TheLeadLeft

Private Credit – Better than Ever (Second of a Series)

“October. This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August, and February.” Mark Twain’s famous dictum on investing came to mind as we watched recent choppiness in public markets. With the waning weeks of summer passing and an uncertain…

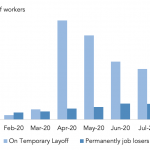

Chart of the Week: Temp to Perm

As the pandemic wears on, workers suffering temporary layoffs have decreased, but permanent job losses are higher.

Private Credit – Better than Ever

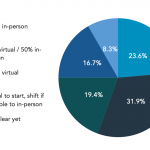

Over the past five months, we’ve examined the impact of COVID-19 on the economy and the markets and interviewed top private equity and investment banking partners on deal making in the U.S. What’s largely lost in media reporting is the dramatic turn in private credit. This asset class emerged from Great Recession to become one […]

The Pulse of Private Equity – 9/7/2020

Will distressed deals see an early comeback? One big, near-term question for private equity will be around distressed companies. Rescues have been made already, while other deals have been done to provide liquidity and strengthen balance sheets. Below the radar, deals have been made with hair salon chains, collegiate study abroad programs and summer sports…

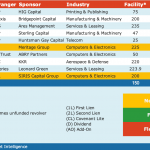

Leveraged Loan Insight & Analysis – 9/7/2020

Covenant and pricing changes were two most amended provision in 2Q20 US middle market Refinitiv LPC tracked 50 US middle market publicly filed 8K summaries that involved a loan amendment in 2Q20. The most changed provision according to those summaries was to financial covenants, where 48% of the amendments involved a change. Borrowers either received…

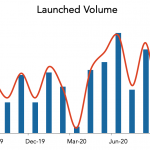

LevFin Insights: High-Yield Bond Statistics – 9/7/2020

Source: LevFin Insights Source: LevFin Insights Source: Lipper Contact: Robert Polenberg robert.polenberg@levfininsights.com

DL Deals: News & Analysis – 9/7/2020

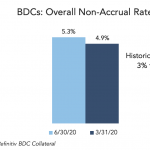

Non Accruals rise, not spike; Lower middle market BDCs steady at 7.5% BDC non-accruals rose to an average of 5.3% at June 30, up from 4.9% at the end of March, based on a DLD analysis using Refinitiv’s BDC Collateral database. Last quarter’s increase hoisted the average above the historical range of 3% to 5%…