PDI Picks – 10/5/2020

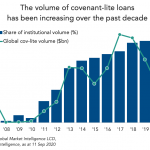

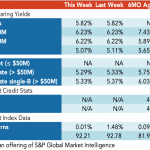

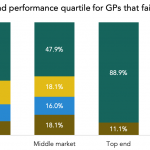

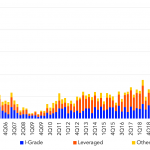

Do the documents offer lenders hope? Borrowers have held the balance of power for some time when it comes to deal negotiations. There are signs that their grip is being loosened, if only a little. In the wake of the covid-19 crisis, it’s hard to view the positives but you should always try…. Subscribe to