Private Debt Intelligence – 6/1/2020

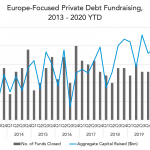

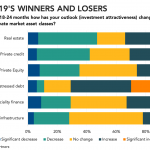

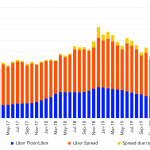

How Has COVID-19 Impacted Private Debt in Europe? Private debt fundraising has impacted differently in the markets of Europe than in Asia or North America. While in the last two regions fundraising declined in Q1 2020, Europe-focused private debt fundraising augmented, and Q2 seems to be decreasing…. Subscribe to Read MoreAlready a member? Log in