Debtwire Middle-Market – 7/26/2021

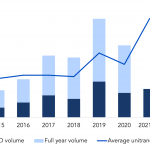

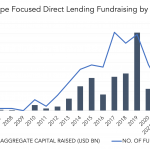

Average WE unitranche size rockets Source: Debtwire Par The total WE unitranche volume for the year is expected to come in higher than last year and lower than the peak volumes seen in 2019. Around EUR 6.8bn has been raised in 2021 to date compared with EUR 5.8bn and EUR 8.6bn secured over the same…