DL Deals: News & Analysis – 6/22/2020

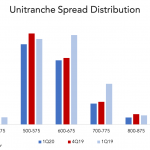

Ardonagh highlights viability for large unitranches It’s not a buyout, but Ardonagh Group’s record unitranche loan of £1.575 billion highlights the viability of jumbo ‘unis’ in a cautious direct lending market. Ares Management’s direct lending platform in Europe is lead arranger on the financing, while Caisse de depot et placement du Quebec, HPS Investment Partners…