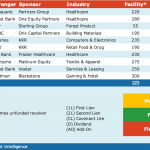

Leveraged Loan Insight & Analysis – 10/4/2021

1-3Q21 leveraged issuance sets new record at US$1.3Tr U.S. bank arrangers completed over US$250bn of leveraged loan issuance during the quarter, the strongest 3Q results since 2017 as liquidity and a resurgence of sponsor activity buoyed the market. At almost US$935bn, leveraged loan issuance for the first nine months of the year was just shy…