TheLeadLeft

The State of Private Credit in Europe (Sixth of a Series)

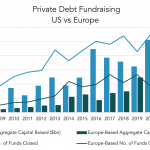

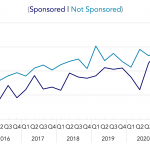

Our Chart of the Week, courtesy Preqin, highlights how both US and European fundraising for private debt came into Covid with a head of steam. That momentum slowed in the wake of the pandemic last year. Since then, however, things have picked up. Our content partner, Private Debt Investor, recently published some excellent commentary related…

Chart of the Week: Fund Stuff

Fundraising for private debt in both US and Europe was strong coming into Covid, fell off, but is recovering.

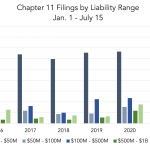

Reorg Credit Intelligence – 7/19/2021

July Sees Uptick in Chapter 11s; Limetree Bay Leads Two Energy Filings This Week Eight chapter 11 cases filed between Monday and Thursday this week as July proves to be much more active than the previous month. The biggest case of the week was St. Croix-based oil refinery operator Limetree Bay Energy, whose capital structure…

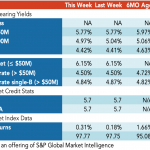

Covenant Trends – 7/19/2021

Average EBITDA Adjustment Cap for Synergies & Cost Savings (Past performance is no guarantee of future results.) Contact: Steven Miller

PDI Picks – 7/19/2021

Markets prove their resilience Performance is on the up and deals are being done as firms show determination to fight their way through the pandemic. It sounds strange, given the harrowing events of the last 18 months, to be talking about markets surpassing all previous landmarks. But there’s no denying that bullishness is very much…

Loan Stats at a Glance – 7/19/2021

Contact: Marina Lukatskymarina.lukatsky@spglobal.com

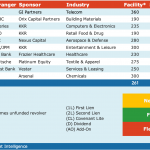

European Direct Lending – By the Numbers

Calculating European direct lending volume is a bit dodgy. But we can triangulate from other metrics. The par amount of all leveraged loans was €15 billion in 1998, per S&P/LCD. It grew to 140 billion before the GFC, and is now a record €240 billion. Conservatively assuming one-third is held by non-banks, that puts it […]