TheLeadLeft

Private Debt Intelligence – 4/20/2020

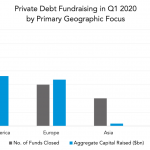

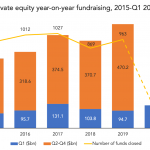

Private Debt Fundraising Tips the Scales into Europe in Q1 2020 Fundraising fell in the first quarter of 2020 and the balance among the regions where funds are focused has slightly changed. Private debt funds focused on North America typically dominate the fundraising market, but in Q1 the balance shifted somewhat. In Q1 2020 there…

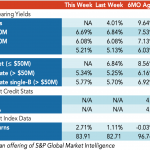

LevFin Insights: High-Yield Bond Statistics – 4/20/2020

Source: LevFin Insights Source: LevFin Insights Source: Lipper Contact: Robert Polenberg robert.polenberg@levfininsights.com

Debtwire Middle-Market – 4/20/2020

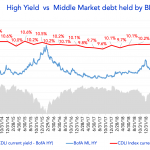

Source: Cliffwater Direct Lending Index and BofA Merrill Lynch US High Yield Effective Yield The red line in the chart is the *Cliffwater Direct Lending Index (CDLI) current yield, which is based on the investment income of the underlying assets held by public and private BDCs. BDCs invest in middle market companies, and the Index…

State of the Capital Markets – First Quarter 2020 Review and Second Quarter 2020 Outlook

Review of Current Market Conditions/ Analysis of Capital Markets Metrics/ Review of Credit Quality/ Outlook for Second Quarter 2020

PDI Picks – 4/20/2020

Private equity bandwagon rolls on, but for how much longer? Fundraising for the asset class was strong in the first three months of 2020 but continuing to defy the effects of covid-19 seems unlikely. As we have noted in this column over the last couple of weeks, private debt fundraising provides a neat reflection of…

Loan Stats at a Glance – 4/20/2020

Contact: Marina Lukatsky marina.lukatsky@spglobal.com

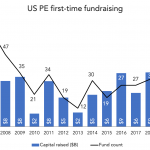

The Pulse of Private Equity – 4/13/2020

Not a good time to raise your first fund Download PitchBook’s Report here. As expected, Q1 fundraising totals were soft, according to PitchBook’s PE Breakdown Report. Just 46 funds were closed totaling $45 billion, and much of that was cinched up in January or February. For context, last year’s figures were 249 funds totaling $315 billion,…

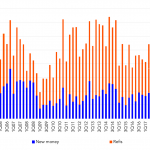

Leveraged Loan Insight & Analysis – 4/13/2020

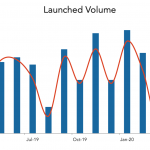

1Q20 MM non-sponsored syndicated loan issuance mirrored 1Q19’s dire levels At US$16bn, 1Q20 non-sponsored issuance was down 25% from 4Q19 and was on par with 1Q19, which was the slowest 1Q since 1Q10. After a slow start in January, issuance picked up in February and was flat in March. According to bankers that focus on…

COVID-19 and the Economic Outlook, with Brian Nick (Part I)

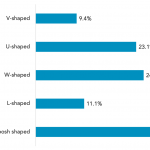

As goes COVID-19, so goes the nation.” We rephrase the famous 1950’s dictum on General Motors’ relationship to the national welfare in examining how the coronavirus has hijacked all aspects of the economy. There’s broad consensus that once the disease runs its course, commercial activity will be restored. It’s also agreed that between now and […]