TheLeadLeft

PDI Picks – 5/10/2021

Remote due diligence is here to stay The challenges of life away from people and offices may have hindered private debt fundraising to an extent, but video meetings also have their supporters. Fundraising these days is a tough slog, right? Well certainly for private debt anyway, even if the still-surging private equity asset class managed…

The Lincoln Senior Debt Index (Last of Three Parts)

“Thank you for this series. I’m curious how the benchmark accounts for where the loan is in the cap structure? For example, recovery rates for unitranche, 1st lien and second lien are different. Any portfolio would have to match the composition to effectively compare against the benchmark. Otherwise, you would need different benchmarks for each.”…

Chart of the Week: Returns Are In

Source: Lincoln International(Past performance is no guarantee of future results.)

Reorg Credit Intelligence – 5/10/2021

Modernland Noteholders Seek 100% Asset Coverage Over New Notes Indonesian real estate developer PT Modernland Realty Tbk (MDLN) today, May 7, scheduled a call with noteholders of its $150 million guaranteed senior notes due 2021 and its $240 million guaranteed senior notes due 2024, with the discussion being centred on additional security collateralising the new…

Debtwire Middle-Market – 5/10/2021

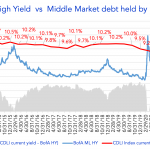

Source: Cliffwater Direct Lending Index and BofA Merrill Lynch US High Yield Effective Yield The red line in the chart is the *Cliffwater Direct Lending Index (CDLI) current yield, which is based on the investment income of the underlying assets held by public and private BDCs. BDCs invest in middle market companies, and the Index…

Private Debt Intelligence – 5/10/2021

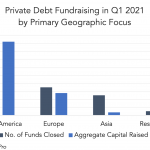

North America dominates Q1 2021 PD fundraising North America-focused private debt managers closed 19 funds, raising aggregate capital of $18.4bn in Q1 2021, more than the other three regions combined. In comparison, the next largest region, Europe, saw seven funds raise $5.6bn…. Subscribe to Read MoreAlready a member? Log in here...

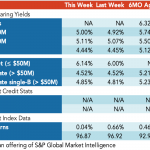

Loan Stats at a Glance – 5/10/2021

Contact: Marina Lukatskymarina.lukatsky@spglobal.com