TheLeadLeft

Covid-19: The Best and the Worst Industries

If you’re watching this broadcast from your home office, you’re not alone. According to one study, 97% of the US population is either at home or sheltering in place. This has completely upended the free-flowing, dynamic nature of the largest, most diversified economy on the planet. -Industries that took decades to develop competitive products and […]

Debtwire Middle-Market – 4/27/2020

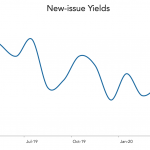

Issuers pay up to tap high yield bond market in April Source: Debtwire Par As the equity and debt markets regain their footing after a period of prolonged volatility and a virtual freeze in new issuance due to the coronavirus (COVID-19) pandemic, the high yield bond markets have opened back up as issuers begin to…

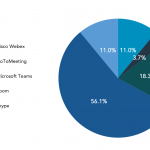

The Great Stay-In (Eighth of a Series)

“The GFC was a crisis that began on Wall Street and spread to Main Street. COVID-19 is a crisis that began on Main Street and spread to Wall Street.” That’s how the capital markets head of a leading private credit firm contrasted the origins of the two worst downturns since the Great Depression. And with…

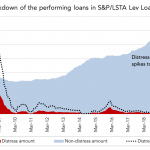

Chart of the Week: Dressed for Distressed

When secondary leveraged loan prices cratered last month, the resulting distressed volume outweighed all 2008-09 loans.

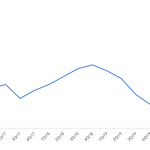

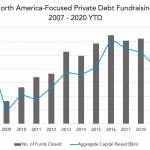

Private Debt Intelligence – 4/27/2020

How Crisis Have Affected North America-Focused Private Debt Fundraising? Private debt has ballooned in size in the decade since the 2008-2009 Global Financial Crisis (GFC), when regulatory changes forced banks to deleverage their balance sheets, and private debt funds emerged as alternative loan providers to fill the void. But the global economic shutdown triggered by…

LevFin Insights: High-Yield Bond Statistics – 4/27/2020

Source: LevFin Insights Source: LevFin Insights Source: Lipper Contact: Robert Polenberg robert.polenberg@levfininsights.com

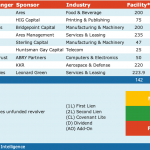

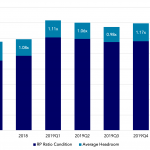

Covenant Trends – 4/27/2020

Average Total Deleveraging Required To Meet RP Ratio Test Contact: Steven Miller