TheLeadLeft

The Pulse of Private Equity – 11/4/2019

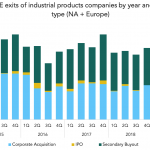

Manufacturing exits are way down We covered China-driven M&A last week, noting that activity has taken a nosedive this year. Chinese acquirers aren’t buying many American companies at the moment, thanks in part to the broader trade war. According to a newly released report from PitchBook and RSM, however, PE is having a rough time…

Private Debt Intelligence – 11/4/2019

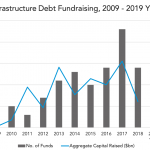

Infrastructure Debt Reaches Momentum Debt providers in more specific sectors have started to take the place of traditional lenders, as for example in the infrastructure industry. Banks are no longer the main source, and investors are moving towards funds to gain access to the capital structure. Infrastructure debt fundraising has had peaks and troughs over…

Covenant Trends – 11/4/2019

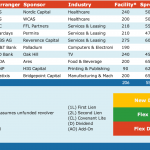

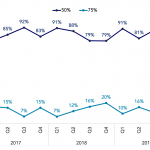

Initial ECF Sweep Distribution Contact: Steven Miller

LevFin Insights: High-Yield Bond Statistics – 11/4/2019

Source: LevFin Insights Source: LevFin Insights Source: Lipper Contact: Robert Polenberg robert.polenberg@levfininsights.com

Leveraged Loan Insight & Analysis – 11/4/2019

Average US second-lien secondary bids at lowest levels since 2016 US second-lien loans have traded down considerably in the secondary market over the past few months. The last round of risk-off behavior by secondary market loan players sent second-lien bids as low as the 87.01 level on October 18th, over a five-point decline from the…

Debtwire Middle-Market – 11/4/2019

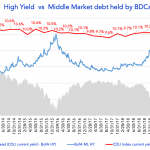

Source: Cliffwater Direct Lending Index and BofA Merrill Lynch US High Yield Effective Yield The red line in the chart is the *Cliffwater Direct Lending Index (CDLI) current yield, which is based on the investment income of the underlying assets held by public and private BDCs. BDCs invest in middle market companies, and the Index…

Whitecaps in Large Caps

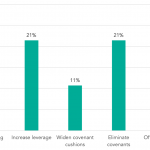

Issuers in leveraged lending today are divided into three categories: the haves, the have-nots, and the wish-they-hads. As the 2019 loan calendar heads into its final six weeks of activity, the differences between the first two categories are becoming more pronounced. In the broadly syndicated market, as we covered last week, the combination of triple-C…

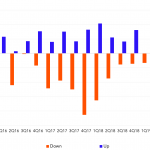

Chart of the Week: The Price Isn’t Right

The volume of middle market spread flex-ups at $2.2 billion was the highest in four years.