TheLeadLeft

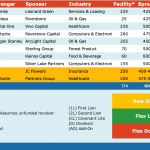

Select Deals in the Market – 6/3/2019

☞ Click for a larger image.

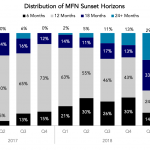

Chart of the Week: Sunset Time

The vast majority of “most-favored nation” provisions in loan agreements are gone after 12-18 months.

PDI Picks – 6/3/2019

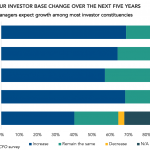

Firms bullish on an expanding investor base As alternative assets continue their rise, private fund managers may well keep notching additional LPs with each new product and successor fund. A majority of private fund managers expect to see growth across most aspects of their investor base, according to a survey conducted last month by Private…

Covenantive Easing (Third of a Series)

As we continue our special series on covenants, we’ve noted how lenders and sponsors are pushing envelopes to deal with an increasingly competitive landscape. This includes areas of the credit agreement that might otherwise appear innocuous. Take financial statements. Quarterly numbers are typically due within 45 days after fiscal quarter-end, and annuals within 120 days…

Covenant Trends – 6/3/2019

Average EBITDA Adjustment Cap for Synergies & Cost Savings Contact: Steven Miller

LevFin Insights: High-Yield Bond Statistics – 6/3/2019

Source: LevFin Insights Source: LevFin Insights Source: Lipper Contact: Robert Polenberg robert.polenberg@levfininsights.com

Debtwire Middle-Market – 6/3/2019

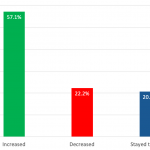

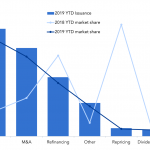

M&A/LBO activity dominates institutional loan issuance YTD Source: Debtwire Par M&A and LBO deals have been the driver of institutional loan volume this year, accounting for two-thirds of issuance. LBOs in particular have been the most active part of the market, posting USD 52bn of institutional loan volume…. Subscribe to Read MoreAlready a member? Log

Private Debt Intelligence – 6/3/2019

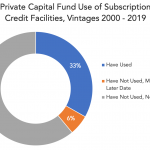

Private Capital Subscription Credit Usage on the Rise Very few developments in alternative assets have attracted such a mixed response as subscription credit facilities (also known as equity bridge facilities, subscription line facilities or capital call facilities). Although they are nothing new, there is a wide range of views between fund managers and investors –…