Featuring Charts

Chart of the Week: The Comeback Kid

Since the 2021 peak, global M&A activity has been on the rebound. Source: LSEG

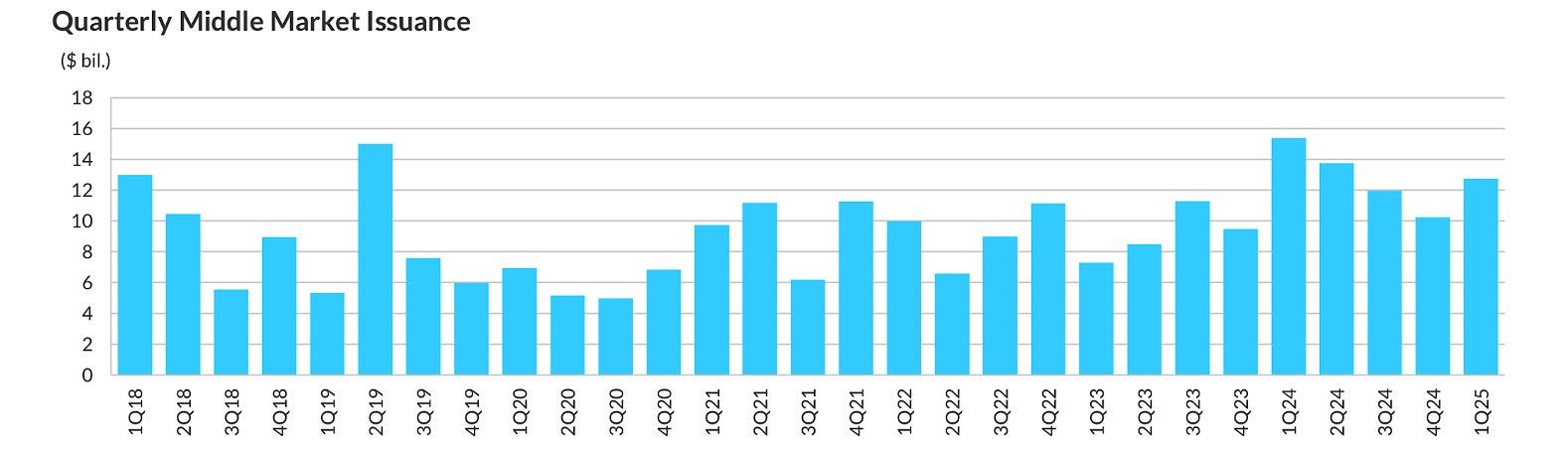

Read MoreChart of the Week: Midcaps Motor On

Through Covid and rate hikes, middle market loan issuance has tracked up. Source: LevFin Insights, a Fitch Solutions company

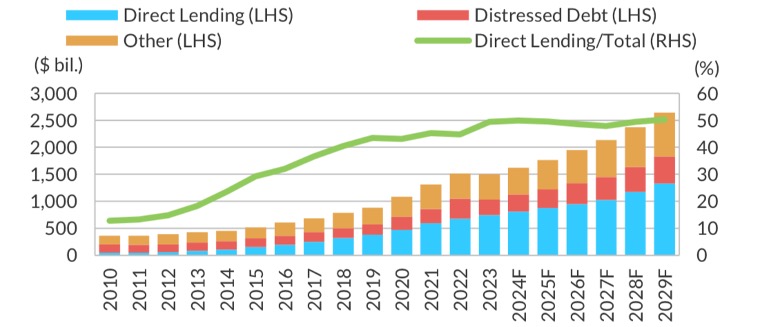

Read MoreChart of the Week: Mission Unstoppable

Private credit AUM expected to continue steady growth, driven by direct lending. Source: Fitch Ratings, Preqin

Read MoreChart of the Week: Rising Sun

Japan’s long-dated bond yields have moved up sharply so far in 2025. Source: The Daily Shot

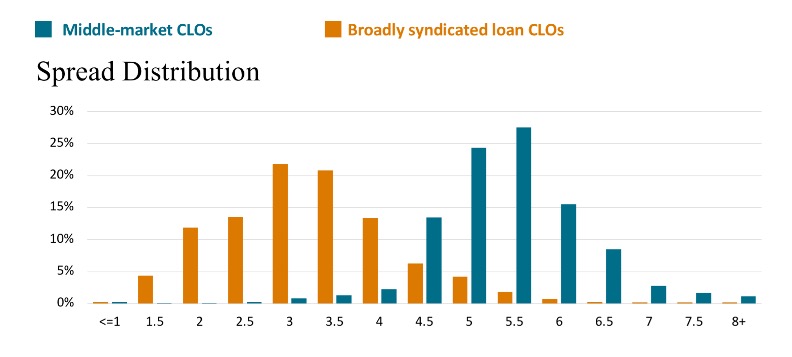

Read MoreChart of the Week: Premium Yields

Spreads for middle market CLOs are distributed higher than their BSL counterparts. Source: S&P Global Ratings

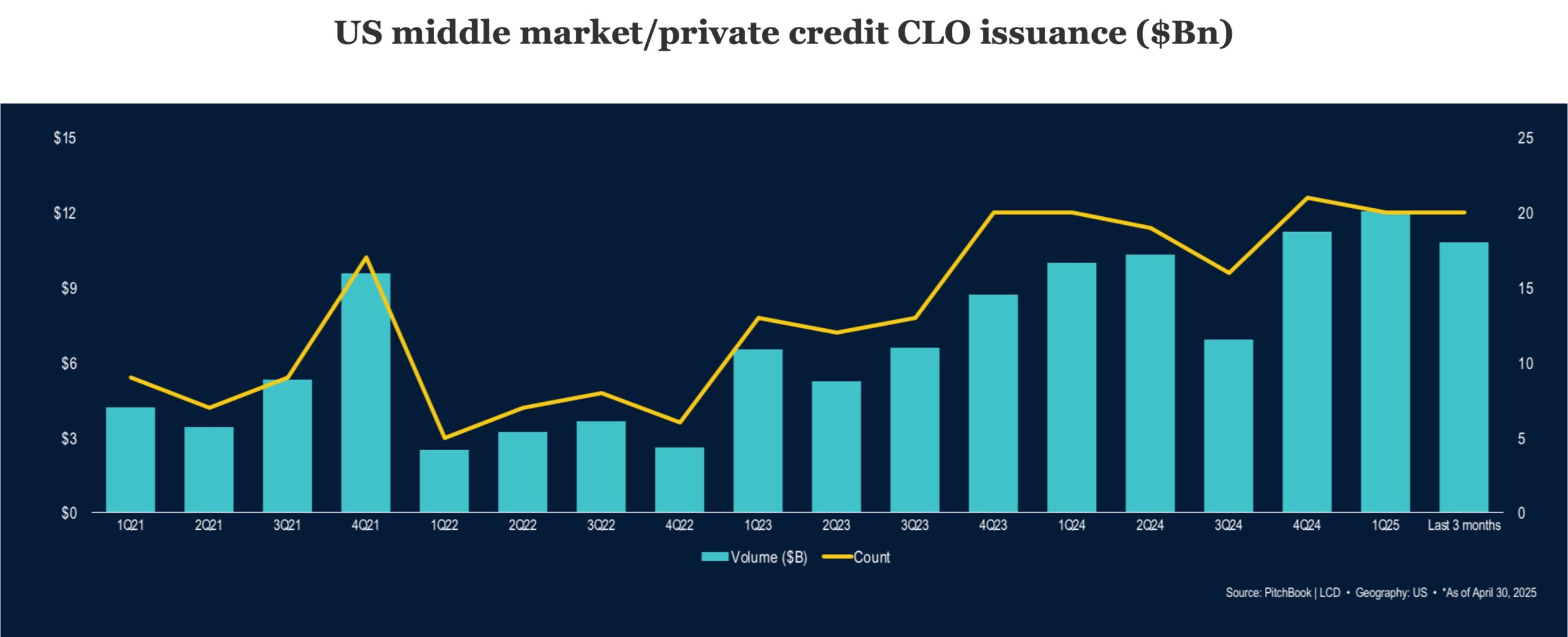

Read MoreChart of the Week: Collateralized Loan Observations

Since the Fed began its rate hike regime in March 2022, MM CLO activity has grown. Source: PitchBook

Read MoreSubscribe Now!

Join the leading voice of the middle market. Try us free for 30 days.

Click here to view the Newsletter sample.

What is the Lead Left?

- One-stop source for deals and data

- Market trend commentary and analysis

- Exclusive interviews with thought leaders

View Article By

Features

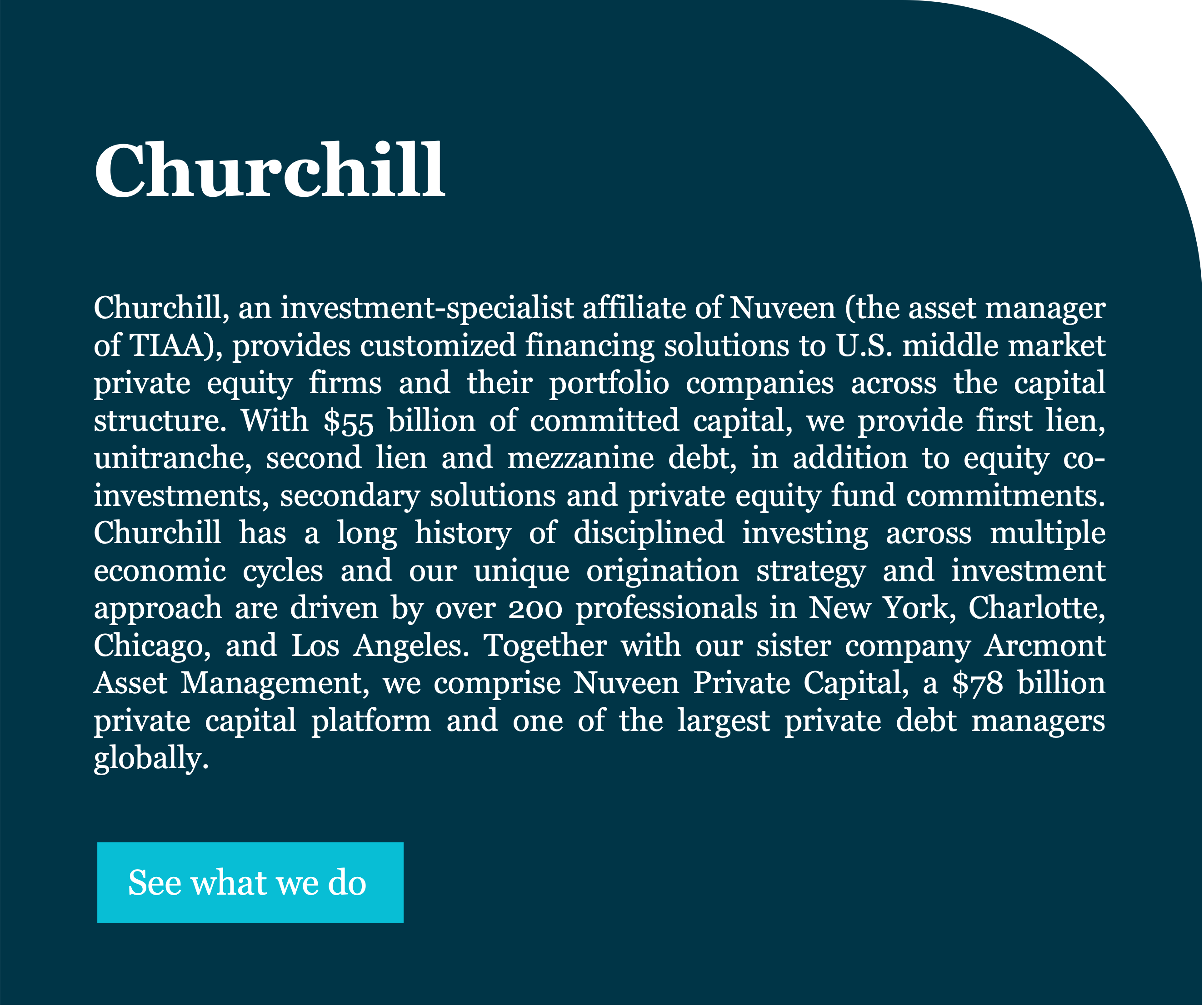

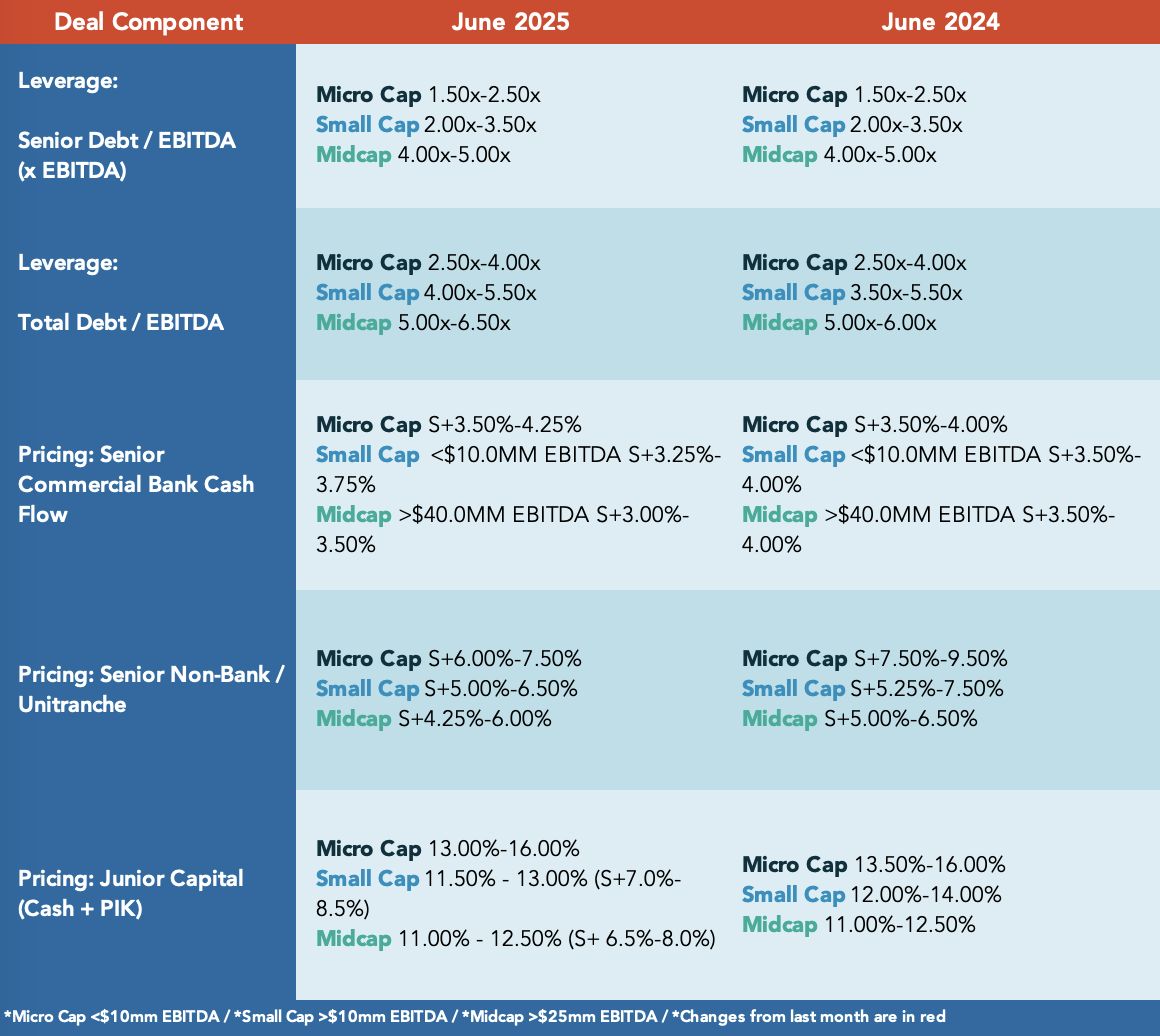

Bloomberg: Leveraged Lending Insights – 6/23/2025

Leveraged loan prices continue to climb in secondary market Average secondary market prices on US Leveraged loans reached 96.44 on June 25th, the highest level since March 17th according to the Bloomberg US Leveraged Loan Index. So far in June, the index has returned 0.51%, bringing the year-to-date figure to 2.47%…. Subscribe to Read MoreAlready

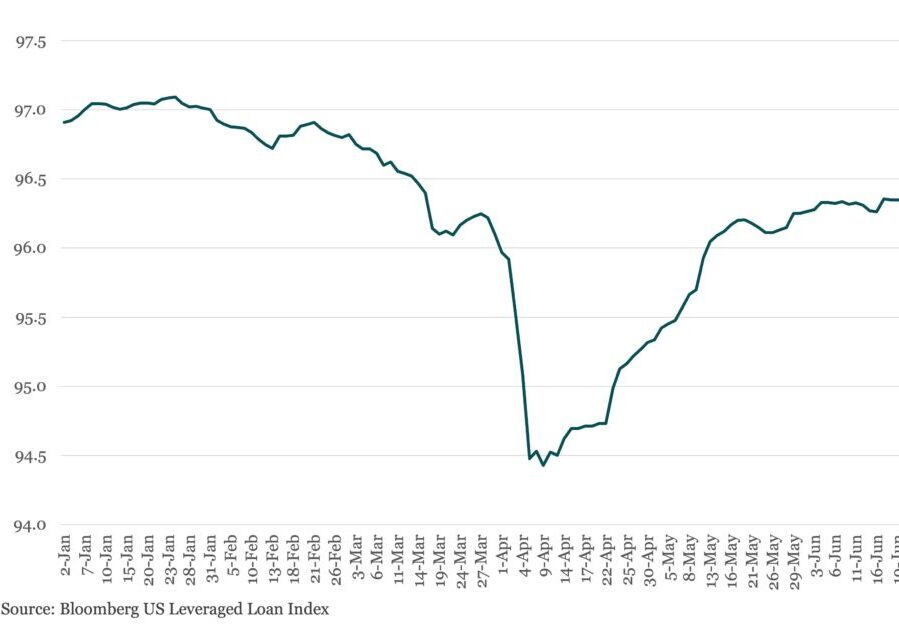

Middle Market & Private Credit – 6/23/2025

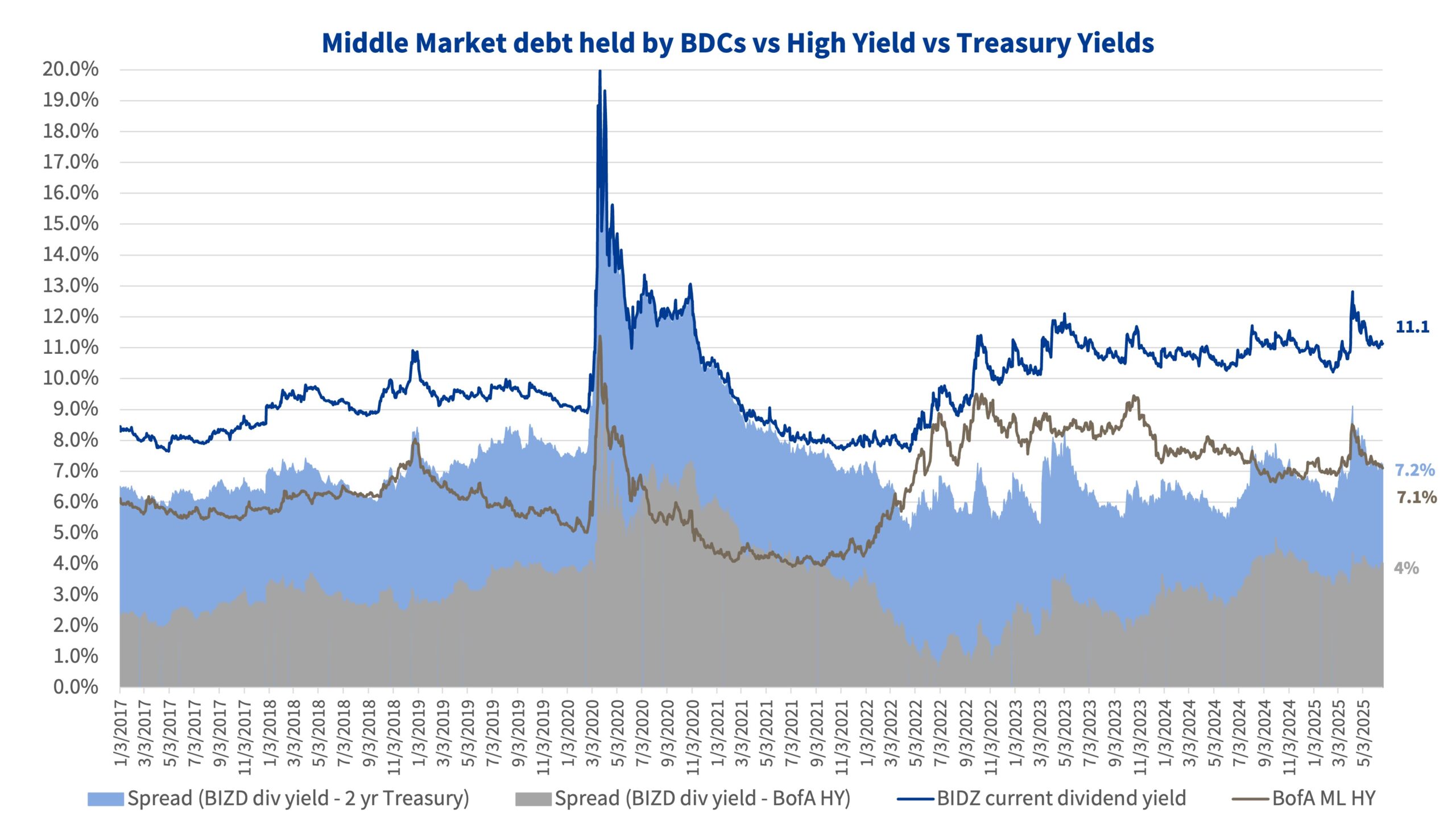

Private Credit’s Growing Complexity Untested Through Market Cycles Click here to download report. What are Key Trends to Watch for BDCs? Fitch’s 2025 sector outlook for BDCs remains ‘deteriorating’ as continued spread pressure and additional non-accruals will likely weaken earnings and dividend coverage for BDCs in 2025…. Subscribe to Read MoreAlready a member? Log in

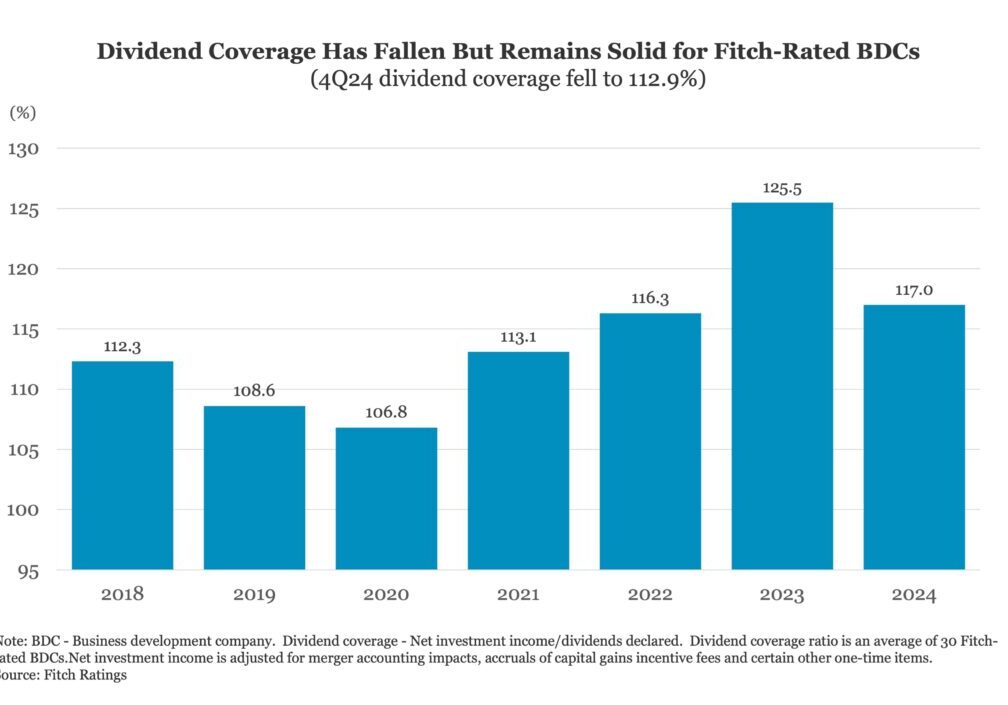

The Pulse of Private Equity – 6/23/2025

PE Index quarterly returns Download PitchBook’s Report here. Preliminary Q4 2024 returns suggest a quarter of weaker performance, potentially tilting the yearly returns for 2024 back into single digits…. Subscribe to Read MoreAlready a member? Log in here...

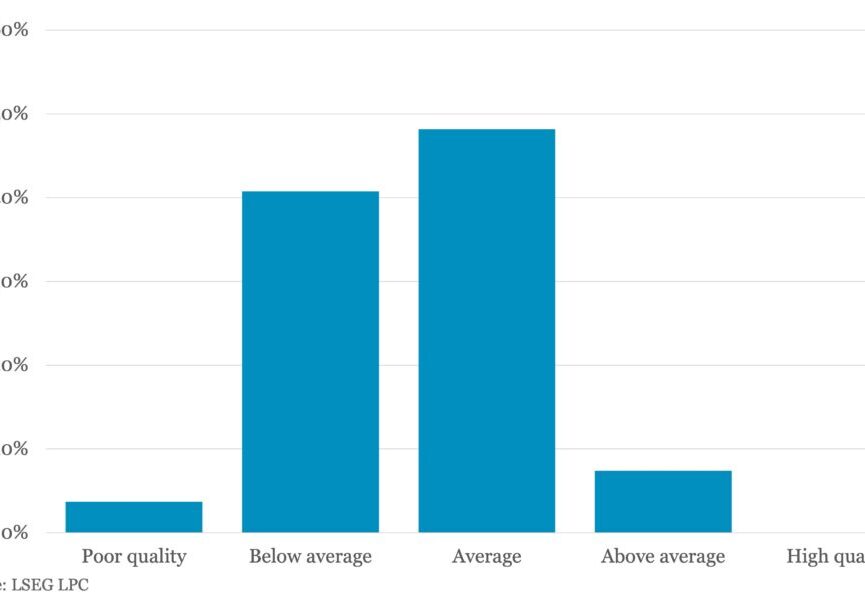

Leveraged Loan Insight & Analysis – 6/23/2025

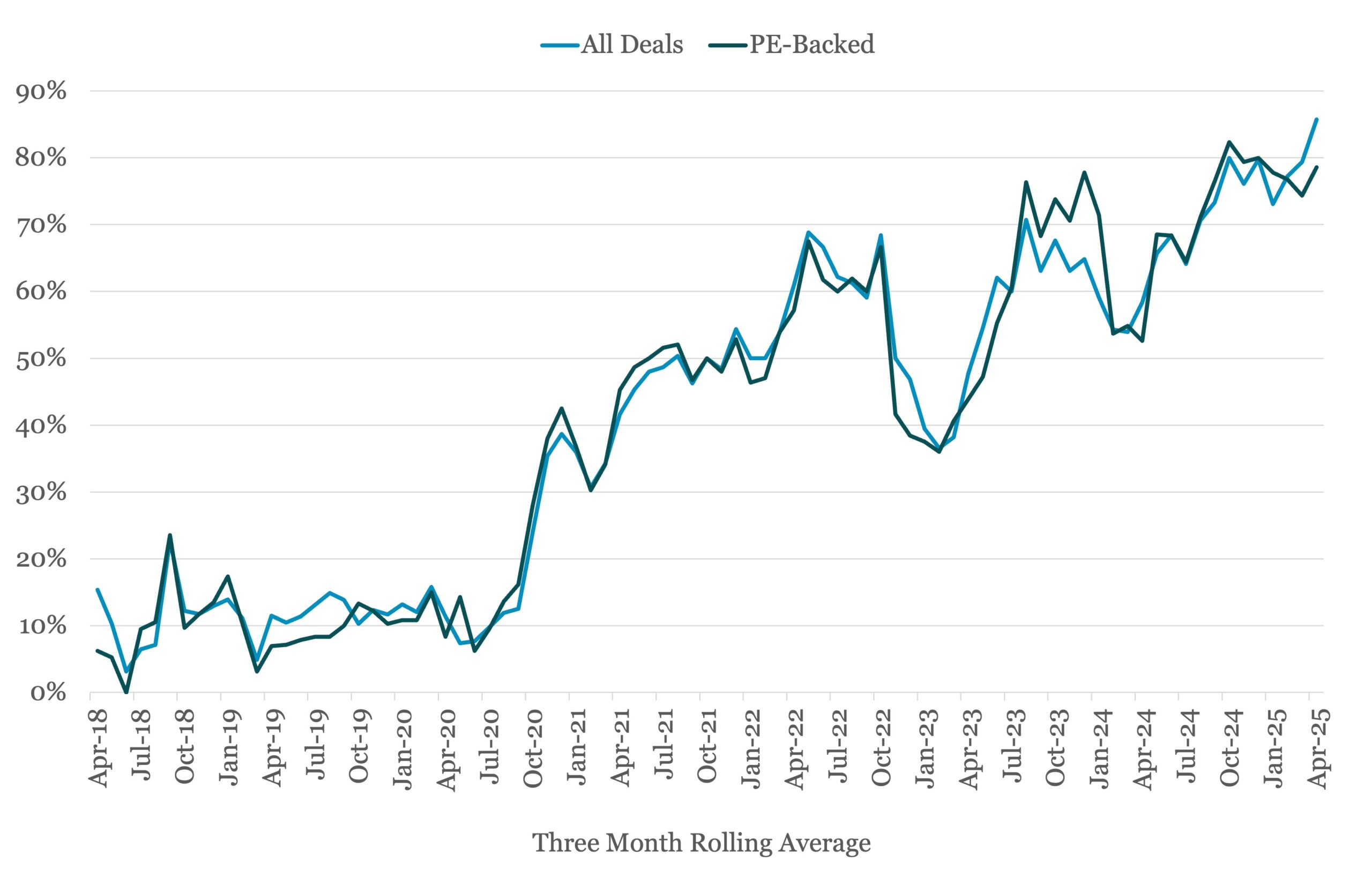

How do middle market lenders characterize the quality of 2Q25 loan supply? According to preliminary results from LSEG LPC’s quarterly middle market lender outlook survey, a large majority (81%) of respondents say they were not able to lend as much as they wanted in 2Q25…. Subscribe to Read MoreAlready a member? Log in here...

Bloomberg: Leveraged Lending Insights – 6/16/2025

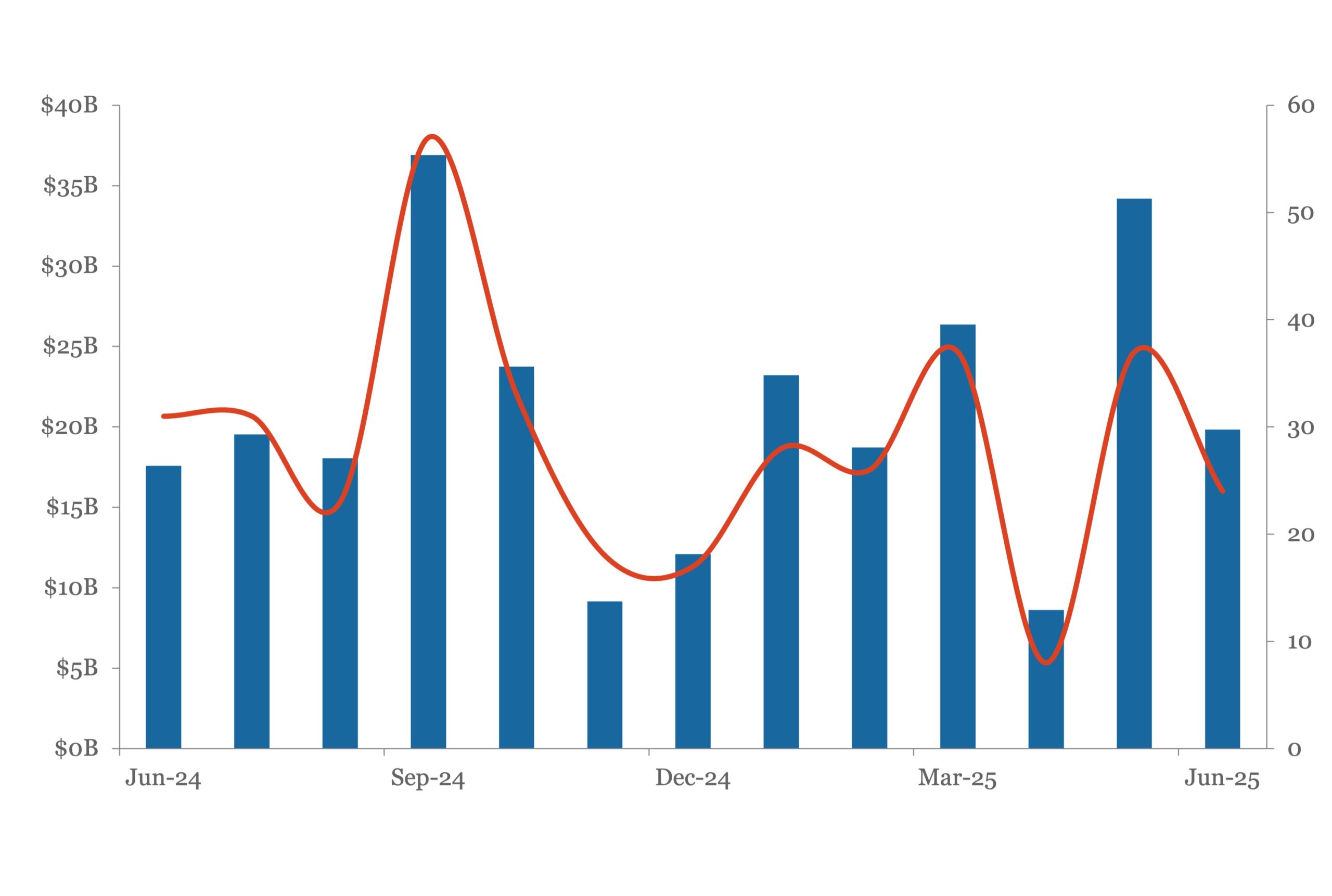

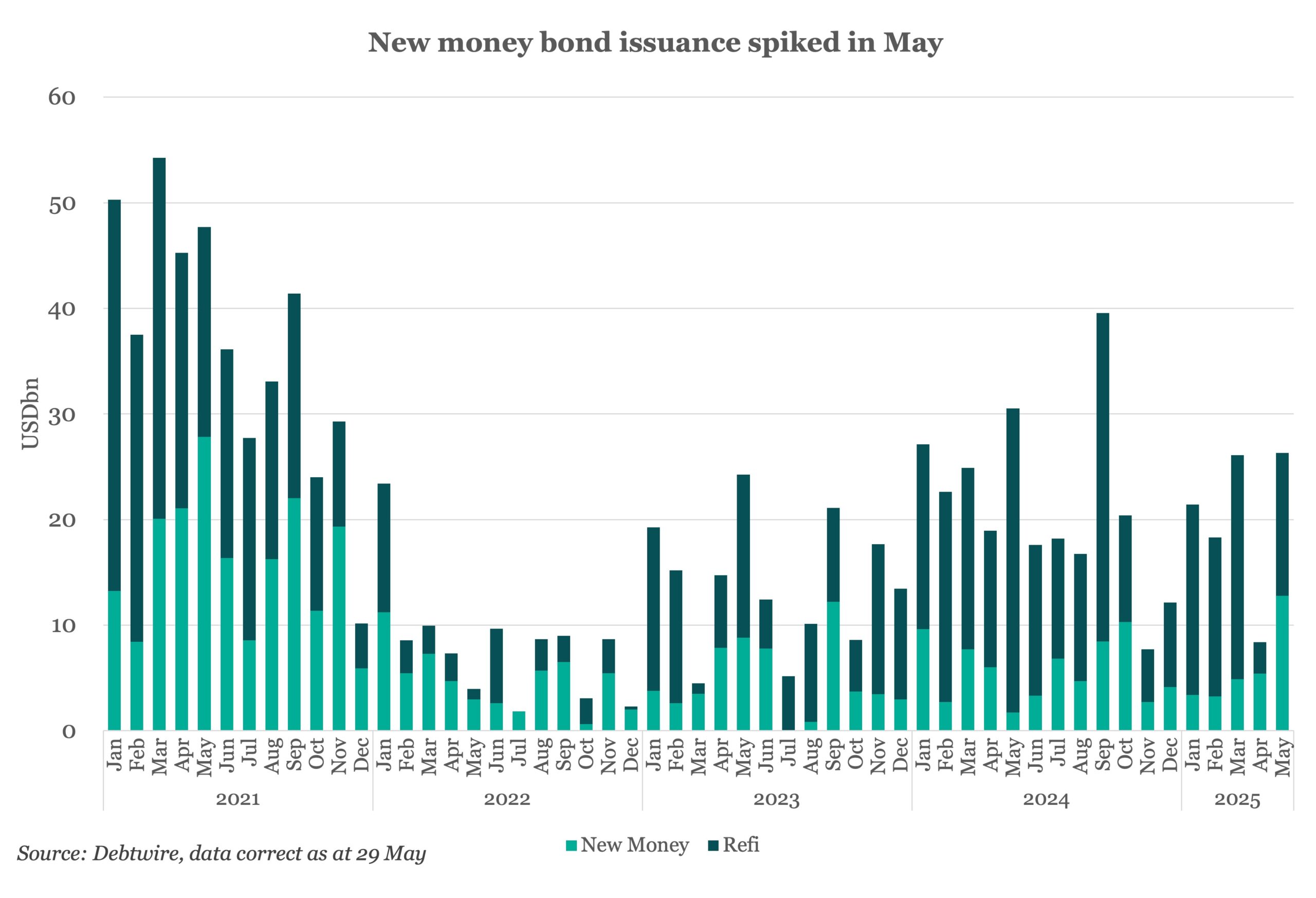

Leveraged Loan Launches Keep Pace as Global Tensions Mount Click here to access Bloomberg’s US Leveraged Finance Chartbook Through June 17th, 59 deals for $47.8b have launched into the US leveraged loan market this month for a 53% improvement from the full month of May figure. Weekly launches exceeded $20bn during the week ending June…

Beginning in July 2022 The Lead Left published a series of articles on credit market. This report consolidates those articles.

Cov-lite trends Inflation & rising interest rates – LIBOR to SOFR transition Mega-tranche uni trend ESG takes center stage Login to view interactive report and download PDF version. … Subscribe to Read MoreAlready a member? Log in here Related posts: 2H 2021 Midyear Outlook Report State of the Capital Markets – Fourth Quarter 2016 Review and

Beginning in September 2021 The Lead Left published a series of articles on supply chain. This report consolidates those articles.