Debtwire Middle-Market – 11/2/2020

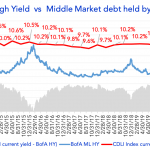

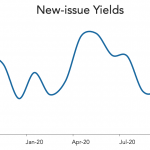

Source: Cliffwater Direct Lending Index and BofA Merrill Lynch US High Yield Effective Yield The red line in the chart is the *Cliffwater Direct Lending Index (CDLI) current yield, which is based on the investment income of the underlying assets held by public and private BDCs. BDCs invest in middle market companies, and the Index…