Debtwire Middle-Market – 6/23/2025

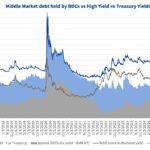

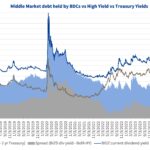

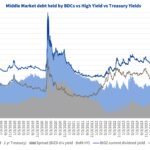

Source: VanEck BDC Income ETF, BofA Merrill Lynch US High Yield Effective Yield The blue line in the chart is the current dividend yield of the *VanEck BDC Income ETF (currently at 11.1% as of 20 June) that tracks the overall performance of publicly traded business development companies (BDCs, are lenders to privately held middle-market businesses…