TheLeadLeft

Covid and Middle Market CLOs

Leveraged lending is competitive. But it pales in comparison to the 2021 Mrs. Sri Lanka pageant. Reigning Mrs. World champion, Caroline Jurie yanked the tiara off newly-crowned winner Pushpika DeSilva, charging Mrs. DeSilva was not married. Mrs. DeSilva fled the stage in tears. Order was eventually restored. Mrs. DeSilva reclaimed her crown, and Mrs. Jurie […]

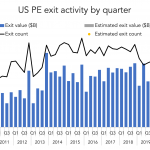

The Pulse of Private Equity – 4/19/2021

Exit ramps remained open in Q1 Download PitchBook’s Report here. US PE exit activity continued its tear in Q1, according to PitchBook’s latest US PE Breakdown Report. Another $162 billion worth of exits was offloaded to start the year, not far off the record-setting fourth quarter of $176.3 billion. That adds up to $338.3 billion, more…

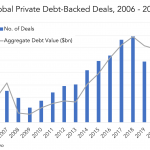

Private Debt Intelligence – 4/19/2021

Mega deals feature in crowded private debt market One of the major trends of 2020 in private debt was an uptick in mega deals, which are classed as those that are part of $1bn+ transactions. Although the number and value of PD deals declined in both 2019 and 2020… Subscribe to Read MoreAlready a member?

Reorg Credit Intelligence – 4/19/2021

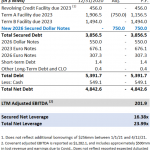

Coty Includes Over $500 Million in EBITDA Addbacks for Lost Revenue Due to Covid Coty Inc. is issuing $750 million of senior secured notes due 2026, with proceeds to be used to repay amounts outstanding under the company’s first lien term loan facility. The new notes are expected to price today. The notes will be…

LevFin Insights: High-Yield Bond Statistics – 4/19/2021

Source: LevFin Insights Source: LevFin Insights Source: Lipper (Past performance is no guarantee of future results.) Contact: Robert Polenberg robert.polenberg@levfininsights.com

Debtwire Middle-Market – 4/19/2021

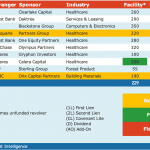

Demand sends loan prices higher in frothy secondary market Source: Debtwire Par, Markit Demand for leveraged loans has remained strong in April, driving the average bid on first lien institutional term loans up to a recent high of 97.14 before retreating to 96.88 by 20 April. Of the most widely quoted loans, 62% have moved…

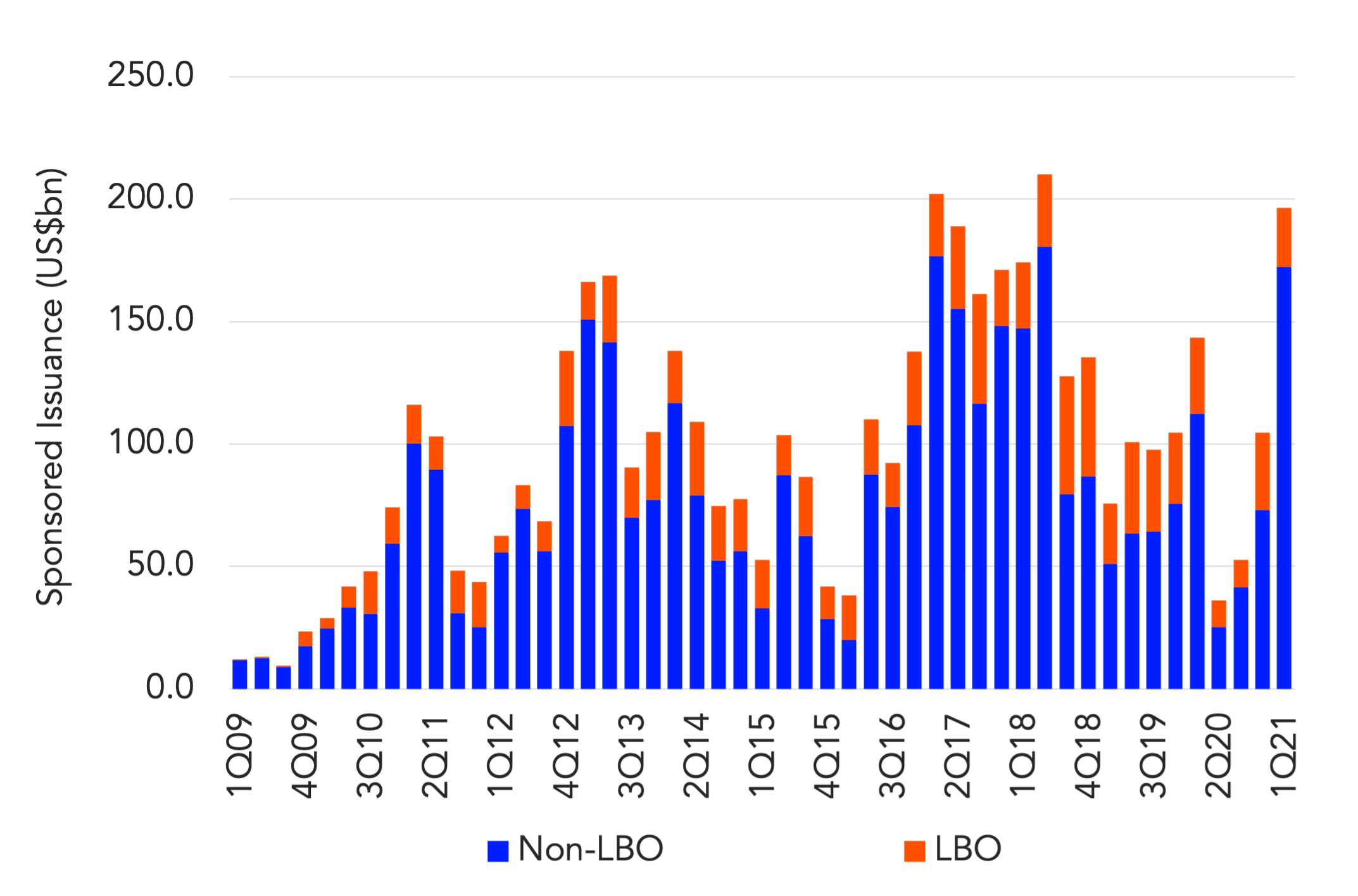

Leveraged Loan Insight & Analysis – 4/19/2021

1Q21 US sponsored loan volume third highest on record Private equity sponsors returned to the loan market in 1Q21 to clear US$196.5bn through retail syndication, the highest quarterly total since 2Q18 and the third highest on record. At US$128bn refinancings represented 65% of the 1Q21 sponsored loan calendar as issuers tapped lenders for repricings and…