Leveraged Loan Insight & Analysis – 12/10/2018

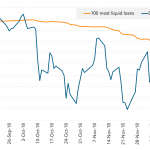

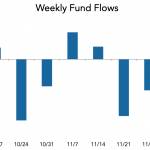

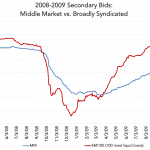

Loan bids continue to decline amidst broader market volatility LPC’s most liquid 100 loans cohort traded down again yesterday to 96.15, its lowest level since March 2016. The volatility in the broader market has bled into the syndicated loans market. Loan investors have reacted by yanking roughly US$5.6bn from retail loan funds since the last…