Leveraged Loan Insight & Analysis – 12/17/2018

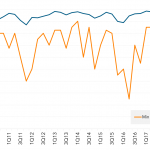

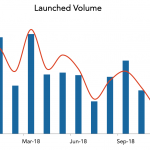

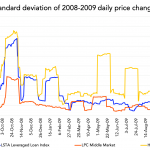

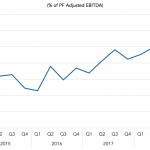

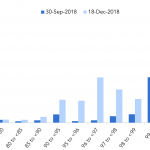

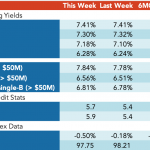

Discounts widen as volatility hits the primary loan market Loan market sentiment has shifted dramatically this quarter as broader market volatility sent waves into the leveraged loan market. Concerns about global growth, trade wars, Brexit worries, and uncertainty over future interest rate hikes have cast a shadow on confidence and investors are a lot more…