The Pulse of Private Equity – 4/21/2025

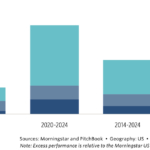

Private debt fund versus leveraged loan returns by quarter Download PitchBook’s Report here. Private credit spreads are expected to tighten further, even after new-issue spreads already declined significantly in 2024…. Subscribe to Read MoreAlready a member? Log in here...