TheLeadLeft

Leveraged Loan Insight & Analysis – 5/20/2019

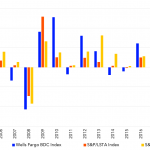

BDC returns superior so far in 2019 BDC share prices are on a tear in 2019. The Wells Fargo BDC Index has delivered a stunning +18.0% return so far in 2019 through May 17th. This is outpacing the S&P500 (+14.1%) and the S&P/LSTA Leveraged Loan Index (+5.72%). Several BDCs are near 52 week highs. Oaktree…

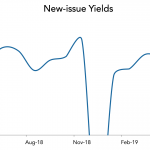

LevFin Insights: High-Yield Bond Statistics – 5/20/2019

Source: LevFin Insights Source: LevFin Insights Source: Lipper Contact: Robert Polenberg robert.polenberg@levfininsights.com

Debtwire Middle-Market – 5/20/2019

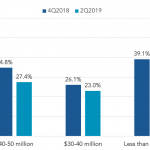

Share of cov-lite loans slips in 2019, but remains the market standard Source: Debtwire Par, Xtract Research After reaching a high in the 80% area in 2017 and 2018, the covenant-lite share of institutional loans has slipped this year to 72% as lenders have in some instances been able to push back against the lack…

Covenantive Easing (First of a Series)

Much attention was paid over the past few weeks to a dramatic series highlighting the struggle between two powerful forces, a dizzying game for world domination, with the outcome hanging in the balance and viewers on the edge of their seats. Of course we’re talking about our recent series on valuations (“Why Valuations Matter” [link])….

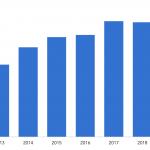

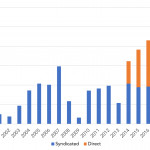

Chart of the Week: Going Direct

Two-thirds of all middle market LBOs are being financed by direct lenders, from zero in 2013.

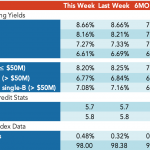

Loan Stats at a Glance – 5/20/2019

Contact: Marina Lukatsky marina.lukatsky@spglobal.com

The Pulse of Private Equity – 5/13/2019

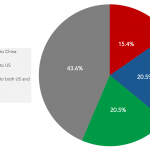

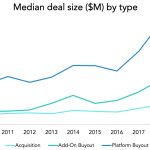

Why are add-ons getting so much bigger? Download PitchBook’s Report here. The median add-on size almost doubled in the span of two years. The $41 million median seen in 2016 ballooned to $76 million last year, an 86% difference. At first glance, it looks like platform deal sizes have gone up much more rapidly, but charts…

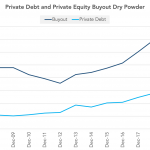

Chart of the Week: Cash to Burn

Direct lending supply and demand is driven by increasing amounts of dry powder.