TheLeadLeft

The Pulse of Private Equity – 9/2/2019

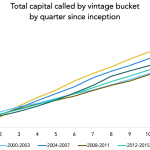

Drawdowns are slower than they used to be Download PitchBook’s Report here. Record years for PE activity are often viewed as fast-moving frenzies, but capital call statistics show the industry is investing much more slowly than it has in the past. Drawdown rates have been relatively slow since 2012, even though 2014, 2015, 2016, 2017 and…

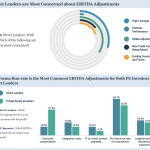

2Q 2019 Middle Market Covenant Research

Lead Left Readers’ Say: Covenant TrendsInfogram

Debtwire Middle-Market – 9/2/2019

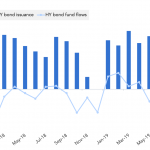

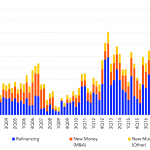

HY bond issuance slows sharply in August, flows turn negative Source: Debtwire Par, Lipper High yield bond issuance slowed sharply in August, totaling just USD 9.5bn, the lowest monthly figure this year, with one deal (Tenet Healthcare’s USD 4.2bn refinancing) accounting for a large chunk of activity. The second half of the month saw just…

Covenant Trends – 9/2/2019

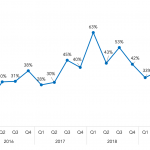

Percentage of Loans with Uncapped Synergies & Cost Savings EBITDA Addbacks Contact: Steven Miller

Private Debt Intelligence – 9/2/2019

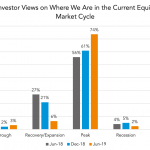

Enthusiasm for alternatives remain among investors Based on the results of the last survey of 177 institutional investors conducted in July 2019 by Preqin, we find out that investors remain upbeat about the future performance of alternatives but are aware this may not continue. Seventy-four percent of investors think that equity markets are at a…

PDI Picks – 9/2/2019

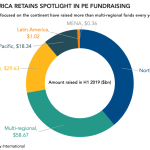

North America tops PE fundraising yet again Despite a global maturation of the asset class, North America still remains the place to be. Private equity has grown globally in recent years, with maturing markets in both Europe and Asia-Pacific, but North America remains the dominant force it has been for years. In the first half…

LevFin Insights: High-Yield Bond Statistics – 9/2/2019

Source: LevFin Insights Source: LevFin Insights Source: Lipper Contact: Robert Polenberg robert.polenberg@levfininsights.com

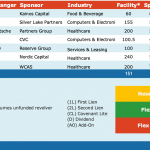

Leveraged Loan Insight & Analysis – 9/2/2019

Leveraged loan market expected to pick up amidst more volatile market backdrop Completed US leveraged loan volume totals US$105bn so far this quarter as lenders look for a pick-up in activity after the Labor Day holiday. 3Q19 leveraged issuance comprises US$59.8bn in new money volume with another US$45.3bn in refinancing volume. Refi activity has been…