TheLeadLeft

All Ahead Full: Private Credit Outlook 2022 (Fifth of a Series)

Inflation and interest rates are linked, but not always in straightforward ways. Fear of higher prices can drive rates up, while markets may ignore actual inflation having anticipated it. This year we devoted a special series to inflation (link) and, with expert help from our favorite economists, have written extensively about rate expectations. Recent data…

Chart of the Week: Below Freezing

Long-term inflation protected Treasury yields have bottomed out to record lows.

Private Debt Intelligence – 12/13/2021

US Remains Most Attractive for Private Debt, But Other Markets Are Catching Up Every year, Preqin asks investors which developed markets they think are presenting the best opportunities in private debt. The US is the top market, although the 65% of investors who identified it is down from 77%. However, a number of other regions…

PDI Picks – 12/13/2021

Europe’s unstoppable deal market Despite the pandemic, it’s been a case of full steam ahead for transactions in the region. European private debt deal numbers breached the 200 milestone during a single quarter for the first time in Q3 according to the latest figures from the Deloitte Alternative Lender Deal Tracker. On the face of…

Covenant Trends – 12/13/2021

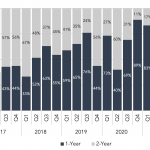

Distribution of MFN Maturity Carveout Horizons (Past performance is no guarantee of future results.) Contact: Steven Miller

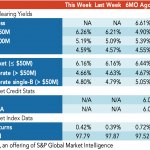

Loan Stats at a Glance – 12/13/2021

Contact: Marina Lukatskymarina.lukatsky@spglobal.com

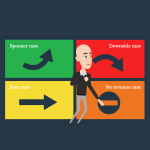

2022 Outlook: Portfolio Construction

At recent private credit conferences we’ve been asked how managers think about portfolio construction. Kind of depends on your experience over the past twenty-two months. As one private equity partner told us, “we had a base case and a down-side case, but we didn’t have a no-revenue case.” Consumer-facing sectors had a rough time early […]