Private Debt Intelligence – 8/12/2019

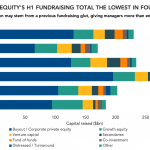

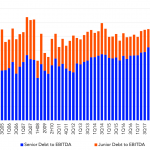

Private Debt Industry Puts Capital to Work The private debt industry has seen the growth in its AUM accelerate in recent years, and by December 2018 (our latest data available) funds held a total of $768bn in assets under management (AUM). The market is now more than three times bigger than it was ten years…