TheLeadLeft

Of Bubbles and Gum

Her name was Lola. At least that’s what Danish archeologists are calling the female whose DNA was discovered in birch bark she had chewed 5,700 years ago. The sticky resin was used prehistorically to fix broken tools, for medicinal purposes, and for gum. The discovery was notable because no other remains of this ancient inhabitant…

Debtwire Middle-Market – 1/6/2020

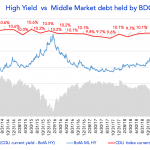

Source: Cliffwater Direct Lending Index and BofA Merrill Lynch US High Yield Effective Yield The red line in the chart is the *Cliffwater Direct Lending Index (CDLI) current yield, which is based on the investment income of the underlying assets held by public and private BDCs. BDCs invest in middle market companies, and the Index…

PDI Picks – 1/6/2020

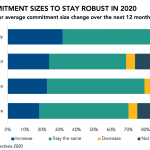

LPs set to continue strong backing of private debt in 2020 Private equity will also maintain healthy investor support, which is likely welcome news to many direct lenders that focus on sponsor-backed transactions. Private debt managers will likely enjoy continued investor support in 2020, according to PDI Perspectives 2020, the latest installment of our annual…

Loan Stats at a Glance – 1/6/2020

Contact: Marina Lukatsky marina.lukatsky@spglobal.com

Private Credit: “Still the Best Place to Be”

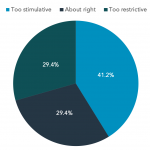

Investors today are faced with mixed signals. November’s impressive labor report of 266,000 job gains went a long way to easing fears of an imminent recession. But with buoyant markets brought fresh bubble fears: Are prices overinflating? Are valuations headed for a bigger fall down the road? And won’t terms and structures continue to weaken […]

Leveraged Loan Insight & Analysis – 12/16/2019

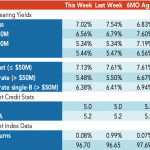

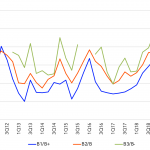

Yields bifurcate within the single-B category Investors took a cautious approach and became more selective in the latter part of 2019. In turn, the yield premium between double-B and single-B rated issuers widened significantly. The bifurcation has also trickled down into the single-B category as there has been a wide differential between higher-rated B1/B+ issuers…

The Pulse of Private Equity – 12/16/2019

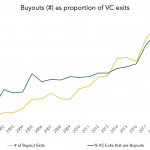

2020 prediction – more VC-to-PE buyouts Download PitchBook’s Report here. Our 2020 Private Equity Outlook went out last week, and we’ll delve into some of our predictions as we roll into the new year. One trend we expect to see more of is VC-to-PE buyouts. Though they’re often mentioned in the same sentence, venture capital and…