PDI Picks – 5/24/2021

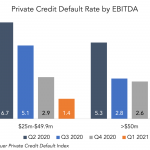

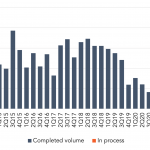

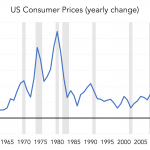

The default story may have another twist Aided by support schemes, many businesses have been protected from the worst effects of the pandemic. But what happens when the support comes to an end? “While we are not out of the woods, we have seen a large number of loans return to performing credits, and we…