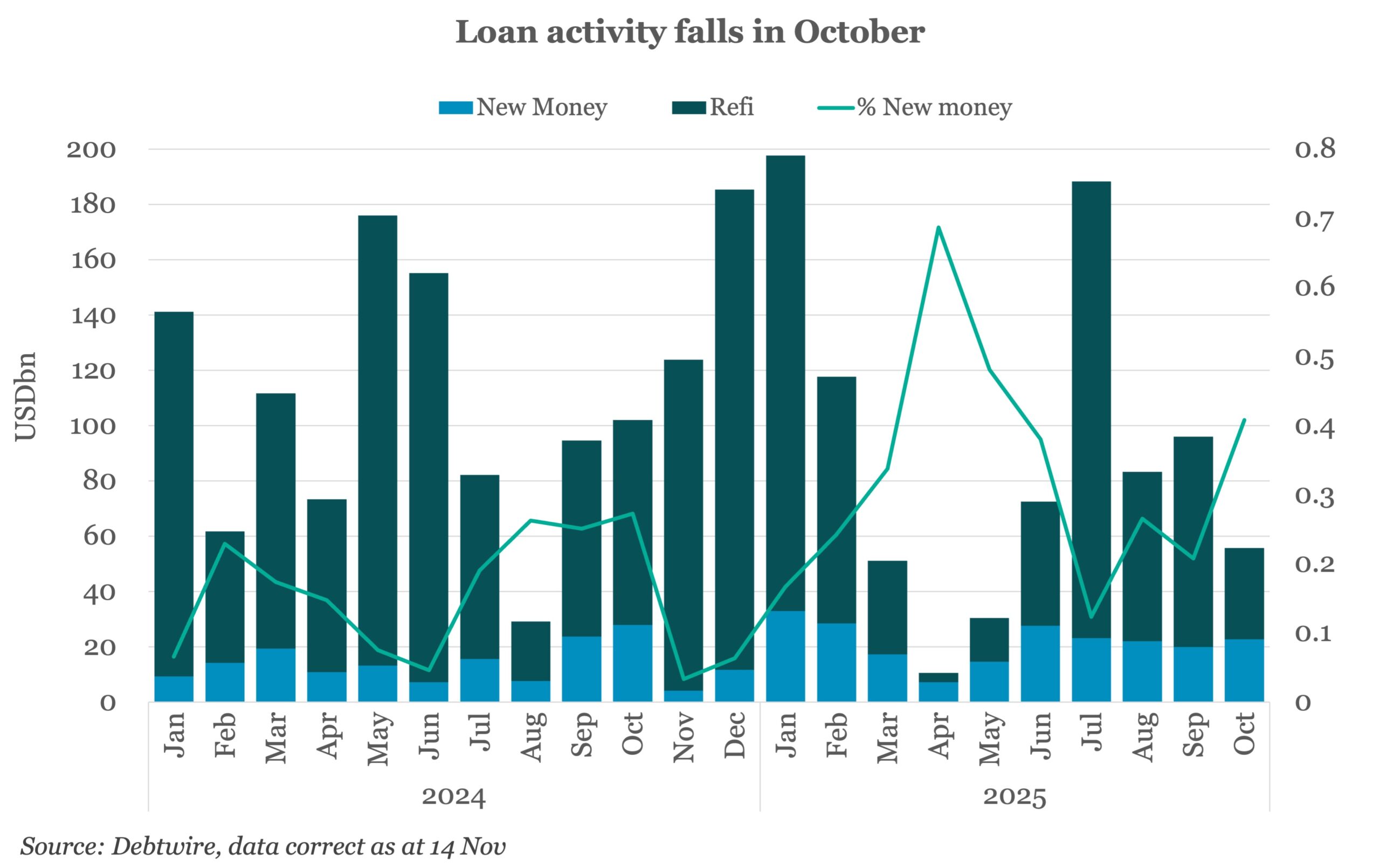

Carveout/divestiture count as a share of all PE middle-market deals by quarter Download PitchBook’s Report here. While quarterly figures can fluctuate, annual trends provide a clearer benchmark, showcasing that carveouts are a core deal type for sponsors…. Subscribe to Read MoreAlready a member? Log in here...

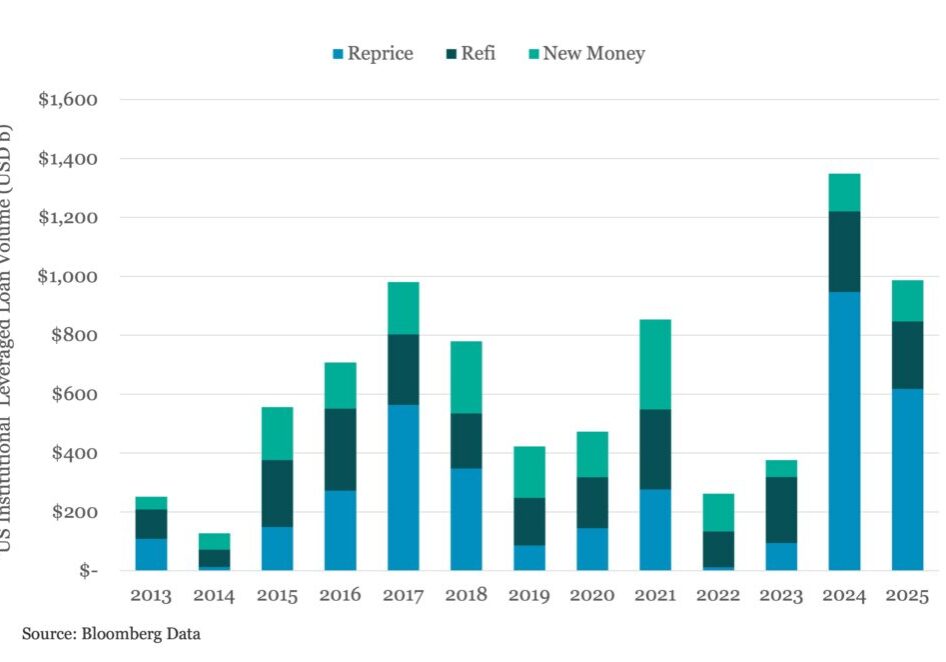

Bloomberg: Leveraged Lending Insights – 1/5/2026

US Leveraged Loan Pricings Remain Elevated in 2025 2025 was another busy year for the US institutional leveraged loan market, with 901 deals for $987.3b pricing over the last twelve months. The figure represents a 25.8% decline from last year’s record-setting volume of $1.3t but is still up significantly from 2023 figure of $376.6b…. Subscribe

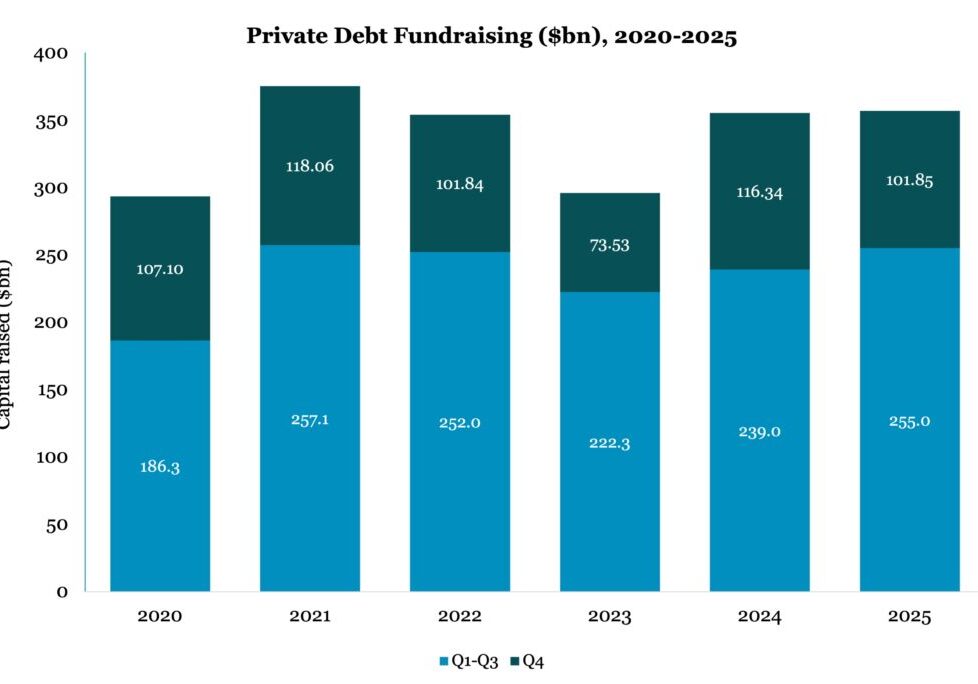

PDI Picks – 1/5/2026

Capital flowing into private debt funds Preliminary data shows capital raising enjoyed a reasonably prolific year in 2025, nudging ahead of the previous year’s total. Last year turned out to be a strong, if not spectacular, year for private debt fundraising globally. With the fourth quarter ending up the most prolific quarter of the year,…

Middle Market & Private Credit – 1/5/2026

Private Credit Outlook 2026 Click here to download report. The global private credit market will continue to grow in scale and complexity in 2026, having become much more diversified and widely held over the past decade…. Subscribe to Read MoreAlready a member? Log in here...

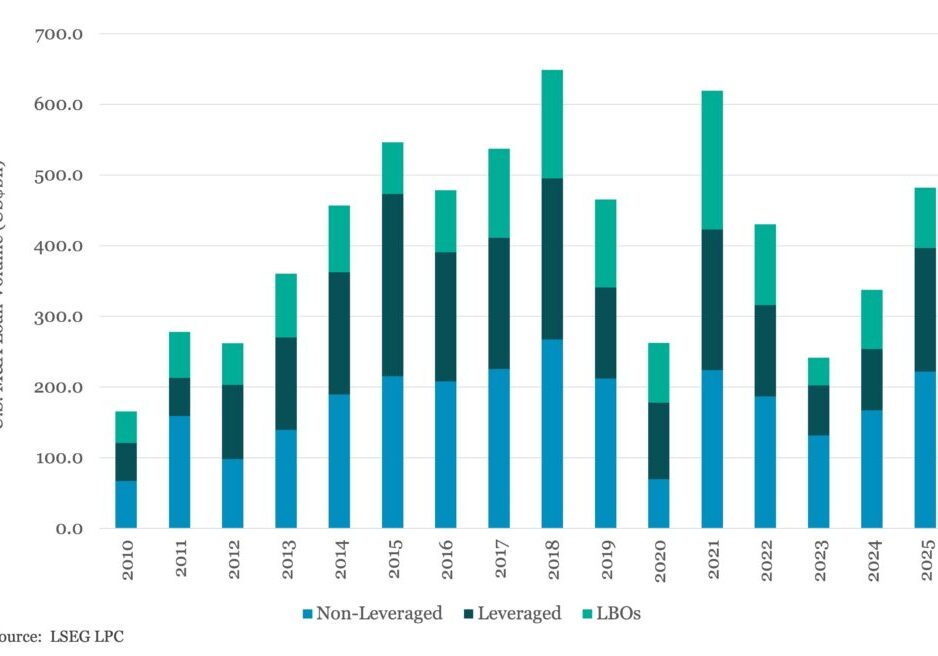

Leveraged Loan Insight & Analysis – 1/5/2026

2025 US M&A loan volume jumps 43% to mark 4-year high at US$482bn US lenders completed over US$482bn in M&A loan volume in 2025, an increase of 43% compared to 2024 totals and the strongest results in 4 years…. Subscribe to Read MoreAlready a member? Log in here...

Beginning in July 2022 The Lead Left published a series of articles on credit market. This report consolidates those articles.

Cov-lite trends Inflation & rising interest rates – LIBOR to SOFR transition Mega-tranche uni trend ESG takes center stage Login to view interactive report and download PDF version. … Subscribe to Read MoreAlready a member? Log in here Related posts: 2H 2021 Midyear Outlook Report State of the Capital Markets – Fourth Quarter 2016 Review and

Beginning in September 2021 The Lead Left published a series of articles on supply chain. This report consolidates those articles.