The Pulse of Private Equity – 2/8/2021

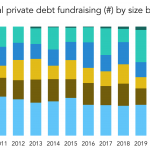

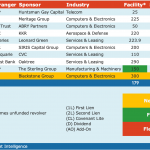

Private debt is becoming top-heavy Download PitchBook’s Report here. Private debt funds have grown much larger over the past two years, according to PitchBook’s latest Global Private Debt Report. Larger funds naturally dominate the charts – by dollars raised, $1B+ funds accounted for almost 80% of all debt fundraising in 2020…. Subscribe to Read MoreAlready a