PDI Picks – 4/27/2020

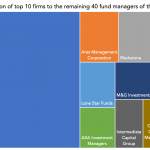

The biggest are the biggest for a reason Nothing much is predictable these days, but don’t expect the fundraising pecking order to change anytime soon. “Do what you can, with what you’ve got, where you are.” The inspirational quote comes from an autobiography of Theodore Roosevelt and surely resonates with anyone forced into lockdown as…