Leveraged Loan Insight & Analysis – 3/9/2020

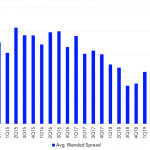

Unitranche in price discovery mode, likely moving back over 600bp Amid falling Libor and more volatile pricing conditions in the syndicated market, unitranche pricing is moving higher after hitting rock bottom levels in 4Q19. So far in 1Q20, the average blended spread on a unitranche is 590bp, up from a low of 578bp in 4Q19….