Leveraged Loan Insight & Analysis – 1/14/2019

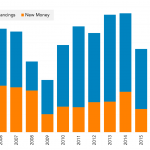

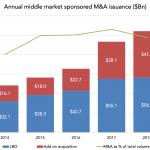

Non-sponsored middle market lending increased to US$102bn but new money collapsed The non-sponsored market continued to tread along in 2018. Issuance was up for the second year in a row to US$102.3bn, but that was still far from 2014’s record and was driven by increased refi activity. Refinancing volume of US$81.3bn, was up 36% from…