Featuring Charts

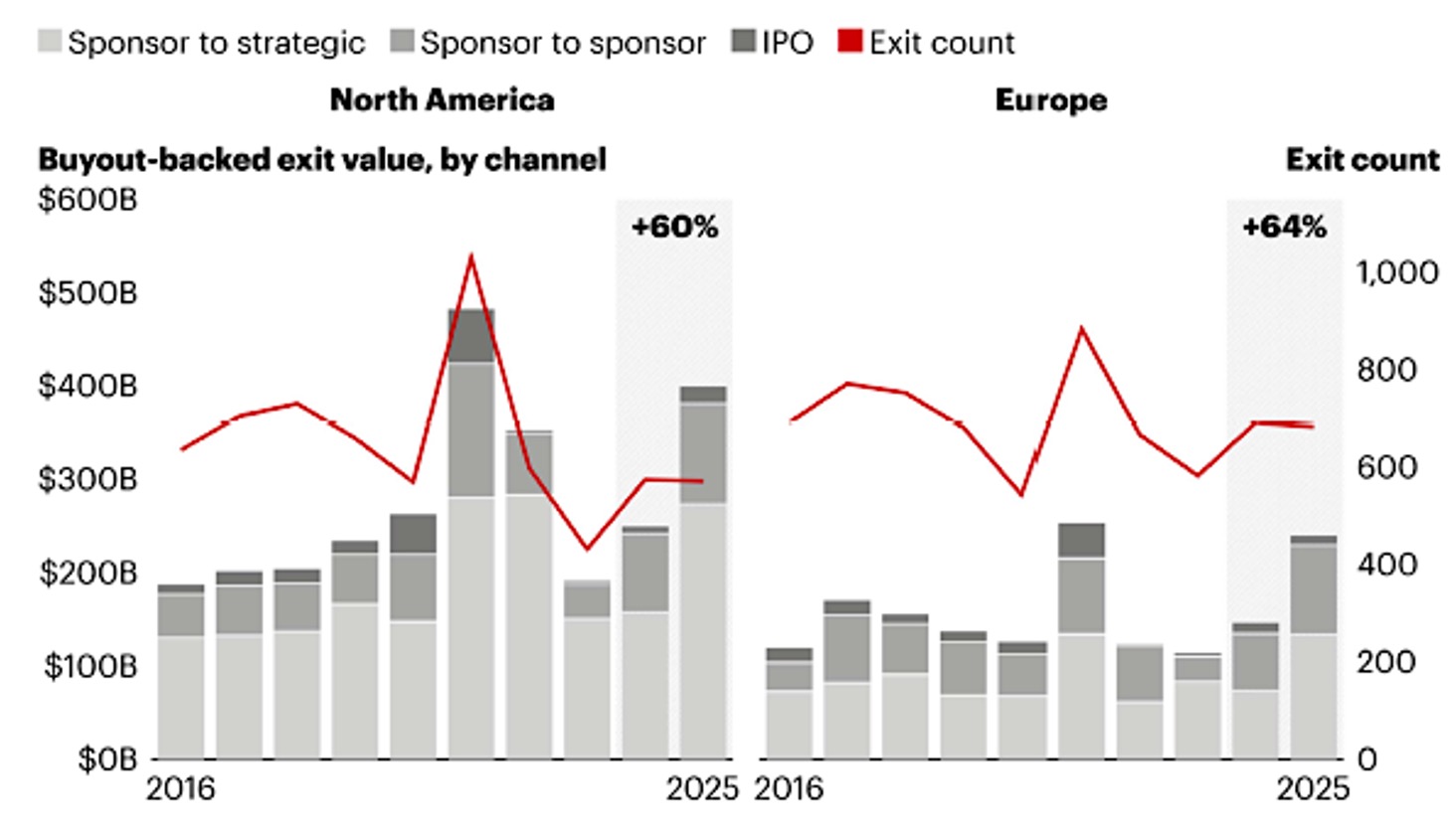

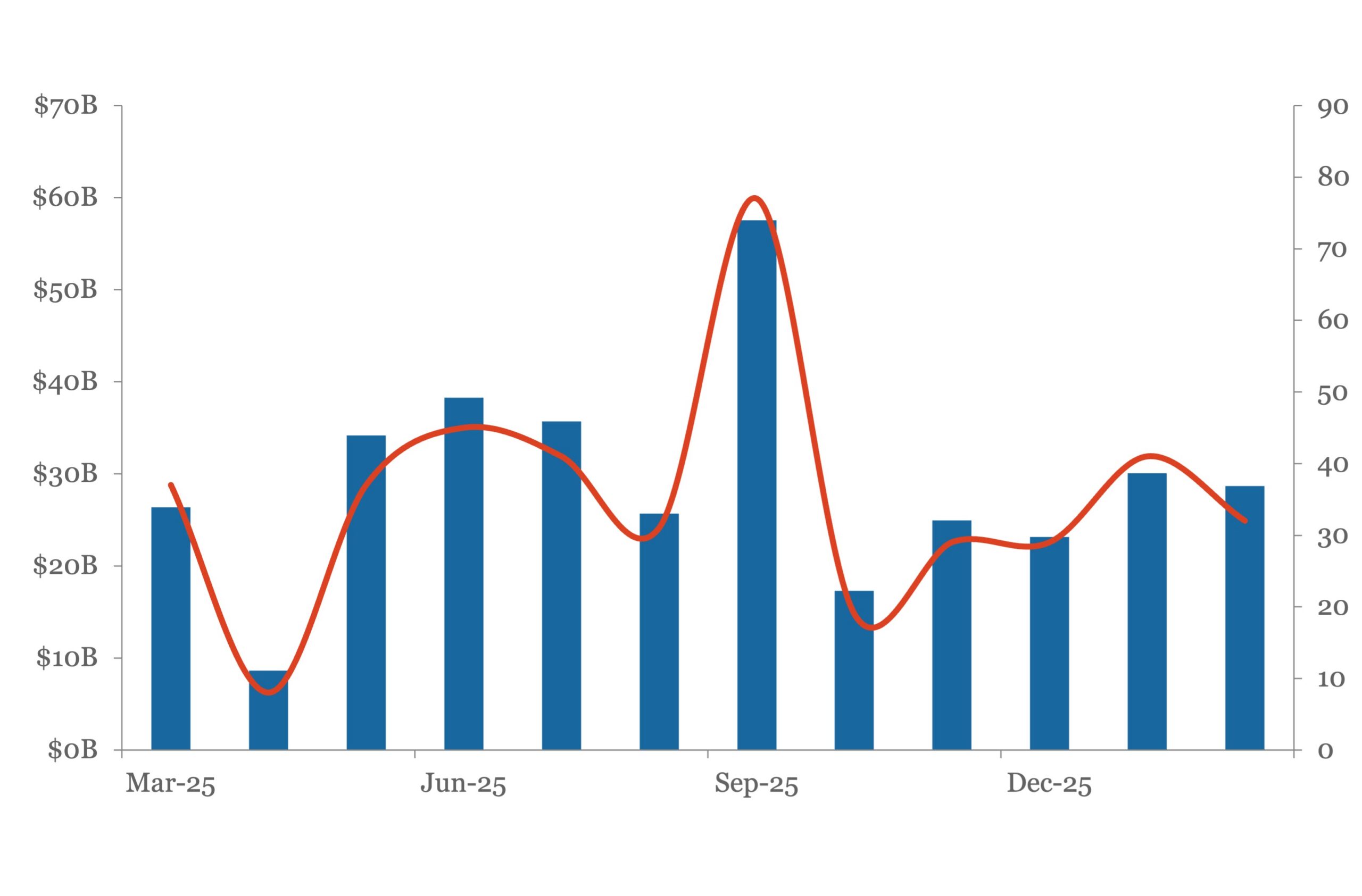

Chart of the Week: Clearing the Backlog

US and European exits were on the rise in 2025. Source: Dealogic, Bain & Company

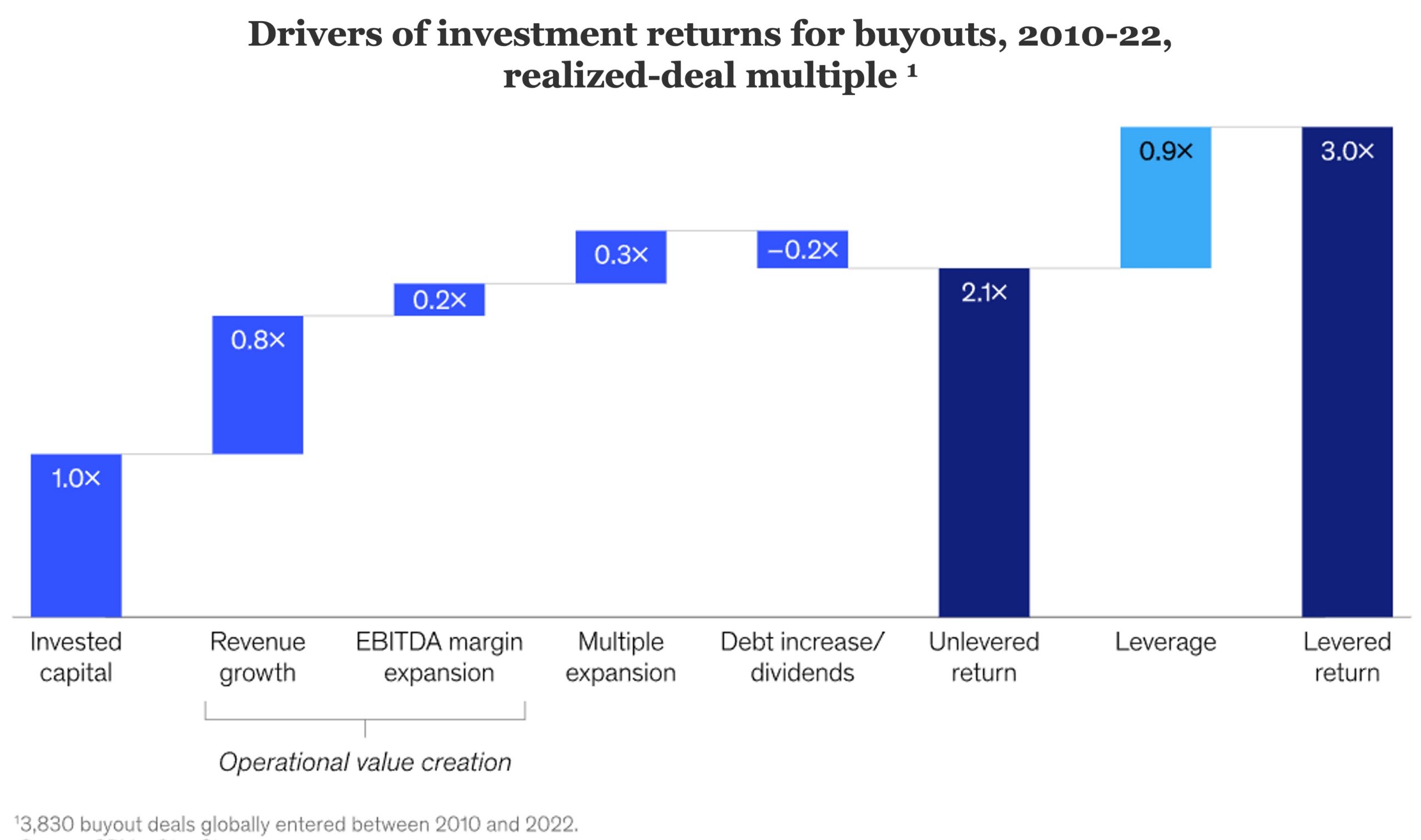

Read MoreChart of the Week: Growth is King

Private equity returns are largely attributable to revenue growth. Source: McKinsey & Co, SPI by StepStone

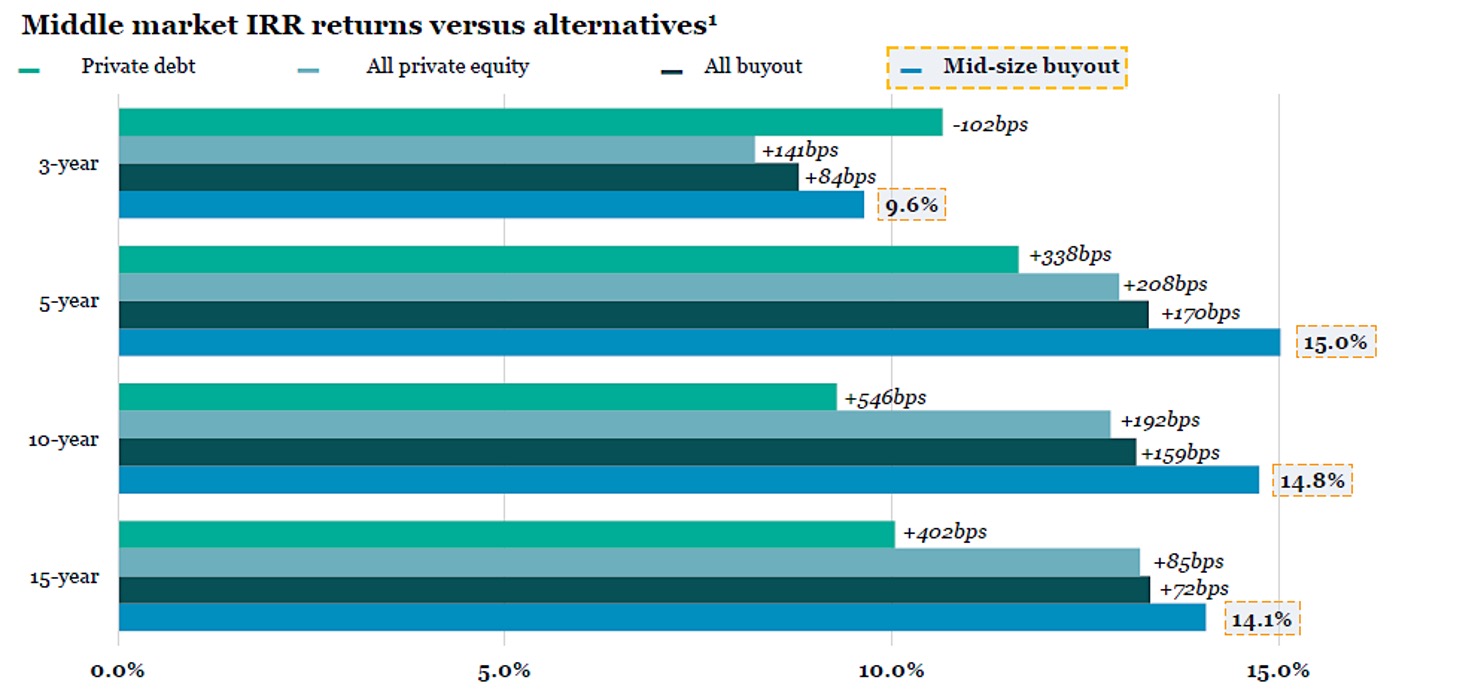

Read MoreChart of the Week: The Sweet Spot

The middle market punches above its weight. Source: State Street Private Equity Index as of 9/30/2025

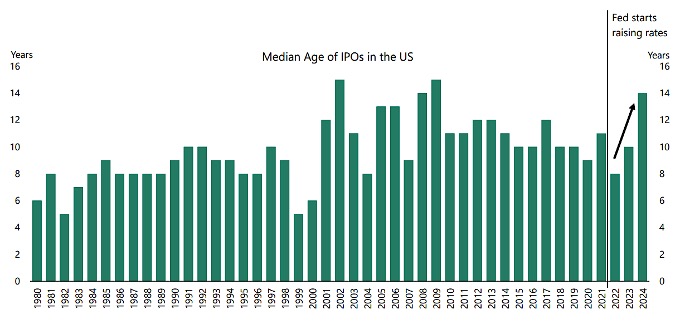

Read MoreChart of the Week: Private-Side Only

US companies that go public are opting to stay private longer. Source: Jay Ritter, University of Florida; Apollo’s The Daily Spark

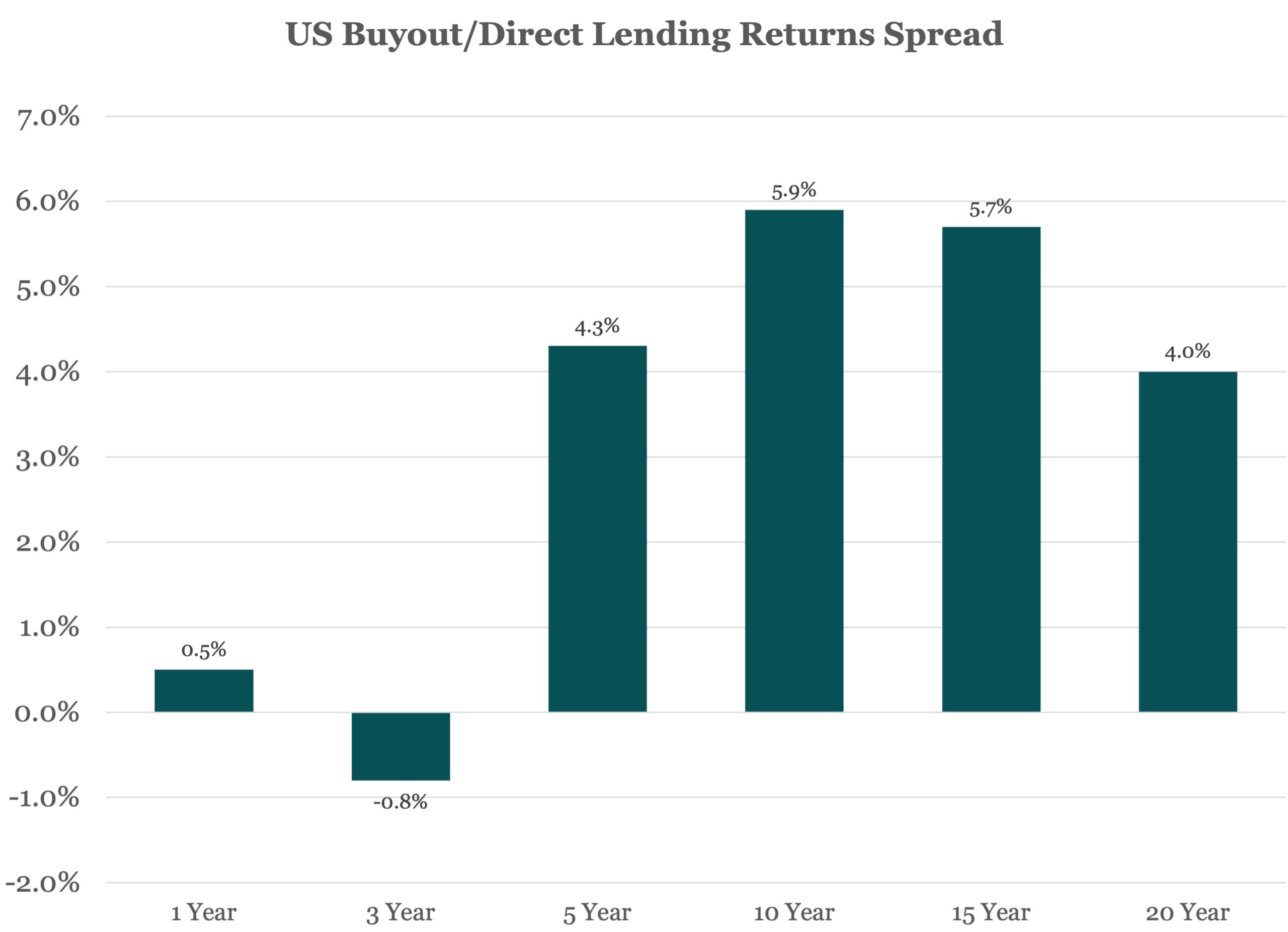

Read MoreChart of the Week: The Equity Premium

In the long-term private equity pays for more risk with better returns. Source: MSCI

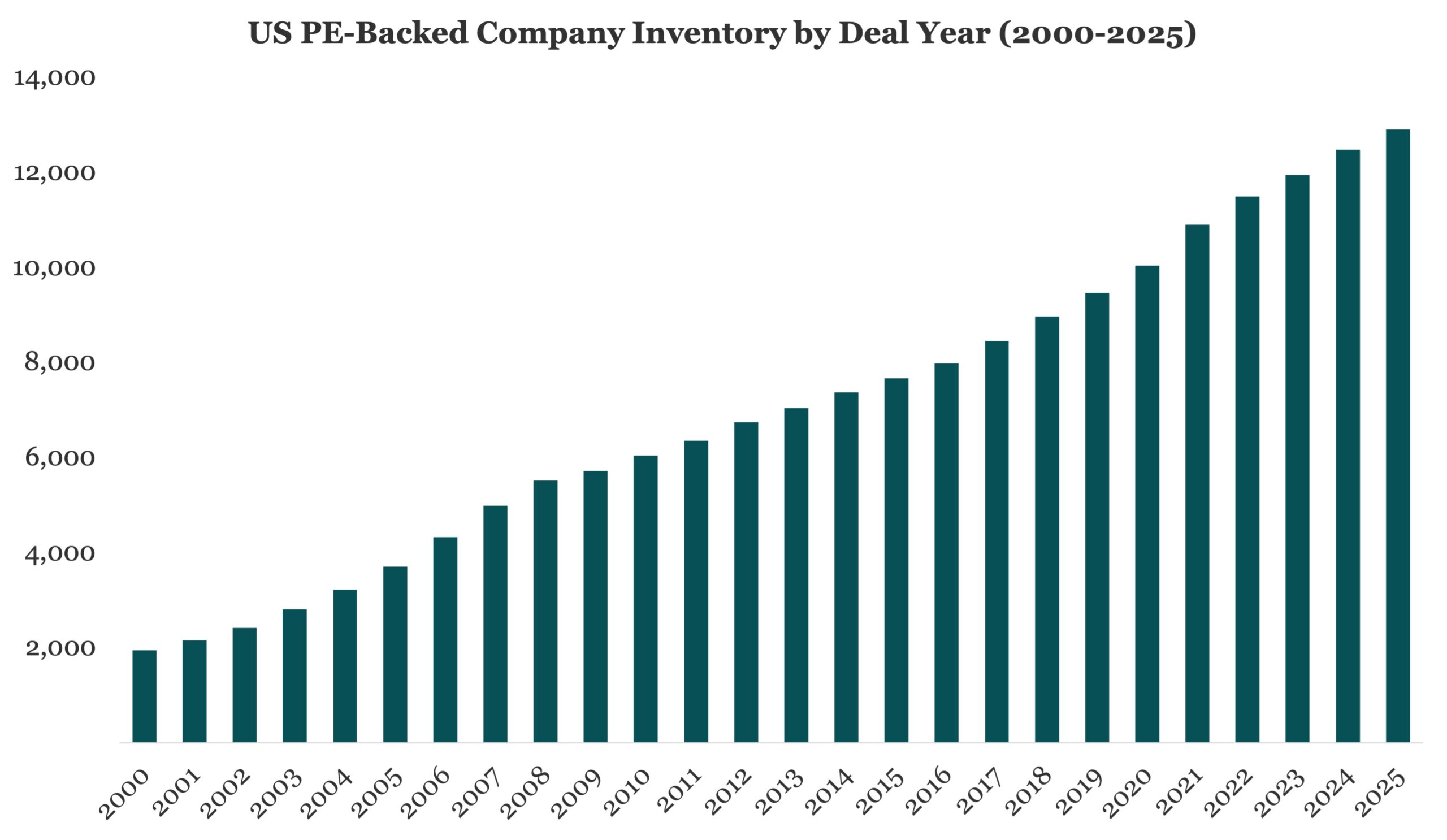

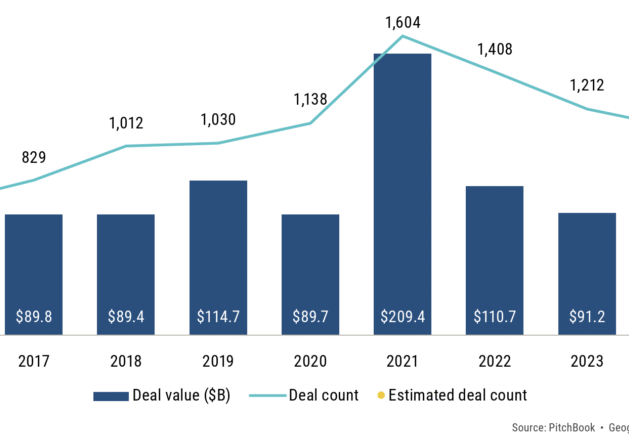

Read MoreChart of the Week: Inventory Check

Private equity remains an attractive option for investors through cycles. Source: PitchBook

Read MoreSubscribe Now!

Join the leading voice of the middle market. Try us free for 30 days.

Click here to view the Newsletter sample.

What is the Lead Left?

- One-stop source for deals and data

- Market trend commentary and analysis

- Exclusive interviews with thought leaders

View Article By

Features

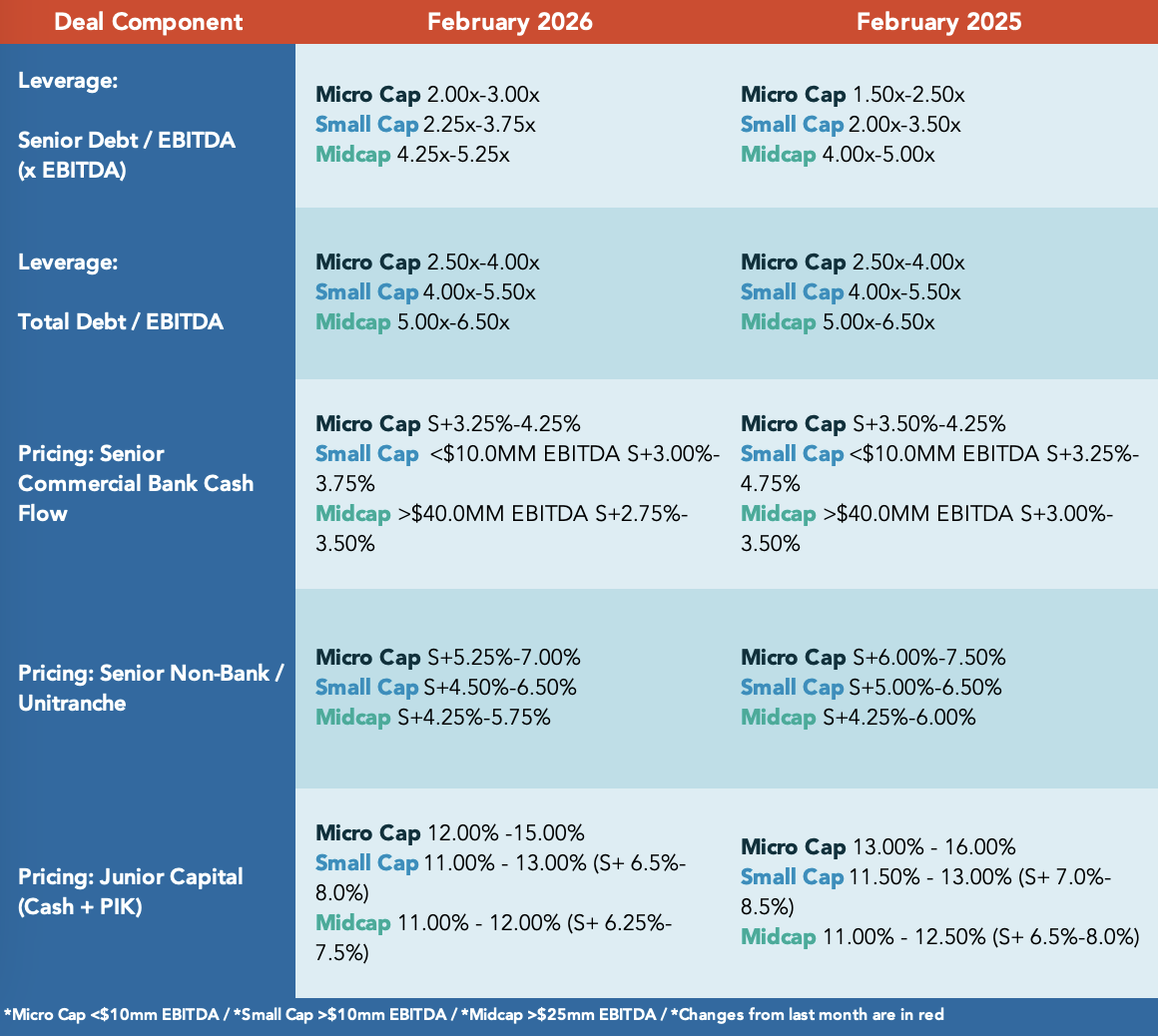

Octus: Private Credit & Deal Origination Insights – 3/2/2026

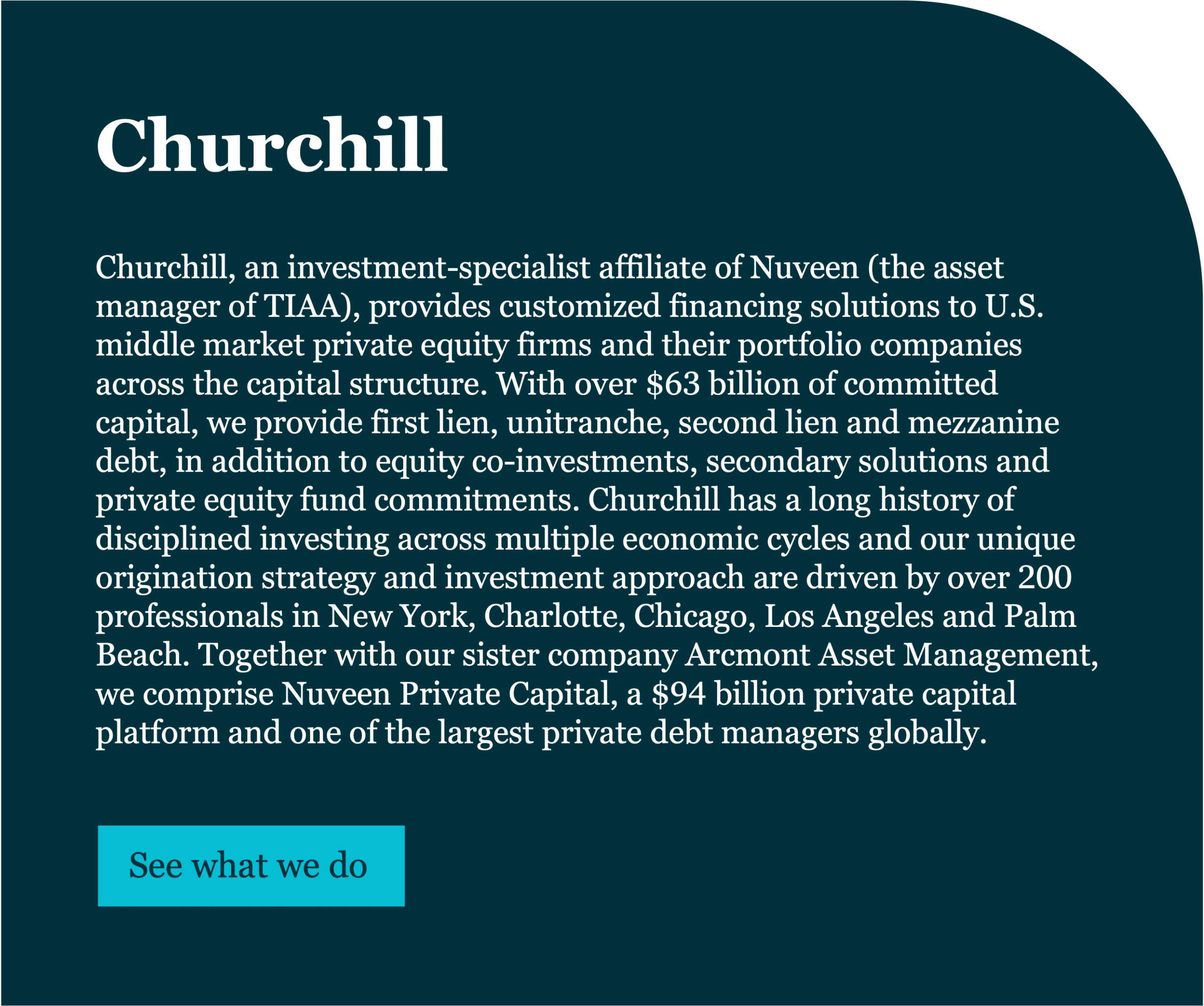

Upcoming Maturities for BDC-Held Software Loans Click here to access the analysis In the near term, private credit restructurings for software companies are likely to be minimal given the relatively low number of loans set to mature over the next few years…. Subscribe to Read MoreAlready a member? Log in here...

Leveraged Loan Insight & Analysis – 3/2/2026

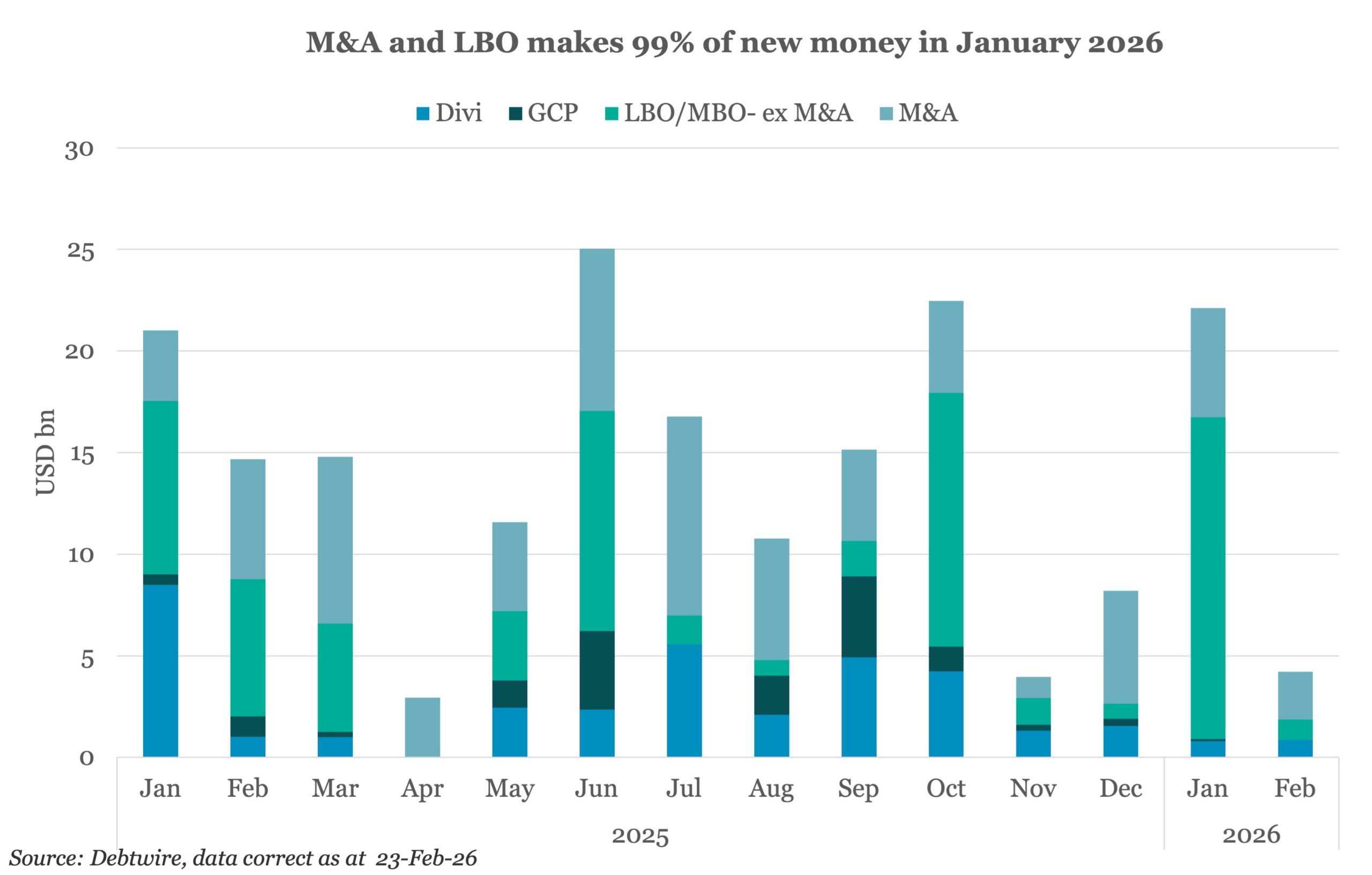

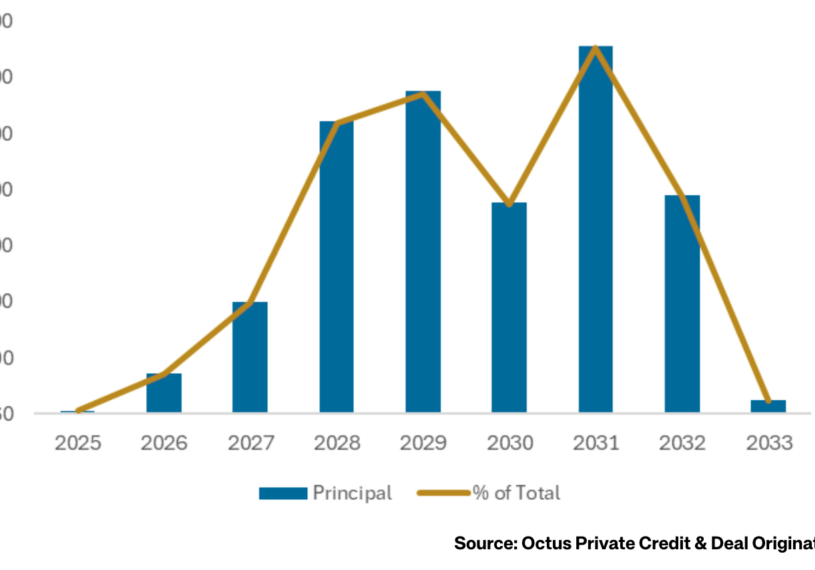

US sponsored loan volume tops US$148.7bn YTD, driven primarily by refinancing activity At US$148.7bn, US sponsored lending was down 26% during the first two months of the year compared to the same period last year, with refinancings accounting for US$82.3bn in volume, while new money totaled US$66.4bn, or 55% and 45% of issuance, respectively…. Subscribe

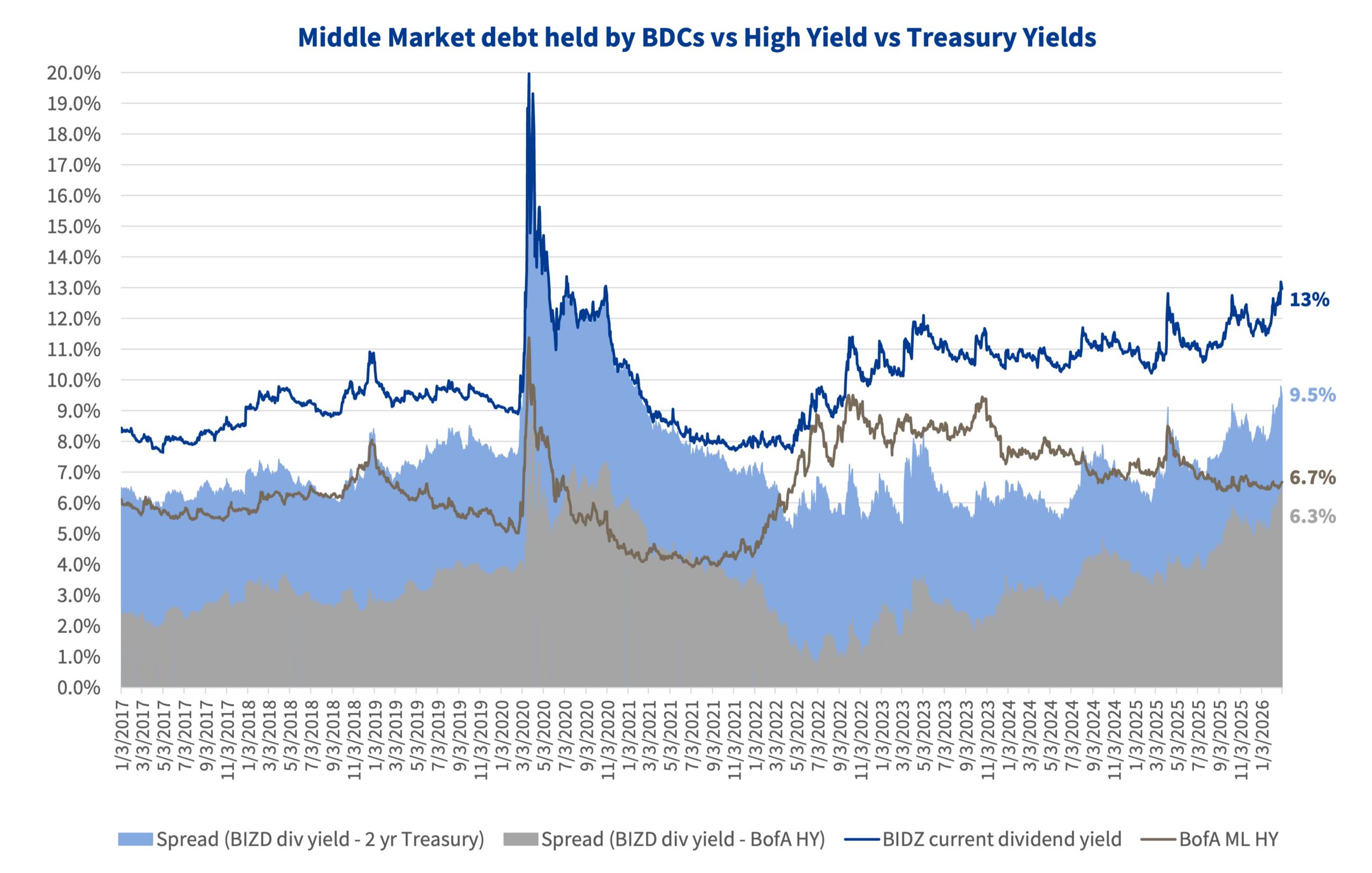

Middle Market & Private Credit – 3/2/2026

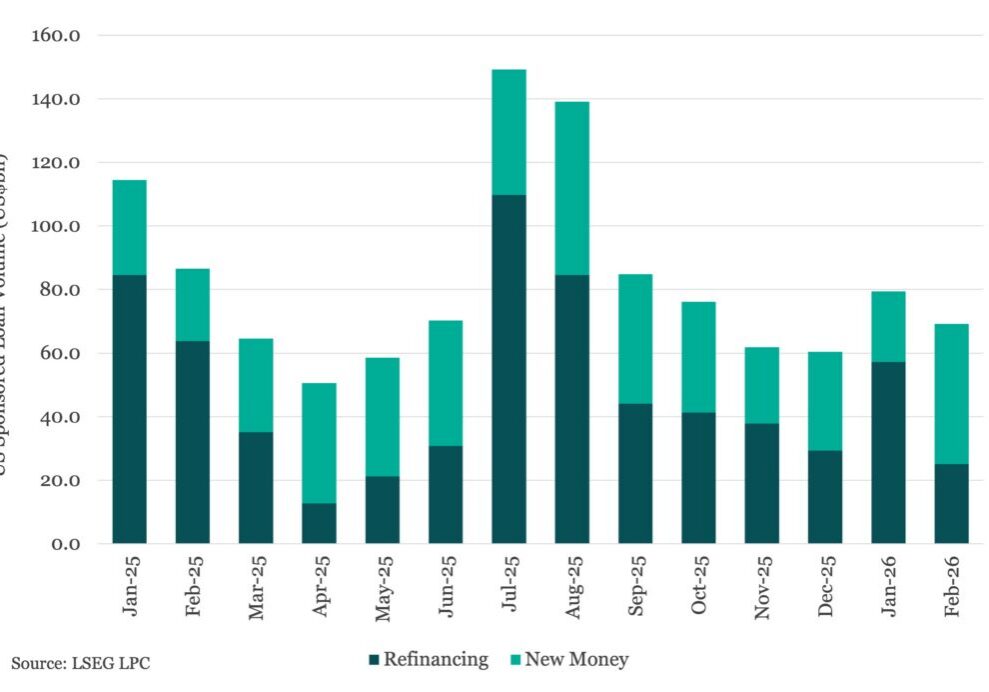

AI Disruption Puts Alt-Investment Manager Software Exposures in Focus Click here to learn more. Sharp declines in major software company valuations amid rising investor concerns about AI-driven disruption have raised questions about lenders’ and asset managers’ sector exposure. While direct lenders, including business development companies (BDCs), typically have sizable software exposures, Fitch-rated alternative investment managers…

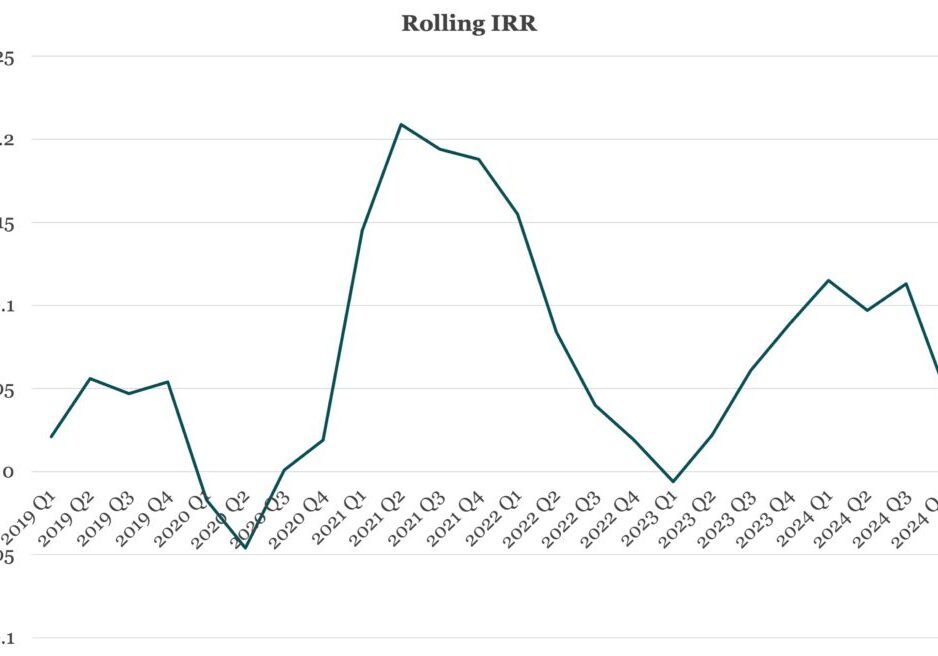

The Pulse of Private Equity – 3/2/2026

Median enterprise value (EV)/revenue multiples on PE deals of $2.5 billion or more Download PitchBook’s Report here. PE buyout valuations were a mixed bag in 2025, with EBITDA and revenue multiples undergoing different trends YoY, but ultimately rebounded from recent lows seen in 2023 to reach the high levels seen in 2021…. Subscribe to Read MoreAlready

PDI Picks – 3/2/2026

Strong performance in a dislocated world The covid pandemic saw high-quality assets with temporary difficulties being snapped up at discounted valuations. In this, the final reflection on our inaugural private markets performance quarterly report, we cast our minds back to a classic period of dislocation – the covid pandemic – and the impact it had…

Beginning in July 2022 The Lead Left published a series of articles on credit market. This report consolidates those articles.

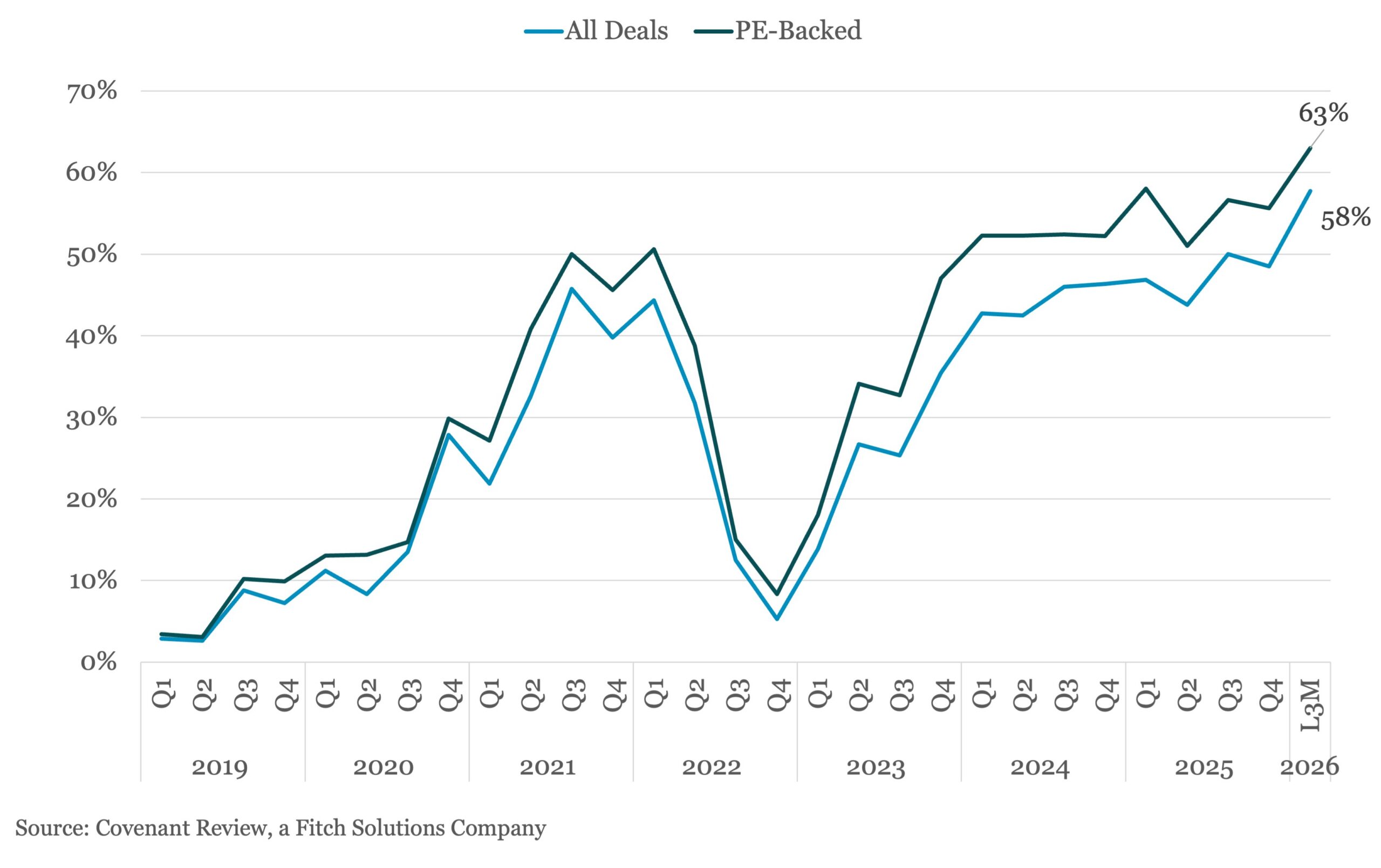

Cov-lite trends Inflation & rising interest rates – LIBOR to SOFR transition Mega-tranche uni trend ESG takes center stage Login to view interactive report and download PDF version. … Subscribe to Read MoreAlready a member? Log in here Related posts: 2H 2021 Midyear Outlook Report State of the Capital Markets – Fourth Quarter 2016 Review and

Beginning in September 2021 The Lead Left published a series of articles on supply chain. This report consolidates those articles.