Debtwire Middle-Market – 5/25/2020

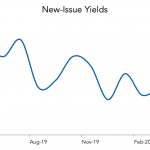

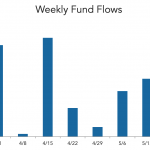

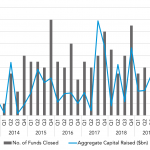

Secured issuance and higher pricing define current HY bond market Source: Debtwire Par The US high yield bond market has been printing paper at a rapid clip since reopening in April, which saw roughly USD 40.6bn in volume, the most active month this year to date, and a far cry from the USD 5.3bn seen…