Inflation Nation (Second of a Series)

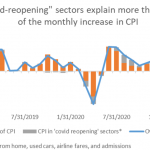

We continue our special series on inflation speaking with Nuveen’s chief investment strategist, Brian Nick. Brian, there’s a lot of attention being paid by markets to inflation risk. Is this warranted? “Prices of certain goods and services in the U.S. are rising for a variety of reasons, all of which we believe to be transitory….