Debtwire Middle-Market – 10/12/2020

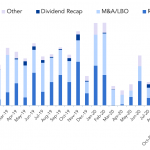

Leveraged loan market sees a pick-up in M&A-related deals and dividend recaps Source: Debtwire Par Following on from September, the month of October is seeing a steady stream of leveraged loan deals, comprised of M&A-related transactions, dividend recaps and refinancings. On a positive note for lenders, M&A-related institutional loan deal flow has topped USD 9bn…