The Pulse of Private Equity – 11/8/2021

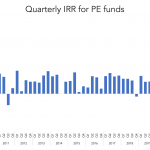

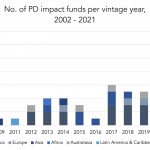

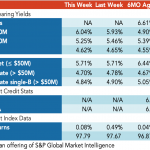

Mega-funds lead PE fund returns Download PitchBook’s Report here. Global PE funds posted a quarterly record in the first quarter, returning 17.6%, according to PitchBook’s latest Global Funds Performance Report. Very active capital markets are helping boost quarterly return numbers to historical highs. Preliminary Q2 returns show some deceleration, estimated at 8.8%, but still well above…