The Pulse of Private Equity – 9/2/2019

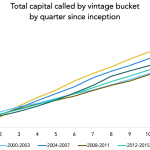

Drawdowns are slower than they used to be Download PitchBook’s Report here. Record years for PE activity are often viewed as fast-moving frenzies, but capital call statistics show the industry is investing much more slowly than it has in the past. Drawdown rates have been relatively slow since 2012, even though 2014, 2015, 2016, 2017 and…