TheLeadLeft

Special Report: Supply Chain Blues

Beginning in September 2021 The Lead Left published a series of articles on supply chain. This report consolidates those articles.

Leveraged Loan Insight & Analysis – 1/3/2022

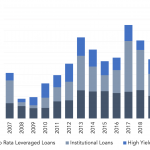

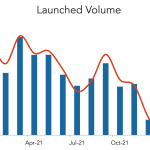

Record US$1.8tr of US leveraged issuance clears market in 2021 In the absence of major market blips or deepening concerns around deteriorating credit quality, US leveraged lenders supported nearly US$1.8tr in loan and bond issuance in 2021, the highest total on record. The unabated presence of Covid-19 certainly impacted lender operations in so far as…

Debtwire Middle-Market – 1/3/2022

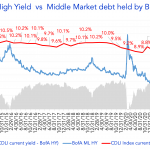

Source: Cliffwater Direct Lending Index and BofA Merrill Lynch US High Yield Effective Yield The red line in the chart is the *Cliffwater Direct Lending Index (CDLI) current yield, which is based on the investment income of the underlying assets held by public and private BDCs. BDCs invest in middle market companies, and the Index…

The Pulse of Private Equity – 1/3/2022

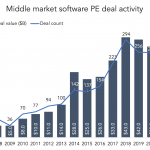

Predicting the year ahead Download PitchBook’s Report here. Every year, PitchBook gets into the prediction game. This year’s US Private Equity Outlook has 7 predictions, including an intriguing one for middle market software investment. 2021 set records for PE software activity – 317 deals totaling $45 billion in aggregate value. For 2022, we’re predicting 400 software…

LevFin Insights: High-Yield Bond Statistics – 1/3/2022

Source: LevFin Insights Source: LevFin Insights Source: Lipper (Past performance is no guarantee of future results.) Contact: Robert Polenberg robert.polenberg@levfininsights.com

Covenant Trends – 1/3/2022

Percentage of Deals with 75+ bps MFN (Past performance is no guarantee of future results.) Contact: Steven Miller

All Ahead Full: Private Credit Outlook 2022 (Last of a Series)

We planned last year to publish a special series on Environmental, Social and Governance (ESG). Unlike most topics in our commentaries, the origins and complexities of ESG were unfamiliar. To the rescue came our Nuveen colleagues, a Responsible Investing team of close to thirty ESG professionals. Of course, risk management is core to Churchill’s own…

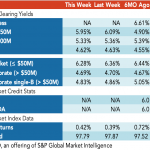

Loan Stats at a Glance – 1/3/2022

Contact: Marina Lukatskymarina.lukatsky@spglobal.com