Private Debt Intelligence – 1/14/2019

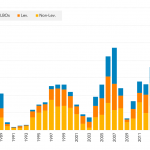

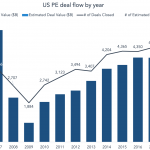

Overview of Private Debt Fundraising in 2018 Private debt fundraising remained strong in 2018, making it the fourth consecutive year in which funds raised over $100bn. In 2018, 162 funds were able to secure an aggregate $110bn in capital. While this was slightly lower than the $129bn in capital raised in 2017, 2018 nonetheless represented…