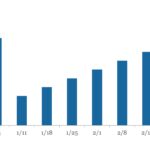

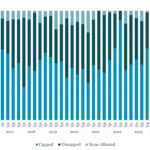

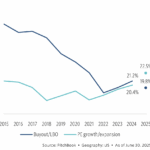

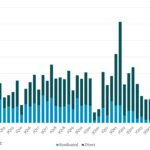

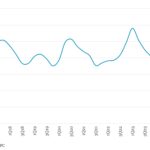

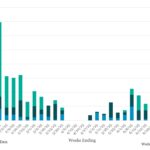

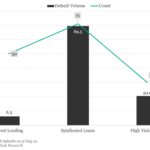

LevFin Insights: High-Yield Bond Statistics – 7/28/2025

Launched Volume Source: LevFin Insights New-issue Yields Source: LevFin Insights Weekly Fund Flows Source: Lipper (Past performance is no guarantee of future results.) Contact: Robert Polenbergrobert.polenberg@levfininsights.com